The interbank market in MSCI Emerging Markets derivatives that five years ago was 98% swaps is now 98% futures, according to Goldman Sachs. But the buyside still remains swayed by the advantages of OTC contracts.

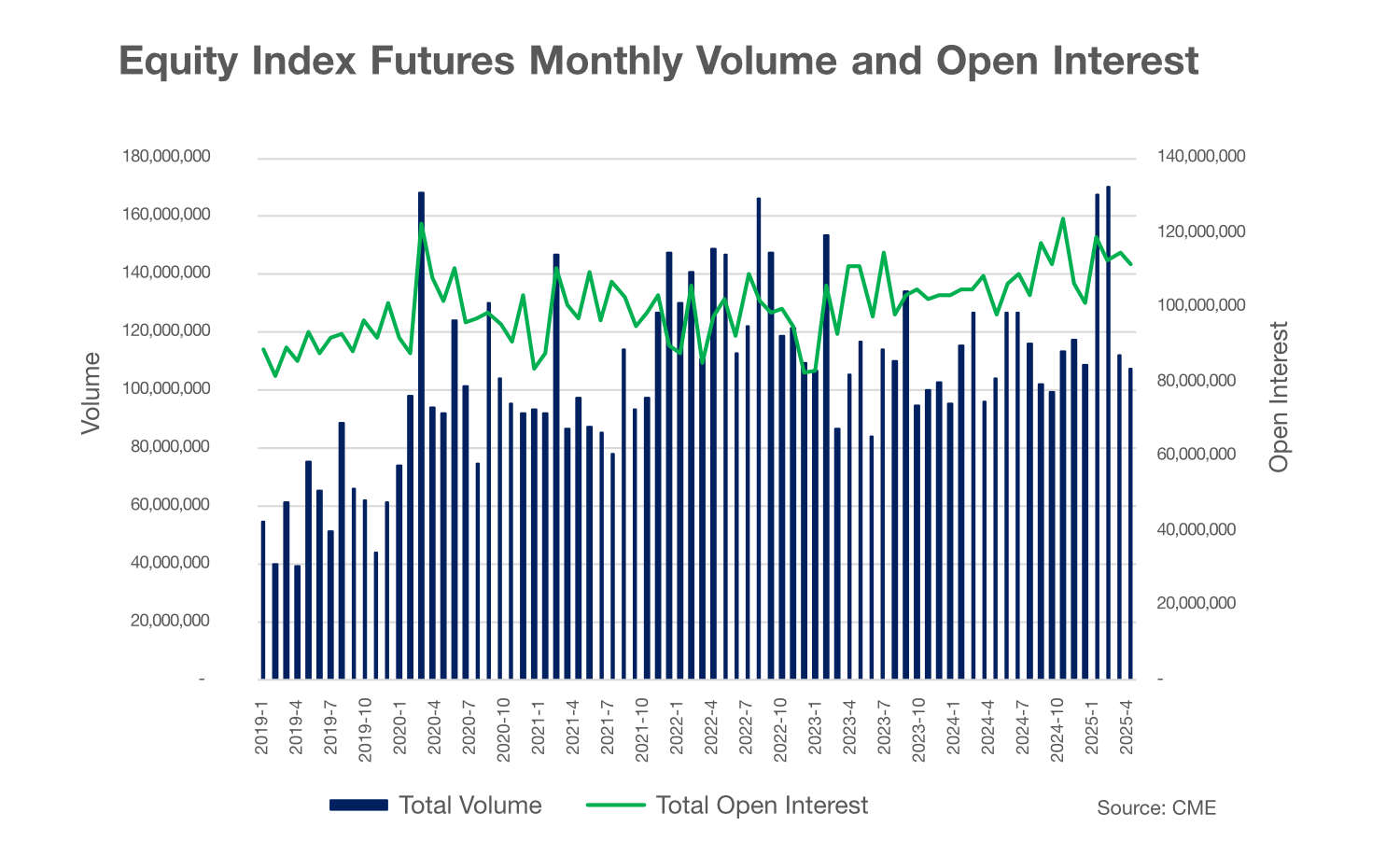

Listed equity derivatives are booming. In April, volume in US equity futures contracts reached an all-time high, according to CME. Similar records were broken in listed equity options as well. European equity derivatives volumes peaked in March, according to data compiled by Eurex.

Listed equity derivatives are booming. In April, volume in US equity futures contracts reached an all-time high, according to CME. Similar records were broken in listed equity options as well. European equity derivatives volumes peaked in March, according to data compiled by Eurex.

Buyside firms have also increased their derivatives activity.

According to Matt Howell, global head of trading strategy at T Rowe Price, “Our derivative use continues to grow, and it’s growing in terms of the strategies that are using derivatives. It’s growing in notional volumes, and it’s growing in the variety of different instruments that we are trading”.

Axa Investment Managers is already well-known to Global Trading readers for its use of tail risk hedging.

Tail risk hedging: Preparing for the crash – Global Trading

This year, derivatives usage has risen further, according to the firm’s senior derivatives trader Dimitri Mongeot. “We have been pretty active since the beginning of the year, so we did increase our volume significantly with the volatile environment. When there is volatility, we try to be a bit more tactical as banks do.”

All this increased activity comes amid claims by sell-side firms and exchanges that the tide is beginning to turn away from OTC derivatives, and in favour of listed products. The buzzword is ‘futurisation’, where structures that in the past would have traded in swap format are being refashioned as listed products.

“It’s a fundamental shift in our markets and how they’re perceived and how they’re utilized”, according to Joseph Nehorai, co-head of global futures at Goldman Sachs, speaking at the FIA’s IDX conference in London in June.

“I see futurisation actually being an incredibly important part of the growth in listed derivatives, as people migrate away from trading swaps,” he said. “The interbank market in MSCI Emerging Markets, five years ago, that was 98% swaps, now it’s 98% futures. The Eurostoxx total return future has a higher open interest than the classic Eurostoxx future, and that’s all interbank hedging”.

Exchanges can take some credit for this growth.

“Europe has been showing leadership when it comes to moving from OTC to listed with the introduction some years ago of total return futures on established indices as an alternative to the use of equity swaps”, Nasdaq’s head of European equity derivatives products Alessandro Romani told the TradeTech audience. “What we are able to offer today to clients that are trading OTC, is the possibility to create their own custom baskets based on the universe of over 1200 stocks covered in Europe and US, and have a futures contract that is listed on exchange and centrally cleared on the very next day as an alternative to using OTC equity swaps”.

Bilateral derivatives are ‘good tools’

However, large buyside institutions in Europe do not seem to have received this sell-side memo. Instead, they respond with complaints about fragmentation between exchanges and lack of on-screen liquidity. Axa IM’s Mongeot makes his firm’s preference for OTC derivatives clear.

“We are significant users of OTC products”, Mongeot told the TradeTech audience. “People talk about fragmentation, but to be a bit of a contrarian, for OTC products, as an asset manager, we don’t feel the issue of fragmentation, because we can get large sizes done on the OTC market. OTC bilateral products are good tools to transfer risk without being visible in the market”.

Trying to assess any buyside trends in derivatives use can be a daunting task, however, because of the sheer variety of the portfolios involved and their investment goals.

“Derivatives are another tool in the toolbox for lots of different strategies that have different objectives”, notes Howell. “If you think about what derivatives can bring to a portfolio, there’s hedging, or removing an exposure from an existing investment. There’s directional, where you’re looking to add an exposure via a derivative, and often embedded in the derivative is some form of leverage. And then there is liquidity which the derivative allows you to access in a way that you’re not able to access directly in the underlying”.

Choosing the right kind of derivative involves understanding portfolio manager objectives, Howell explains.

“The implementation discussion, which is what my team spends a lot of time doing, involves understanding the exposure, the investment time horizon, the strategy that they’re running, and then coming up with the cleanest, operationally-supported implementation suggestions, backed by data, coherent with the wrapper that’s being used, and liquidity is obviously a big factor”.

“The reason you’d use a particular instrument is dictated by the combination of investment objectives, strategy that it is residing in and the fund wrapper.”

Howell is reluctant to publicly describe T Rowe Price’s mix of derivatives, but in the one case where Howell does express a preference for OTC products, he explains that for buyside institutions, bilateral contracts overcome the drawbacks of listed products when trading options in Europe. The problems stem from multiple exchanges offering the same contracts on-screen, each with multiple strikes and maturities with limited liquidity. Institutions that need to trade larger size off-book are frustrated by block trade crossing rules that vary between different exchanges.

“I’ve been working for US firms transacting European business across derivatives for many years, and often our challenges accessing listed option markets have been because the lack of on-screen volume, because of rules around crossing blocks, etc, and that’s always been difficult to interact with and we’ve often fallen back on OTC because it’s easier”, Howell says.

Collateral convenience

Being able to trade in size is not the only reason that many buyside traders favour OTC.

“It does have another advantage for us”, says Mongeot. “When we do these trades for institutional clients, from a collateral perspective, you can post [investible] assets you have on your balance sheet against it”.

This flexibility contrasts with listed derivatives, where exchanges require cash in order to meet margin calls – often a scarce resource for buyside firms.

“OTC products are governed by a credit support annex (CSA) that is negotiated bilaterally and optimized to the need of each account, giving the client the freedom of a bespoke collateralization in opposition to listed products that are subject to daily margin calls in cash”, Mongeot told Global Trading.

However, this flexibility is less important for fund managers that ringfence their funds.

“All of our strategies and funds have their own legal entity identifier (LEI)”, one such buyside trader told Global Trading. “We trade as an advisor across all of those entities. What we can’t do is use positions in one legal entity to support positions in another legal entity”.

“If you’re trading for one LEI that’s running lots of strategies, then collateral becomes much easier. This is why large hedge funds can often implement new strategies faster. It’s because they’re not dealing with onboarding 400 separate agreements just in order to enable the platform to trade”.

For Howell, collateral is ultimately determined by the underlying fund, which often determines the type of derivative used.

“You’ve got this exposure you want to take, and you’ve got the strategy it operates within – if you’re talking about an equity strategy, then you’re not going to be a natural holder of bond collateral,” he says. “But if you’re executing in a fixed income strategy, you’re probably holding Treasury bonds, which you might want to use as collateral, rather than posting cash. That asset class strategy would help you decide whether you’re going to trade bilateral or whether you can trade listed”.

And some fund management clients might not even be able to trade OTC derivatives at all.

“We might have a situation where we’ve got a client who doesn’t have ISDA agreements”, Howell points out. “An exchange traded derivative makes more sense for that client than a bilateral product”.

Transatlantic differences

For all the talk of record listed equity derivatives volumes, growth is still dominated by the US. In Europe, Frankfurt-based Eurex may have seen record volumes in March, driven by its benchmark Eurostoxx contracts, at a time when uncertainty over US policy was at its peak. However, Paris-based rival Euronext reported equity derivatives volumes that were actually lower than the previous record in July 2024, despite a flurry of recent derivative product launches aimed at prompting new business.

Market participants highlight the difference between the freewheeling culture of the US versus Europe, where market counterparties are more risk averse and counterparties expect options to be packaged together with their underlying hedge, which reduces risk.

“Talking about trading style, it’s completely different between the US and Europe,” Axa IM’s Mongeot explains. “In Europe you will trade options against the delta, and you need to actually hedge the delta, whereas in the US you don’t”.

By contrast, US markets have liquidity providers happy to take the opposing side of an option trade without any hedge in place, Mongeot says.

“The US structurally has bigger volume, which creates a dynamic where, when you trade with a liquidity provider, a bank, or newcomers in the market, they take the opposite side of your trade. You don’t have that at all in Europe, which I think is one of the main reasons you have a lot of engagement in the US market”.

One reason for this difference is retail use of options in America, which has sparked a craze for zero-date-to-expiry (0DTE) contracts facilitated by online zero-commission broker platforms. According to CBOE, 61% of S&P 500 options volume in May was 0DTE, driven by retail. If exchanges want to transform equity derivatives in Europe, retail needs to be involved, insists Mongeot.

“Retail participation is much lower in Europe than it is in the US, and something needs to be done,” he says. “Now in the US, 0DTE equity options is actually 50 to 60% of the volume, and it’s nowhere in Europe”.

Mongeot believes that 0DTE has improved liquidity across the entire US options market.

“It just shows that if you have traction in these options at the front end of the curve, you might have it propagating towards the other end of the curve as well, and probably more trading volume overall,” he says.

There are some encouraging signs in Europe, such as from the Nordic region. “We have seen strong growth in retail participation from the domestic client base”, Nasdaq’s Romani told the TradeTech audience. “The retail flow from online brokers serving the local market has been growing 40% over the past five years”.

European exchanges should also learn to be less tight-fisted when it comes to fees and data feeds, according to Iouri Saroukhanov, head of European derivatives at CBOE.

“[The industry] can start being more generous with our data that we give to the retail participants. We [CBOE] offer it for free. We are committed to that. I’m sure there’s other ways of doing zero-fee retail broking. That’s what actually allowed retail to spring up in the US. So, let’s have a look at some of the lessons from across the pond.”

Others warn that retail growth in Europe will have to wait for an easing of over-coddling regulation and the development of a risk culture, moves which have only just begun.

De-fragmenting European listed derivatives

In the meantime, industry participants urge getting to grips with the perennial bugbear of fragmentation. This can mean a number of things, from multiple exchanges offering the same contracts which have low levels of liquidity, and the lack of interoperability between Europe’s numerous clearing houses.

Charlotte Alliot, head of financial derivatives at Euronext questioned the framing of the debate in her comments at TradeTech. “The issue is not fragmentation, it’s culture. Because if you look in Germany or France, they do structured products rather than options. When you go to Holland, the minister used to be an options trader. Everyone does options, and it’s fantastic. And if you go to Italy, they love fixed income, and they like futures.”

Meanwhile, CBOE Europe, which is not competing against European listing exchanges with new contracts [in the equity space], focuses on the clearing problem. CBOE’s Saroukhanov told the TradeTech audience, “Fragmentation comes up a lot, and we’re offering pan-European access and also pan-European clearing as well. When you start talking about equity options and the multiple central securities depositories (CSDs) that we have in Europe, it’s hugely important to be able to offset options against equity flows and here, clearing is extremely important”.

According to the sell-side, fragmentation is no longer an obstacle. “The level of sophistication from our clients has gone up”, Goldman’s Nehorai told the IDX audience. “Because of the increased use of futures across every asset class in every region, they want to maximize their leverage through optimizing their margin, whether that’s posting different types of collateral or forcing prime brokers to provide margin offsets within their own risk models, or choosing to execute the future, or give an exchange where they have an existing position around the future that gives them a correlated margin offset”.

Yet the public numbers still fail to support such assertions. Even Goldman’s own quarterly Federal Reserve disclosures show the firm’s equity futures positions lagging well behind OTC equity derivatives notionals. Exchange derivatives volumes are still dominated by their biggest index products rather than new contracts. When it comes to futurisation, the jury is still out.