Market-structure specialists, analytics vendors and buy-side traders are seizing on a new Aquis Exchange study to demand that regulators finish the job MiFID II started and impose a single, enforceable flag taxonomy on all post-trade reports.

Read more: Frustration builds over Europe’s hidden liquidity

“Today’s liquidity figures are still filtered through a patchwork of more than two hundred sub-flags whose meaning shifts desk by desk,” says Mark Montgomery, chief commercial officer at analytics firm, Big Xyt.

He argues the cure is simple: “Mandate a slim, standardised set of five or ten MMT flags, feed that clean data into a consolidated pan-European tape and we could publish a transparent, venue-level picture of liquidity tomorrow. The technology is ready—the mandate is what’s missing.”

Montgomery’s frustration was triggered by a paper from Laetitia Visconti, head of market structure at Aquis Exchange that re-maps the myriad MMT sub-flags. By stripping out clearly non-price-forming prints and re-classifying much of the flow reported on Systematic Internalisers (SI), off-book-on-exchange channels and OTC venues, the report shows that Europe’s equity accessible liquidity is almost one-third larger than the commonly used addressable definition suggest.

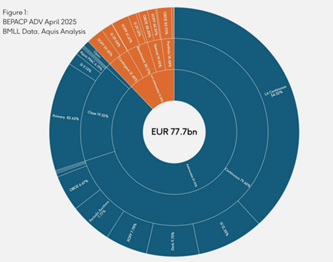

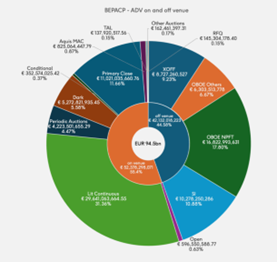

For the Cboe Europe All Companies universe, the study finds average daily turnover of €67 billion in April 2025, against €52.8 billion when only lit, dark and auction prints are counted. Almost 88% of all reported volume, the paper finds, is realistically tradable, accessible by professional desks; four fifths of that is executed during continuous trading and the remainder at the close. This proportion might be skewed due to the volatility in April 2025.

Visconti keeps MiFID II’s broad categories but redraws the boundary around what counts as tradable liquidity: standard SI flow, plain negotiated transactions and close-benchmark SI prints are labelled “accessible”, whereas guaranteed VWAP deals, contingent blocks and portfolio trades remain outside because they depend on bespoke bilateral agreements. The reports acknowledges limitations. Only the UK forces firms to tag closing-price SI prints explicitly, so EU trades may hide inside generic labels; banks still double-report some UK-listed stock in EU venues and vice versa; and legal interpretations of the two-hundred-plus sub-flags continue to drift, making identical transactions look different on the tape.

Even so, the notion that so much genuine volume sits behind inconsistent labelling strikes a nerve for market participants.

“What was once considered non-addressable activity is being reassessed,” says Rebecca Healey, managing partner at Redlap Consulting and FIX EMEA co-chair. “Automated bilateral flow is increasingly price-forming and has to be in the picture.”

Traders say that Aquis’s definition of liquidity may become adopted for some trading styles but not for others.

Fabien Orève, deputy global head of trading & securities financing at Candriam said: “Depending on trading style (“low-touch” style based on broker’s smart order routers and “high-touch” style based on large, complex, sensitive orders’ execution), equity traders need to look at two levels of Average Daily Volume (ADV) for European stocks: a basic ADV based on addressable liquidity in the strict meaning of the word, and a broader ADV based on a wider interpretation of liquidity (including off book on-exchange and systematic internalisers’ volumes).”

Bilateral trading related concerns already dominated March’s FIX EMEA conference, and they are likely to be very present in the European Commission’s Savings & Investments Union consultation’s answers, which asks whether divergent post-trade practices still hamper capital-markets integration; the deadline for responses is10 June 2025

Read more: FCA pledges caution as industry voices concern over rise of bilateral trading

ESMA declined to comment on the Aquis findings or the broader transparency debate.