A David-and-Goliath battle has broken out in the world of pre trade transaction cost analysis (TCA). In one corner, upstart vendor Simudyne unveiled an agent-based TCA model that it claims outperforms Bloomberg. Now the data and analytics behemoth has hit back, accusing the upstart of mischaracterising its research.

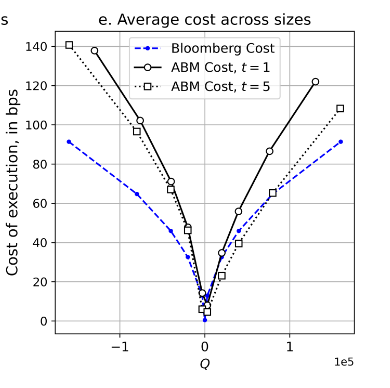

In its research paper ‘Agent-based liquidity risk modelling for financial markets’, Simudyne presents a simulator of a continuous double auction in which fundamental investors, momentum traders and noise agents interact so that short-lived and permanent price impacts emerge from the simulation rather than being imposed ex-ante from empirical formulas. The authors calibrate to Hang Seng index futures and run Monte Carlo paths to generate liquidity-risk surfaces across order sizes and horizons; to demonstrate the strength of the endeavour they compare reinforcement-learning execution schedules with time weighted average price (TWAP) and volume weighted average price (VWAP), two common strategies to minimise market slippage.

Simudyne frames the work as both research and live tooling.

“This liquidity risk calculation, this liquidity risk manager, is currently in use in production in Hong Kong stock exchange,” said Justin Lyon, founder of Simudyne, describing scenarios run daily by venue risk managers.

He also told Global Trading that the simulator could have a large impact improving the execution of meta-orders: “We are showing, with evidence, that we can deliver at least a 10-basis-point improvement in execution. Instead of relying on bog-standard liquidity-seeking algos, the portfolio manager simply says, ‘spin up the AI-powered simulator’. It is calibrated and run overnight, and by the next morning it is executing a completely bespoke algorithm – specific to that flow, specific to that venue.”

Hong Kong Exchanges and Clearing (HKEX) declined to comment on the paper and the use in production of the model for liquidity risk prevention at its central counterparty (CCP). But Richard Wise, head of risk for HKEX group, co-authored both the aforementioned paper and others with Simudyne, including one presenting how the simulator is used to estimate potential liquidation costs in real-time with HKEX.

Not everyone is convinced by the substantial improvement promised on large order executions. A head trader at a large European institution told Global Trading: “Ten basis points against arrival price seems a massive improvement to achieve.”

When we contacted Bloomberg, whose pre-trade transaction cost analytics (TCA) tool is widely used by buy- and sell-side desks, the firm was sanguine about how its approach is presented in Simudyne’s paper.

Vlad Rashkovich, global head of trading research and analytics at Bloomberg, said: “The part that is a bit surprising to me is that the formula that they are quoting is not the one used in Bloomberg’s TCA equity model. Their research references many documents, but they have no reference to the paper, which we published in the Journal of Trading, (Autumn 2012), where we introduced our approach and share our results.”

He also stressed the scale and breadth of the firm’s calibration set: “Bloomberg’s pre-trade TCA model is based on millions of parent orders from some 500 buy-side firms across 89 countries.”

Bloomberg told us that its model fit (r²) varies by region and microstructure, and is typically around 10% in the US 8-9% in Western Europe, and 7-8% in developed Asia. Their model coefficients evolve slowly as market structure changes. Their refresh cadence depends on asset class: some fixed income models are recalibrated daily, others are reviewed quarterly.

The firm also emphasised that execution horizon has been central to its framework since 2012, rather than relying on a simple ‘block’ formulation, and that its models are trained on contributed parent-order data large enough to link fills into meta-orders across brokers and regions.

Simudyne argues that a venue-calibrated, agent-based exchange can do three things empirical pre-trade models cannot provide directly.

First, it can run fully specified counterfactuals: by simulating many price paths for a given order and horizon, the desk can separate market-risk variance from market-impact cost rather than inferring that split from past orders.

Second, it can let microstructure effects emerge: By allowing agents to update beliefs and interact through the order book, both short-term and permanent impacts arise without pre-imposing a functional form.

Third, it can produce learning-based schedules: reinforcement learning strategies trained inside the simulator can output execution trajectories that adapt to the calibrated venue state, which the firm says underpins the “10 bps” claim when compared with standard participation templates.

Some market participants we talked to criticise the published calibration as limited to a single venue/day and that independent validation across regimes remains the key test.

Other independents are innovating and adapting existing models to specific microstructures.

BestEx Research has launched Pulse, a futures-specific pre-trade estimator delivered by API within its algo management system that seems to compete with Simudyne ABM simulator, while Bloomberg does not offer futures pre trade TCA at the moment. BestEx says Pulse is symbol/future-specific, accounts for “shadow liquidity” and explicitly splits total slippage into market-impact and order-placement components.

As Hitesh Mittal, founder and chief executive, says: “From a Pulse perspective, the benchmark is arrival, arrival price… It breaks it down into two components… Market impact cost and order placement cost. it is not an optimiser; it is really an estimator;” BestEx argues that in many futures, reported contract volume is a poor proxy for executable capacity across related markets and along the curve, and that liquidity is better proxied via spread, depth, and resilience.