When machines learn to trade like video gamers

A branch of artificial intelligence first used to master Atari video games is not an obvious choice for applying AI to trading. But deep reinforcement learning excels at playing the stock market, according to a paper by Jedrzej Maskiewicza and Pawel Sakowski. The AI trader can choose trading strategies in response to market conditions, and is assigned a reward function that measures how well the strategies perform. A neural network learns to choose strategies that minimise the difference between predicted and actual rewards based on the current market state. When applied to daily trading on liquid equity and FX markets, this approach outperforms other machine learning-based approaches. (Link to paper: 2506.04658 )

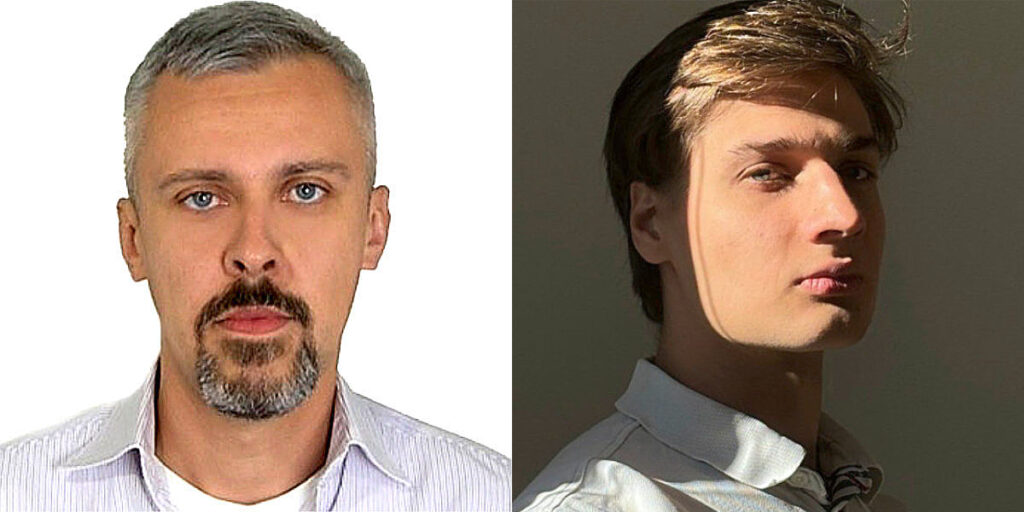

Using AI doppelgangers to trade Chinese limit order books

High-frequency trading of Chinese stocks is challenging – the limit order book updates only every 3 seconds, and stock prices typically jump after the close. Jiahao Yang, Ran Fang, Ming Zhang and Jun Zhou tackle this challenge using long short-term memory (LTSM) networks – an AI technique developed before large language models – with a twist. They deploy a pair of ‘Siamese twin’ deep learning networks to the bid and ask side of the order book, encoding the LOB into a features vector that is used to predict the next state of the market. The approach outperforms other techniques, especially when the LOB is compressed using order-flow imbalance. (Link to paper: 2505.22678 )

Benchmarking Bloomberg’s TCA formula using agent-based modelling

Pioneered by Doyne Farmer, agent-based modelling is at the heart of market microstructure theories, outperforming traditional efficient market frameworks even when the agents possess ‘zero intelligence’. Perukrishnen Vytelingum, Rory Baggott, Namid Stillman, Jianfei Zhang, Dingqiu Zhu, Tao Chen and Justin Lyon simulate fundamental and momentum-driven agents interacting with a central limit order book, trading Hang Seng index futures. Calibrating their model to market data, they find that transaction costs vary with order size much more than anticipated according to Bloomberg’s widely-used transaction cost analysis formula. (Link to paper: Agent-based Liquidity Risk Modelling for Financial Markets )

Trading creates volatility

According to financial economics textbooks, volatility is caused by new information reaching the market, and prices reflect this information. Not so, according to market microstructure experts who argue that volatility is caused by trading itself. Guillaume Maitrier and Jean-Philippe Bouchaud may have settled this question once and for all with a careful empirical study that brings together three apparently unrelated things: the square root law of price impact, random walks of prices and the impact of order imbalances. Using public tape data for index futures and stocks, they find that a crucial parameter, the long-range correlation between metaorders, plays a decisive role in ensuring that trading creates volatility. (Link to paper: The Subtle Interplay between Square-root Impact, Order Imbalance & Volatility: A Unifying Framework )

The toxic flow problem

Market makers and brokers love trading with uninformed traders (often equated with retail) but live in fear of being picked off by informed traders, who leave them with inventory that is about to rapidly change in price. In the past, quants have tackled the problem of avoiding such ‘toxic flow’ but their models only worked over a limited time horizon. Álvaro Cartea and Leandro Sanchez-Betancourt use a Hamilton-Jacobi-Bellmann approach to extend this to infinite times, providing rules for inventory growth rates based on market volatility and transaction costs. As a bonus, they provide an algorithm that allows practitioners to apply their research on lit order books. (Link to paper: [2503.18005] A Simple Strategy to Deal with Toxic Flow )