Navigating fragmented markets: the importance of independent TCA in enhancing execution outcomes

By Mark Montgomery, CCO, big xyt

In today’s increasingly fragmented and complex market landscape, buy-side trading desks face the dual pressure of achieving execution quality and maintaining regulatory compliance, all while navigating complex liquidity environments. Traditional transaction cost analysis (TCA), often reliant on broker reports and static benchmarks, is no longer sufficient to meet the demands of today’s execution landscape.

Market participants are instead turning towards independent, high-precision analytics that offer a more granular view of market behaviour – supporting not just regulatory mandates, but more informed trading decisions.

Fragmentation and Complexity: Structural Challenges for the Buy-Side

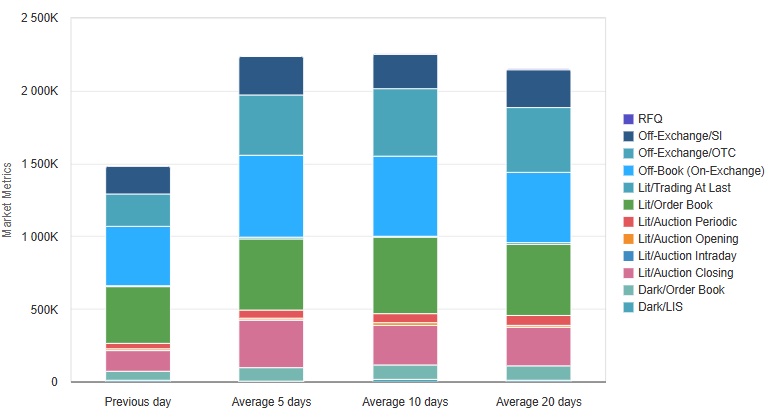

Modern equity markets operate across a broad spectrum of venues including lit exchanges, dark pools, systematic internalisers and periodic auctions. Each presents unique characteristics in terms of liquidity access, price discovery and transparency. This dispersion has introduced new layers of complexity into execution workflows, particularly for buy-side firms aiming to minimise slippage and market impact while accessing sufficient liquidity.

The reliance on broker-provided TCA poses a risk in such an environment. Without a neutral, data-driven benchmark, it becomes difficult to assess whether execution strategies are achieving their intended outcomes or simply aligning with broker capabilities. Independent analytics offer an alternative lens – helping to validate execution quality and inform future trading behaviour based on actual market conditions.

Market Volume by Trade Category

Why Independence Matters

Why Independence Matters

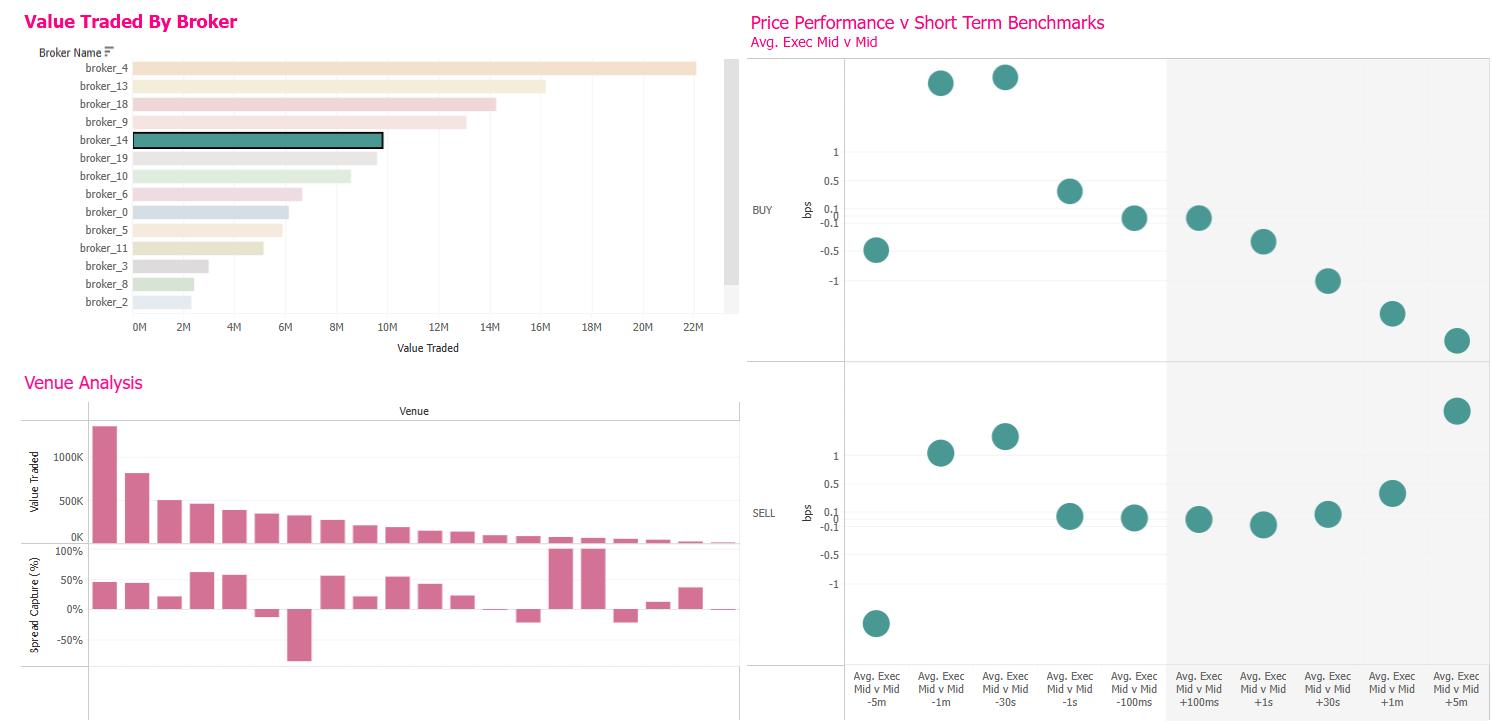

The value of independent TCA lies in its ability to remove conflicts of interest from the measurement process. An analytics provider that does not participate in trading or route flow is better positioned to offer objective insights into how orders are executed, where slippage occurs, and whether broker routing decisions align with client performance goals.

This independence becomes particularly important in multi-broker environments where assessing comparative performance is critical. It allows trading desks to ask more rigorous questions about venue selection, liquidity access and execution timing – questions that may not be answered fully by internal or broker-led reporting.

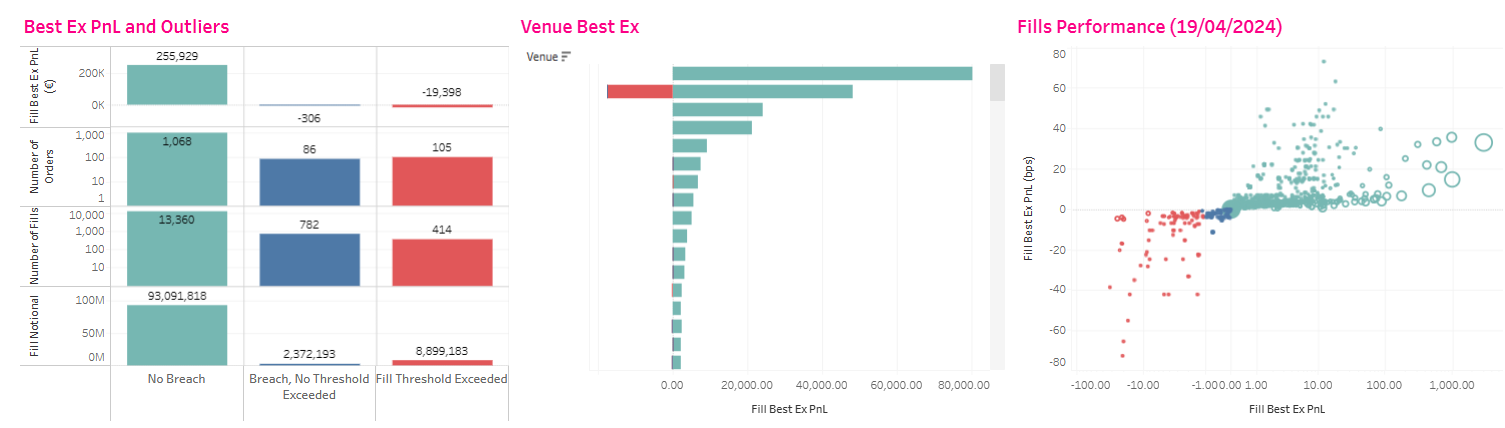

Broker Performance

The Importance of Data Transparency and Quality

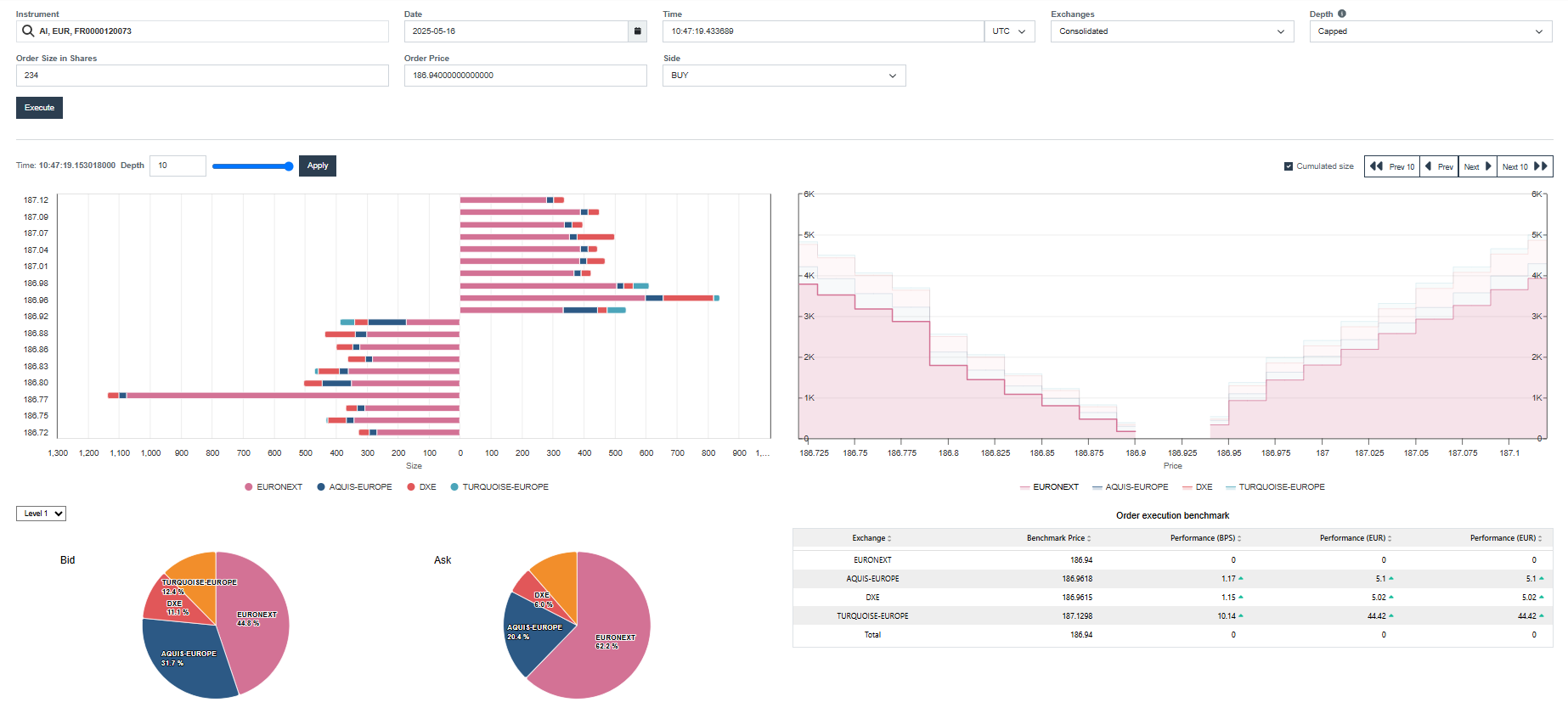

Data transparency is foundational to effective TCA. Access to raw tick data – particularly Level 3 order book information – enables a detailed reconstruction of the market environment at the time of execution. This level of granularity supports analysis not just of price outcomes but of market dynamics around each trade.

Order Book Replay

Robust data quality controls are equally essential. With the sheer volume of global trading activity, systematic cleaning, validation and normalisation processes are needed to ensure consistency across venues. Independent analytics platforms that integrate these capabilities reduce the operational burden on trading desks and support more accurate, comparable metrics.

Robust data quality controls are equally essential. With the sheer volume of global trading activity, systematic cleaning, validation and normalisation processes are needed to ensure consistency across venues. Independent analytics platforms that integrate these capabilities reduce the operational burden on trading desks and support more accurate, comparable metrics.

From Compliance to Continuous Improvement

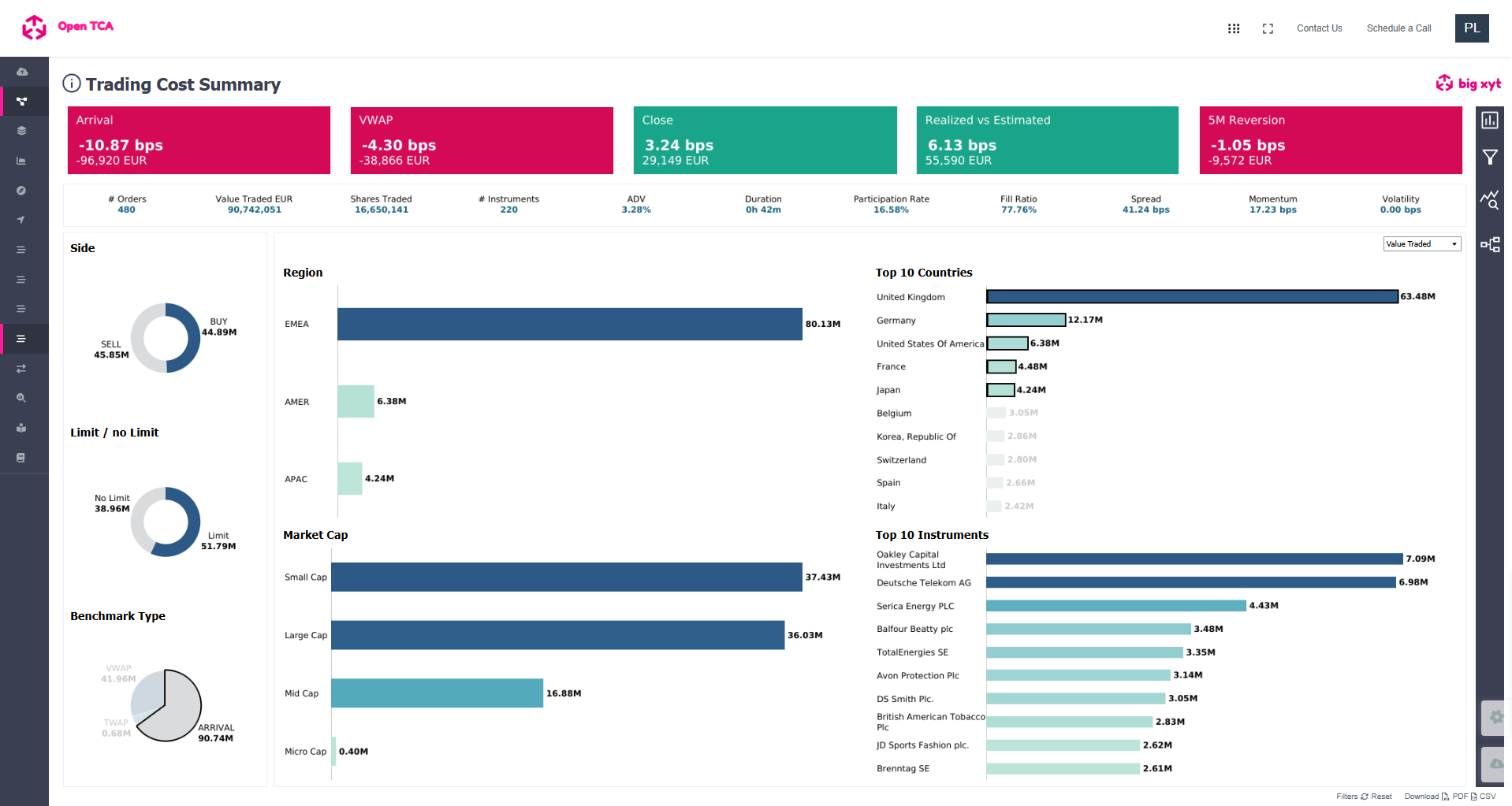

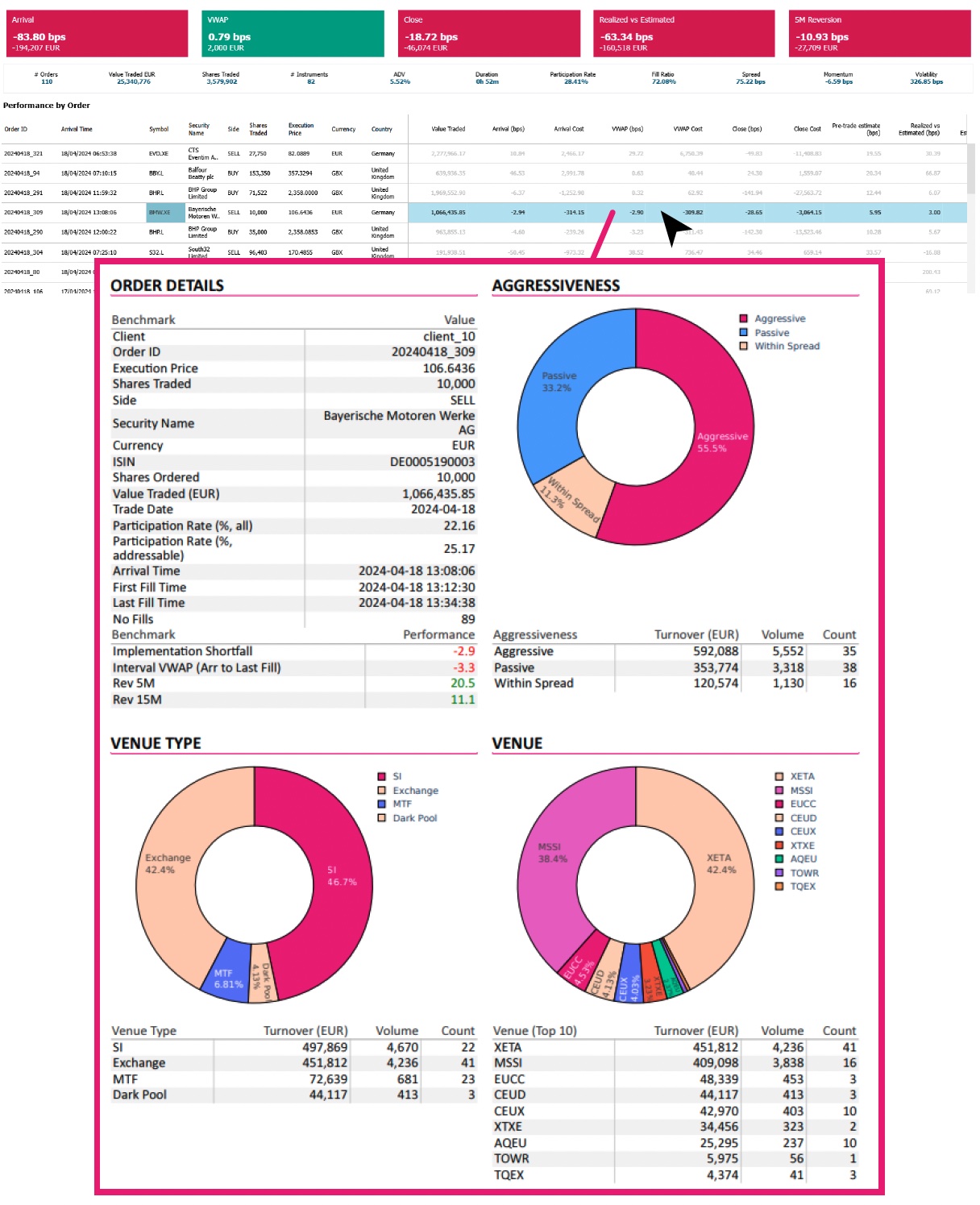

TCA remains a central component of regulatory frameworks like MiFID II, which require firms to demonstrate best execution. However, the role of TCA is expanding beyond compliance. Increasingly, it is being used to inform strategic questions: Are participation rates optimised for current liquidity conditions? Which venues are most suitable for different order types? How do execution outcomes vary across time-of-day or volatility regimes?

When aligned with these goals, analytics become a tool for continuous improvement. They help identify areas for strategy adjustment and provide the evidence needed to justify tactical changes, such as altering venue preferences or rebalancing between aggressive and passive execution styles.

Real-Time and Intraday Insights

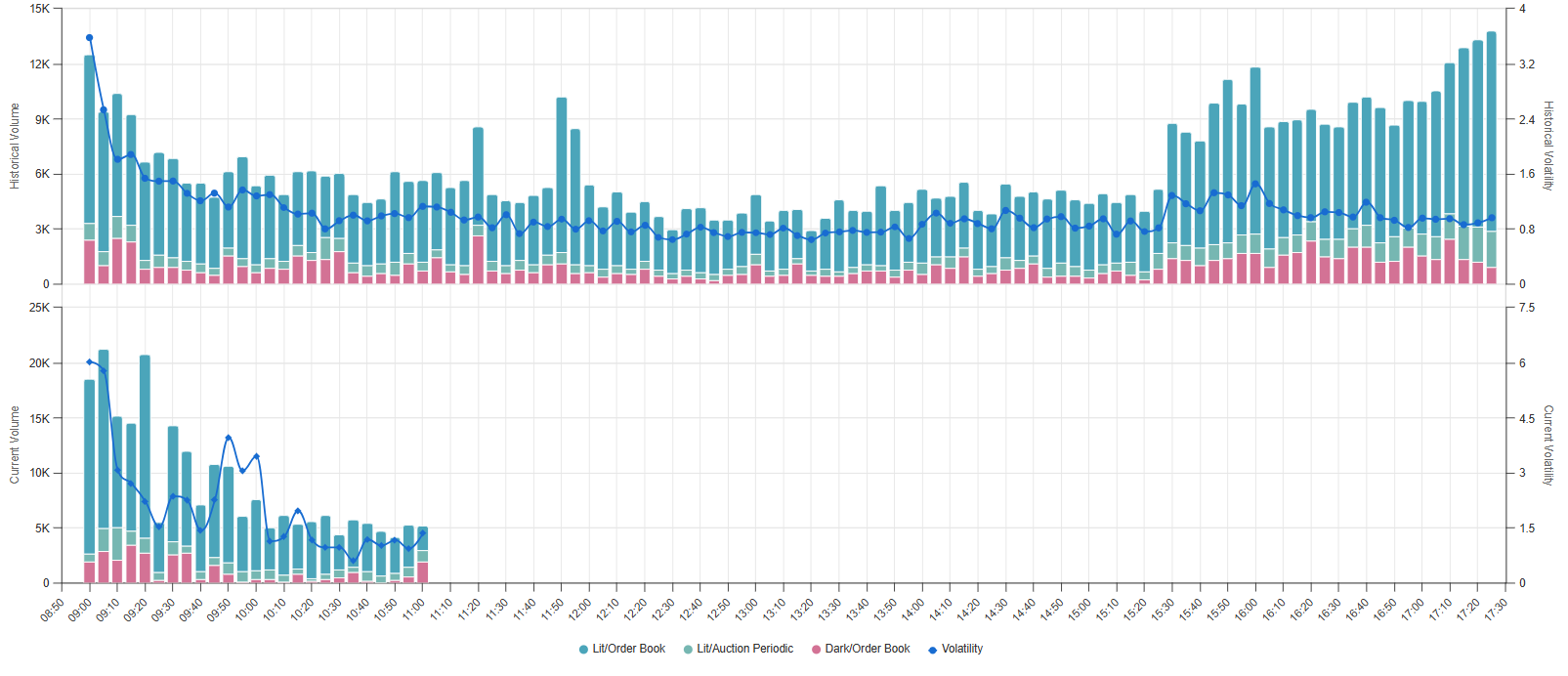

While many TCA processes operate on a T+1 basis, real-time analytics are playing a growing role – particularly for desks managing high-touch or algorithmic strategies. Intraday visibility into order execution, liquidity fragmentation and off-book trading patterns enables quicker decision-making and proactive risk management.

Volume and Volatility (Historical vs. Intraday)

This is particularly relevant in volatile market conditions where trade-offs between immediacy and market impact shift rapidly. Intraday alerts on unusual trading patterns or liquidity imbalances can inform whether to pause or adjust execution strategies mid-session.

This is particularly relevant in volatile market conditions where trade-offs between immediacy and market impact shift rapidly. Intraday alerts on unusual trading patterns or liquidity imbalances can inform whether to pause or adjust execution strategies mid-session.

Data Science and Adaptive Models

Execution analytics is also evolving with the integration of advanced data science techniques. Machine learning and clustering algorithms can segment securities not just by sector or size, but by shared trading behaviours, such as spread dynamics, turnover patterns or typical market impact curves. This allows for more targeted strategy development and a move away from overly broad classifications that may not reflect trading realities.

Adaptive models are especially useful in markets where historical relationships can break down quickly, as was observed during recent episodes of extreme volatility or structural shifts in liquidity provision.

Flexibility in Access and Integration

Buy-side firms differ significantly in how they structure their trading and analytics functions. Some may require dashboard visualisations for pre-trade planning, while others embed TCA directly into their OMS or EMS workflows. Others, particularly quantitative teams, prioritise access to raw data and APIs for deeper, customised analysis.

A flexible architecture that accommodates these varied needs – through API endpoints, file delivery options or browser-based tools – can support a more integrated approach to execution analysis. It also reduces reliance on internal infrastructure, which can be costly to build and maintain, especially when handling large-scale tick data.

A Broader View of Execution Performance

Execution quality is multi-dimensional. It encompasses cost, timing, market impact and relative performance against benchmarks. As buy-side firms look to balance these factors across increasingly diverse market conditions, independent TCA plays a key role in maintaining discipline and visibility.

By grounding execution decisions in data rather than anecdote, firms can foster a more accountable and performance-oriented trading culture. This not only helps meet regulatory expectations but also supports better outcomes for investors over time.

Looking Ahead

As trading markets continue to fragment and technology continues to evolve, the need for robust, transparent execution analytics will only grow. For the buy-side, this means prioritising solutions that offer independence, data quality and analytical depth – while remaining agile enough to adapt to new trading behaviours and regulatory pressures.

Independent TCA is no longer a luxury – it’s a necessary component of a modern execution strategy. By embedding it into daily workflows and decision-making processes, firms can gain a clearer understanding of market mechanics, improve execution outcomes and stay ahead in a competitive and complex trading environment.

TCA Portal

Best Execution by Venue

Single Order TCA Report from Order List

Why Independence Matters

Why Independence Matters