BNP Paribas’s €5.1bn purchase of AXA Investment Managers (AXA IM) is increasingly reliant on a 15-year distribution deal with fund group’s insurer parent, that insulates the bank against customer flight towards lower fee funds.

The takeover would boost BNP Paribas Asset Management’s footprint from €604 billion to €1.5 trillion and BNP would jump into Europe’s top three asset managers overnight. It would also turn its Insurance & Protection Services (IPS) division into “the biggest growth driver for the group in the next few years”, chief financial officer Lars Machenil said on a 24 April investor call.

The deal is two-pronged, with on the one hand a 15-year distribution agreement and on the other hand the folding of AXA IM into BNP’s IPS division. BNP had hoped to offset the reduction in capital by using the so-called Danish Compromise, a European tweak to Basel banking rules that allows banks to avoid deducting the value of insurance subsidiaries from capital.

In an interview published on the European Central Bank’s website in April, chair of the supervisory board Claudia Buch, poured cold water on BNP’s ambitions, stating that “it’s intended to be applied to the insurance sector and not to, for example, asset management undertakings”. BNP says discussions are “ongoing” and insists its plans will still allow for capital to be returned to shareholders. “We have already received the ECB’s green light for a €1 billion share buyback that will launch in Q2,” Machenil reminded investors on the same call.

Without the capital benefit, BNP’s acquisition depends more upon its 15-year agreement to step into Axa IM’s shoes as manager of the assets backing Axa’s insurance liabilities. Having such a captive client gives the bank protection against customer flight towards lower-cost fund providers and exchange-traded funds.

Blackrock, Vanguard took $500bn in passive fund 2024 inflows as actives fight back – Global Trading

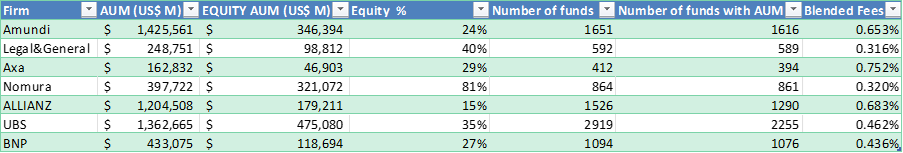

Among European fund groups, Axa IM is particularly dependent on high fees, analysis by Global Trading shows.

AXA IM currently manages about €895 billion across fixed income, multi assets, equity and private markets franchises, and earned net revenues of €1.6 billion in 2024. Its funds, of which in our sample 29 % of assets are allocated to equity, command the highest average fees amongst those reviewed from UBS, Legal & General, Allianz and Amundi: 0.75 % versus Amundi’s 0.65 % and LGIM’s 0.32 %.

Peer snapshot (funds listed on Bloomberg):

Data covers only funds that are individually listed on Bloomberg and whose parents were searched for. Blended fees are calculated only for the subset of funds with a disclosed AUM, so rates may differ from group actual global fees.

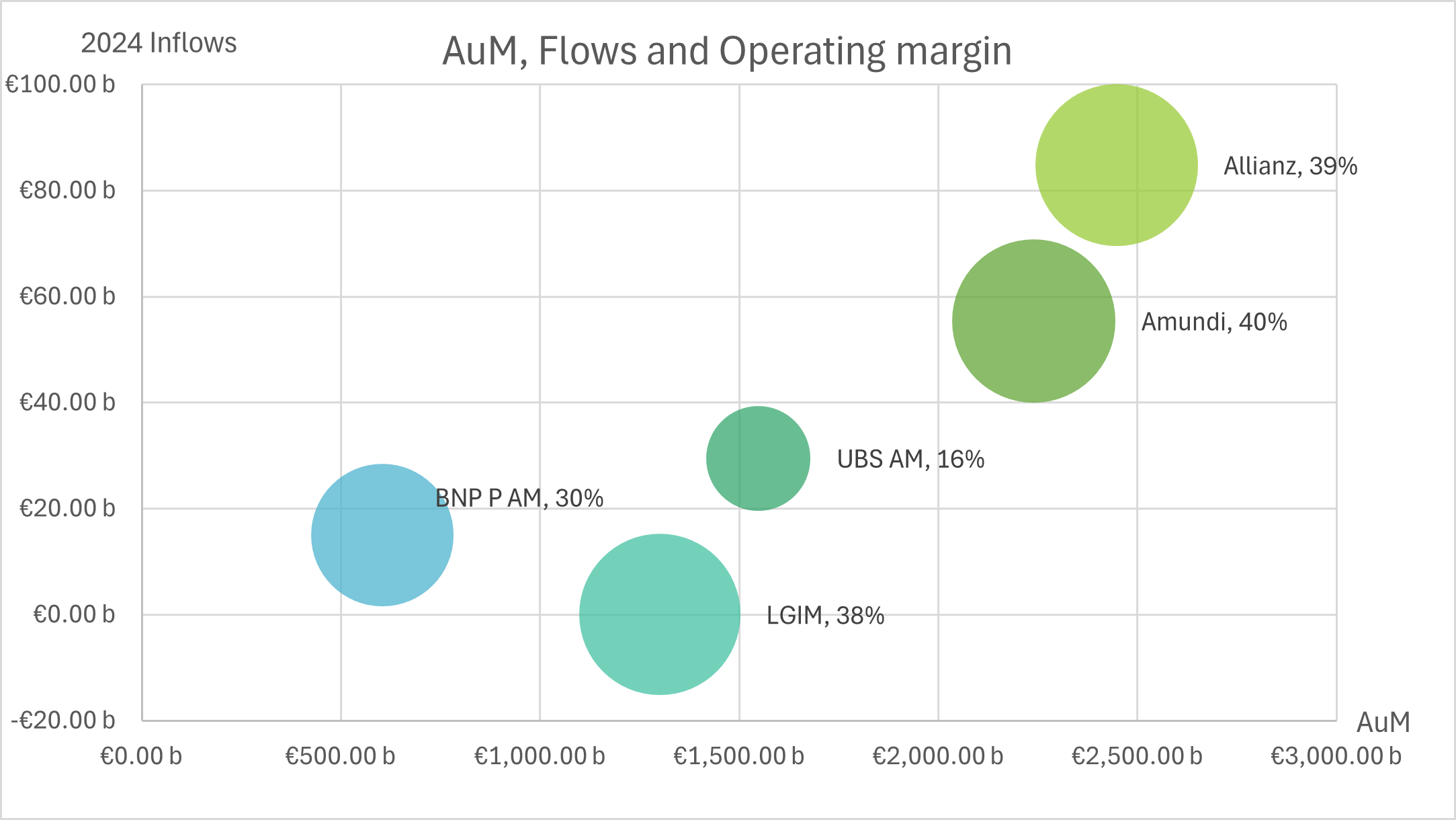

Even without M&A, European asset managers grew in 2024, but the money did not land evenly.

“2024 was a record year—€55 billions of net inflows, with every client segment contributing and AuM topping €2.2 trillion,” Amundi chief executive Valérie Baudson said on her results call on 4 February.

“Bond funds did the heavy lifting: Allianz Group enjoyed €70 billion inflows at PIMCO that more than offset equity redemptions at Allianz GI,” Allianz SE CFO Giulio Terzariol told analysts on 28 February.

And Suni Harford, president of UBS Asset Management, noted on the 6 February call that “The integration of Credit Suisse’s funds is running ahead of plan; we captured CHF29.5 billion of net new money in 2024 even as consolidation costs peaked.”.

Against that backdrop BNP AM registered €15 billion inflows and closed the year on €604 billions of AUM. Both Axa and BNP declined to comment.