As in Europe, Australia is suffering a dwindling IPO market – so much so that the Australian Securities and Investments Commission (ASIC) is stepping in to speed up the process for those who do want to list Down Under.

Eligible offer documents of entities listing on the Australian Stock Exchange (ASX) through the fast-track process will be informally reviewed by ASIC on an informal basis up to two weeks before they are publically submitted.

Engaging with the issuer before exposure cuts down the need for supplementary and replacement documents, minimises the need for the usual 7-day exposure period to be extended, and could reduce the IPO timetable by up to a week, the commission says. The risk impact of market volatility and consequential prices on investor appetite will also be reduced, it added.

“Creating a more streamlined IPO process underscores our commitment to ensuring our public markets remain attractive to companies and investors,” affirmed Joe Longo, ASIC chair.

“Our initial public offerings are the lowest they have been in over a decade, and companies are de-listing,” he warned.

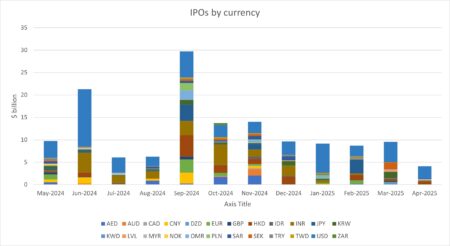

Despite the region’s woes, the US$2 billion in AUD-denominated IPOs issued between May 2024 and April 2025 dwarfed the US$1.4 billion issued in GDP. However, the Aussie dollar remains far behind its APAC peers – US$9 billion in IPOs were yen-denominated over the 11 months, and US$13 billion in HKD.

The fast-track process is available on a two-year trial basis to entities with a market cap below AUS$100 million at the time of listing and no ASX-imposed escrow.

The trial also includes a class no-action position, allowing eligible companies to accept retail investor applications before the public exposure period ends. This will further reduce administrative timelines, ASIC says, and align prospectus and product disclosure statement processes.

Longo stated: “While we do not see regulatory settings as the silver bullet, we have received lots of ideas and are considering further regulatory adjustments to support a strong and well-functioning market.”

The announcement follows a February consultation paper reevaluating capital market dynamics in Australia and globally. More than 50 public submissions were made, including from industry bodies such as the National Stock Exchange of Australia, Bloomberg, and Apollo Asset Management.

“Greater deal certainty for companies should help deliver more IPOs, which means more investment opportunities so companies can expand, increase jobs and ultimately economic growth,” Longo concluded.