Top US banks redeployed capital into their trading businesses ahead of the Federal Reserve’s 2025 stress test results, which softened the worst-case stress scenario for a market downturn.

As US banks prepare to release their second-quarter earnings, results from the Federal Reserve’s annual stress tests, on 27 June, free additional risk capital at major US banks.

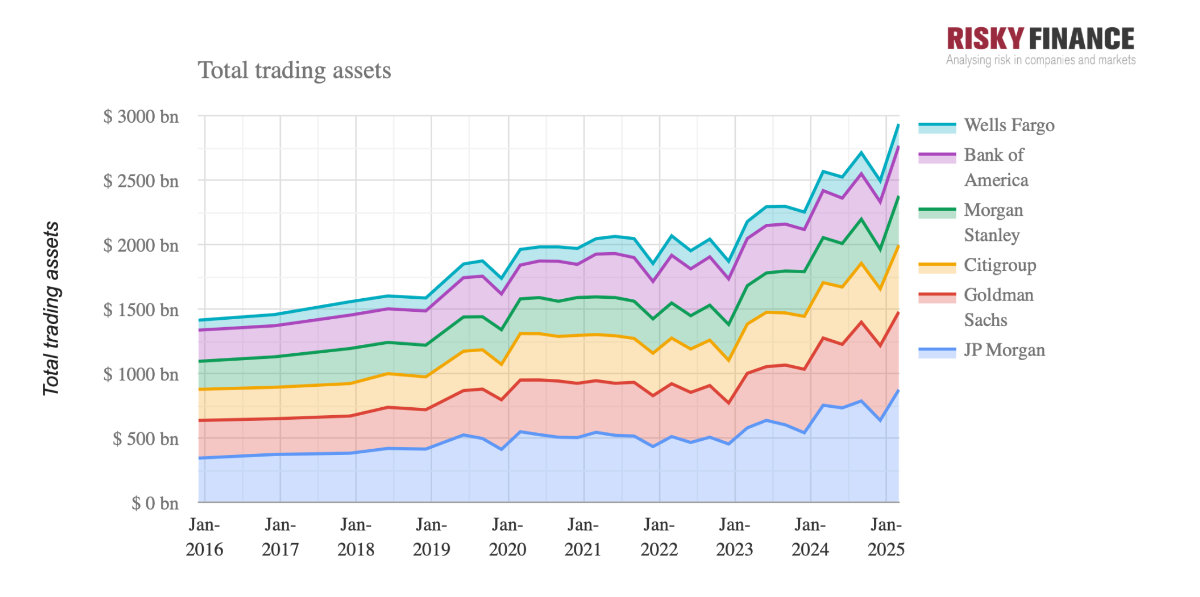

Tallies, provided by Risky Finance, of trading asset trends across major US banks, including JP Morgan, Goldman Sachs, Morgan Stanley, Citigroup, Wells Fargo and Bank of America, show total trading assets on US banks’ books have been accelerating upward. This increase was already pronounced from the end of 2024 into 2025 with the arrival of the new US administration; JP Morgan total trading assets grew from US$637 billion at the end of 2024 to US$873 billion at the end of Q1 2025, and from US$579 billion to US$604 billion for Goldman Sachs.

Goldman Sachs was the clearest victor of this year’s Fed’s less stressed scenario, with projected trading loss shrinking to just US$300 million, compared to US$18 billion in the previous year. The bank benefited from tighter internal risk controls and methodological easing in the Fed’s stress testing, such as the removal of private equity investments from its market shock scenario.

Morgan Stanley analyst, Betsy Graseck, highlighted the impact of recent trading dynamics: “Capital markets are back. We expect 2Q25 Equities markets revenues to be robust at +10% year-over-year. Industry data supports revenues potentially coming in even higher, with off-exchange volumes up +83% y/y in April, +45% y/y in May, and +80% y/y in June.”

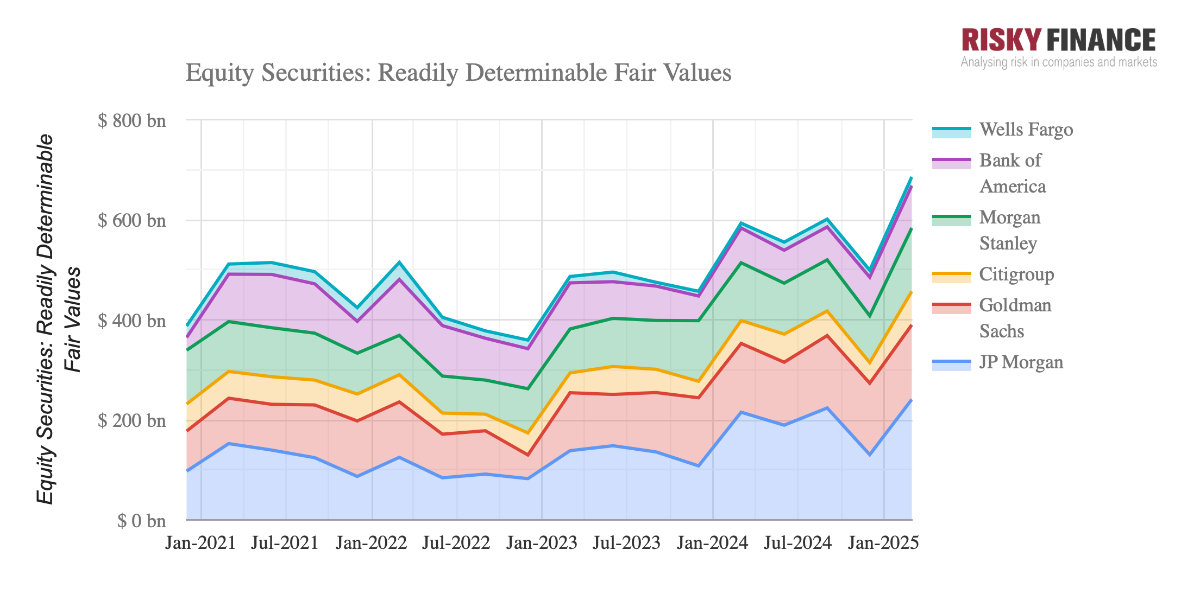

Equity securities held by banks also reached record highs as of 31 March 2025, with Morgan Stanley owning $US127 billion worth of stocks at the time, Bank of America held US$84 billion worth of stocks, JP Morgan US$241 billion, and Goldman US$149 billion.

The relief provided by the stress tests has direct implications for the banks’ capital allocations. Morgan Stanley’s research estimated that “excess capital at large-cap banks rose by 26% post-stress test, increasing from US$156 billion to US$197 billion, driven by a 60 basis points decline in the stress capital buffer (SCB) at the median bank.”

Goldman Sachs, benefiting most prominently from the stress test methodology adjustments, reduced its core equity tier one (CET1) capital requirement from 13.6% previously to just 10.9% of risk-weighted assets. It is its lowest since the Fed’s current regime began in 2020.

JPMorgan also saw substantial benefits from the latest stress test, with its stress capital buffer (SCB) declining by eighty basis points, from 3.3% to 2.5%. Morgan Stanley analysts also noted JPMorgan’s strong potential Q2 trading results: “We expect JPMorgan’s equities trading revenue growth to reach approximately +8% year-over-year, supported by increased market activity and client-driven transactions.”

Citigroup experienced a more moderate decline in its SCB, dropping fifty basis points from 4.1% to 3.6%. Morgan Stanley’s analysis indicated that Citigroup would see revenue growth driven by fixed income, currencies, and commodities (FICC) markets, with “revenues expected to increase +8% year-over-year, benefiting from improved market conditions and trading volume expansions.”

Wells Fargo analysts, led by Mike Mayo, described the overall fed stress test scenario as “the least stressful this decade,” attributing the positive outcomes to “lower loan losses, lower private equity losses, and less global market shock.” They further emphasised that capital markets-focused banks such as Goldman Sachs, JPMorgan, and Citigroup stand to gain significantly, given their ability to redeploy substantial excess capital into core trading activities.

Morgan Stanley noted that Goldman’s strategy to focus heavily on financing revenues will further boost its performance:

“For equities markets, we expect revenue growth of +16% y/y versus consensus of +13%, given Goldman’s focus on growing financing revenues,” said Graseck.

With second-quarter earnings imminent, both Morgan Stanley’s and Wells Fargo’s analysts say the banks will have the opportunity to clarify how they will apportion this freed-up capital between further growth of their trading asset bases or returns to their shareholders.