A deep-dive discussion with Alison Hollingshead, jupiter’s investment management chief operations officer, and Mike Poole, head of trading.

(This article first appeared on Best Execution, a Markets Media Group publication.)

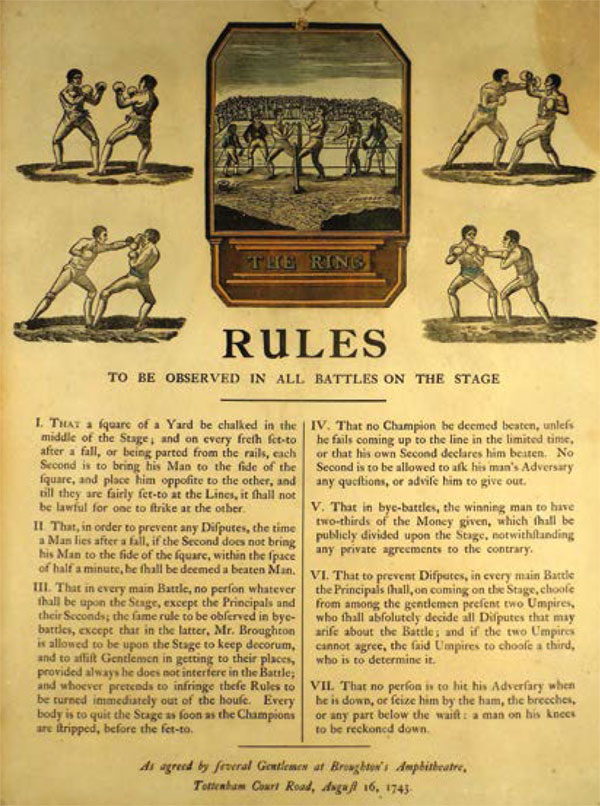

It’s not always about packing the biggest punch… sometimes it’s picking the right battle that counts. Laurie McAughtry talks to Alison Hollingshead and Mike Poole about Jupiter Asset Management’s ongoing transition strategy – and how a positive working relationship can bring about transformational change both on the floor, and in the market.In 1743, English champion Jack Broughton revolutionised the world of bare-knuckle boxing with the introduction of seven simple rules to civilise what was, until then, a sport both brutal and bloody. These new ‘rules of play’ codified the formalities of a fair fight – including how players entered and acted in the ring, the enforcement of fair play, the introduction of umpires and the distribution of prize money. Crucially, Broughton was also the first to differentiate between light and heavyweight divisions in the sport.

This transition from lawlessness to regulation ushered in a new era of public approval for boxing – and it is no great stretch to draw parallels with today’s highly regulated yet aggressively competitive trading landscape.

This transition from lawlessness to regulation ushered in a new era of public approval for boxing – and it is no great stretch to draw parallels with today’s highly regulated yet aggressively competitive trading landscape.

But there are no weight categories in asset management. Firms with trillions in AUM compete for liquidity with investment firms managing a fraction of those volumes – and so smaller players have to use brains to outbox their larger competitors, targeting their punches with surgical precision.

Fast forward almost 300 years and in June 2022 Jupiter Asset Management, a firm with £51.4 billion AUM, appointed Alison Hollingshead as investment management chief operations officer (COO) and Mike Poole as head of trading, to support a turnaround in its capabilities.

Hollingshead, who was hired after 18 years at Man Group, has over the past year formed a strong partnership with Poole, a lifelong Jupitee who was promoted to head of trading in November of the same year after almost two decades with the firm. With very different approaches to their work (but very similar standards for performance), we talk to the turnaround team about leadership, learning, and putting in the legwork.

“A desire, a dream, a vision” – Joe Frazier

It has been a turbulent few years for Jupiter after its 2020 acquisition of Merian, an investment firm with around £22.4 billion AUM. Following a change in leadership and a transition in strategy, led by CEO Matt Beesley who joined in January 2022, Hollingshead was appointed to revolutionise the investment floor.

“My role essentially covers everything on the investment floor that isn’t actually investing,” she explains. “That means running the operations and business management of investment, with responsibility for everything from trading and data science to controls and oversight – anything that isn’t directly related to fund management.”

“My role essentially covers everything on the investment floor that isn’t actually investing,” she explains. “That means running the operations and business management of investment, with responsibility for everything from trading and data science to controls and oversight – anything that isn’t directly related to fund management.”

Hollingshead’s initial background in equities trading stood her in good stead when transitioning into her new team, as did her later experience driving transformational change at Man Group following its acquisition of GLG in 2010.

“That front office focus of driving change and supporting better use of technology and data is very much what we are now trying to do at Jupiter,” she says. “I see my role has having two key aspects. One is driving the modernisation of the investment process, while the other is supporting culture and collaboration across the floor. Mike’s team is a huge part of that.”

If Hollingshead is the arm, Poole is the punch. She creates the art and science of trading, while he has the skills to translate that into the ring – and onto the markets.

If Hollingshead is the arm, Poole is the punch. She creates the art and science of trading, while he has the skills to translate that into the ring – and onto the markets.

Poole himself joined the firm back in 2005 on the equities desk, before switching into fixed income for most of his latter career – with a steep learning curve through the subsequent financial crisis.

“Learning the importance of relationships, market change and shifts in liquidity during that time stood me in great stead as I moved into management roles and running a team,” he says. “That’s where Ali and I benefit from our differences in background.”

“It isn’t the mountains to climb that wear you out, it’s the pebble in your shoe” – Muhammed Ali

“It isn’t the mountains to climb that wear you out, it’s the pebble in your shoe” – Muhammed Ali

Between the two of them, they’ve shaken up the investment floor – in more ways than one. When Hollingshead first started she changed the whole layout of the space: knocking down walls, opening things out, moving the data science team to the centre and rotating the trading desk to sit at a 90º angle to everyone else. Now the investors are back-to-back with their traders, and the whole atmosphere is much more immediate. “It works really well,” says Poole. “It feels like the engine room now. And Ali is right there in the middle.”

“And the trading desk usually has sweets,” adds Hollingshead. “So I often find myself inexplicably drawn towards it.”

The past year been a journey of growth and discovery for both. “When I first joined, we sat down in the break-out area together and chatted for over an hour,” remembers Hollingshead. “I came out and immediately said to Matt Beesley: ‘I LOVE Mike’. Right from our first conversation, I think we knew we had found a kindred spirit in each other. We are both constantly looking at how we can improve things, and we’re never satisfied with the status quo.”

“We’re always asking why,” agrees Poole.

Agility is everything. Limited resources drive creative innovation, and Hollingshead brings a questioning mindset based on the high expectations engendered by her previous roles. For example, she has an allergic reaction every time Poole mentions the word ‘manual’.

“Her ears prick up, and I always know that the question is coming,” he laughs. “That makes me realise that perhaps we don’t have to be doing things a certain way – and it takes Ali asking the question for me to realise that there is the potential to change. It’s like a Russian doll set – we just keep on asking each other why until we reach a solution. And that happens all the time now.”

“I don’t find it easy to accept ‘no’ as an answer,” adds Hollingshead. “If I’m told something is not possible, I want to know why.”

“The harder the battle, the sweeter the victory” – Floyd Mayweather

But creative solutions require effective resource allocation, especially in today’s cost-cutting climate. “How do you fix things without spending money? The important thing to remember is that it’s not about not spending money,” says Hollingshead.

“It’s about being thoughtful about how you spend it, and spending it in the right place. It’s about looking at your existing processes and people and learning how you can leverage them in the right way,” she observes. “If you do have a new system you want to bring in, or headcount you want to add, then go ahead – but only after you’ve looked at the foundations of what you’ve got and optimised them the best you can.”

“The foundations are absolutely crucial,” agrees Poole. “Something I hadn’t realised, before I got in the seat, was how much work that would require. I came in with a big vision, but quickly realised I could only achieve that once I’d built a foundation that was both standardised and structurally sound. That was quite a challenge.”

He notes: “The easy route would have been to do a request for proposal (RFP) to a dozen data providers, tell them our problems, and throw some money at the person who shouted the loudest. Instead, we chose a different path. We looked around the floor and asked: which parts of the business have we not leveraged properly in the past? How can we use what we already have, but better?” “If you work hard in training, the fight is easy” – Manny Pacquiao

“If you work hard in training, the fight is easy” – Manny Pacquiao

Hollingshead brought a wealth of data science experience to the firm, and this became a crucial building block to support trading and investment.

“When I first arrived, that was definitely a skillset I wanted to introduce,” explains Hollingshead. “Manual is a dirty word now, and we needed a tech focus. It’s been a cultural change. You can have all the in-house tools you like but to achieve better outcomes you have to train people to think about things the right way.”

“Getting the right people in the right roles to understand our vision was key,” Poole chimes in. “We made an internal hire of a new business analyst, and she came with a very tech-focused mindset and the ability to automate. That ability to standardise the datasets has been a game-changer.”

Investment in technology doesn’t always need to involve a big budget – sometimes it just takes some fancy footwork. The team uses a number of different platforms and while BlackRock Aladdin is their main source of investment data for trading and counterparty information (and one of their biggest tech investments to date), the challenge has been to extract the right data at the right time to achieve the right results.

“It was a big decision, but we are an Aladdin house now,” admits Hollingshead. “The challenge this past year in terms of investment has been to leverage this super powerful tool the best we can. How do we get the most out of the platform, and how do we build around it? There are things it doesn’t do yet that we want it to do – in terms of data visualisation, for example, or data sets that we want to integrate – and that’s where we’ve been spending a lot of our time and effort.” “The fight is won or lost far away from witnesses” – Muhammed Ali

“The fight is won or lost far away from witnesses” – Muhammed Ali

The team is now working on building its own tools to layer over the Aladdin platform.

“By leveraging in-house data science expertise, we’ve been able to build a tailored dashboard that standardises the entire piece, so that now I can just slice and dice whatever I want to see,” reveals Poole. “How much business have I done in US Treasuries electronically with Goldman Sachs in Q1? Bang, it’s right there, instantly.”

“We had all the pieces, but they just hadn’t been joined together in the right way,” explains Hollingshead. “That’s a classic asset management problem – getting the right data in the right place at the right time to make the right decisions. We’re trying to move that needle.” “What keeps me going is goals” – Muhammed Ali

“What keeps me going is goals” – Muhammed Ali

While traders target best execution for their end investors on a daily basis, at a strategic level, having a world class trading team proves a greater asset to the business.

“A centralised, high touch trading team can offer a hell of a lot more than just execution,” stresses Poole. “It can be part of RFPs for clients. It can be a differentiator when you’re looking at retaining alpha for clients. It can help people understand investment risk, scalability, liquidity profiles.

“My job is to allow my traders to shout a bit louder about that. I have a team of nine, all of whom are great at their jobs. Now they have access to these new tools, it’s amazing how quickly they learn to use them, because they can see the value.”

Poole and Hollingshead are currently in the process of implementing a new treasury function within the investment floor, reporting into Poole, which will seek to optimise income from cash, now a fully-fledged asset class in its own right, with a standardised mandate from all investment managers on the floor. Poole is promoting from within to build the new team, with an existing FX trader taking on a new, non-execution role as head of the investment management treasury function.

“We are also hiring,” he reveals, referring to Hollingshead’s earlier point about investing in the right areas when there is appropriate need. The team will start off with two people, with a primary remit to manage cash as an asset. However, Poole also plans to fold in other processes.

“We are also hiring,” he reveals, referring to Hollingshead’s earlier point about investing in the right areas when there is appropriate need. The team will start off with two people, with a primary remit to manage cash as an asset. However, Poole also plans to fold in other processes.

“There are a number of strategies around the floor that are still quite manual in terms of the way they manage their cash positions, and we’ll be looking to use this new function to standardise that and then analyse off the back of it to maximise income. Essentially, we’re bringing functions together to achieve effective and scalable change without excessive investment. Which is exactly what we’re trying to achieve across the board.”

“On the one hand we’re trying to maximise scalability and standardisation on the investment floor, but we also have the challenge of the global institutional business,” points out Hollingshead. “We’re trying to futureproof the trading desk to support the growth of that business.” “If you know what you’re worth, then go out and get what you’re worth” – Rocky Balboa

“If you know what you’re worth, then go out and get what you’re worth” – Rocky Balboa

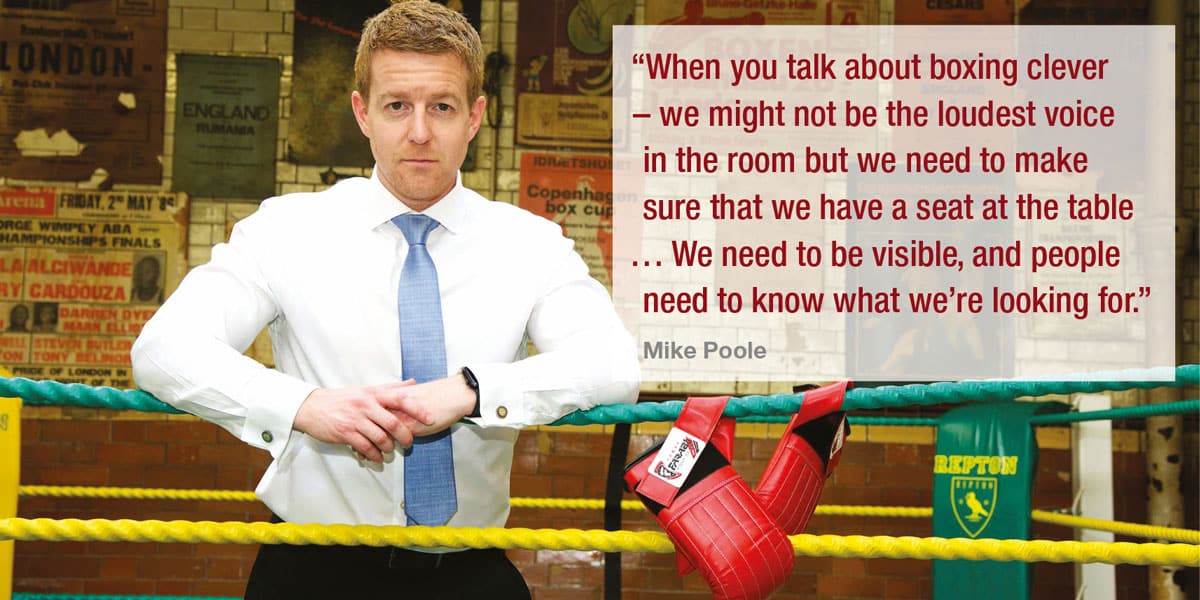

“My biggest headache right now is ensuring that as a desk, we have the right data at the right time to ensure the right outcome,” says Poole. “We operate in a very fragmented marketplace and while the data is out there for those with deep pockets, we need to think a bit smarter.

“That might be via Aladdin, it might be via our transaction cost analysis (TCA) providers, it might be an investment approach, an execution approach, our relationships with our counterparties – we just need to make sure we have the right conversations with the right partners to ensure we are making the best decisions for our own book of business. When you talk about boxing clever – we might not be the loudest voice in the room but we need to make sure that we have a seat at the table, and that the type of business we carry out is facilitated by the technology providers we pay for. It’s about getting that value for money.”

“And it’s about figuring out the problem before we spend money on a solution,” intersperses Hollingshead.

For example, Jupiter might not always be at the front of the queue for block trades, but Poole has ensured that his systems are set up to make the most of what’s out there.

“We ensure that we have the right relationships, the right order management system (OMS) and execution management system (EMS) capabilities, and that we can make a decision quickly with the appropriate data when an opportunity becomes available,” he says. “We need to be visible, and people need to know what we’re looking for.” “He who is not courageous enough to take risks will accomplish nothing” – Muhammed Ali

“He who is not courageous enough to take risks will accomplish nothing” – Muhammed Ali

“I try to be very collaborative with my peers,” says Poole. “While we are up against each other when it comes to asset gathering, what we all want is a functioning marketplace with deep liquidity and optionality. So if you’re trying something different and you think it might enhance your outcomes, try it. If it doesn’t work, fine, but try the change.”

One of their central precepts is the idea of failing fast. “Close the losing trades quickly,” stresses Hollingshead. “Learn the lesson, be agile, move on and move quickly.”

“That’s the beauty of my relationship with Ali,” agrees Poole. “If something isn’t working, she will tell me and we will move on. But at the same time, we won’t wait for perfection. If it gets to about 75% likely it’s going to work, it will probably work. If you want to implement meaningful change, you have to take risks.”

“How do you eat an elephant?” asks Hollingshead. “One bite at a time.” “A person who never made a mistake never tried anything new” – Sugar Ray Leonard

“A person who never made a mistake never tried anything new” – Sugar Ray Leonard

It has been a learning curve, though. When Poole first took the reins he had big ambitions – and reevaluating those expectations hasn’t always been easy.

“It’s like moving house. You think you’re going to redo the loft and change the bathroom, and then you move in and realise you spend 80% of your time in the kitchen with the family, so that’s what you have to fix first.

“As soon as I got into the seat, I realised that I couldn’t make the changes I wanted without the fundamental datasets being correct. I remember in one of my first meetings with Ali I said: ‘standardise, then analyse’. But I thought the analysis would happen much faster than it did, and I was initially very frustrated. It was a challenging time.” “There’s nothing that can compare to testing yourself” – Sugar Ray Leonard

“There’s nothing that can compare to testing yourself” – Sugar Ray Leonard

“I remember the first month-end reporting that Mike did, it was really manual and quite stressful,” recalls Hollingshead. “I promised him that it would never be that bad again.”

“And you were right,” admits Poole. “Every month it got better. This is something Ali has done from day one – recognise when I need that help and support. We have a very similar vision and when she sees that I’m trying to change something and it’s not happening, she always provides the internal support that I often don’t even know I need. That allows me to spend my time adding value rather than wasting my time getting frustrated.”

“It’s been a journey. But this point about the right people for the right tasks with the right tools has been the constant theme throughout this year,” stresses Hollingshead. “It raises morale, it adds value, and it makes our whole output more efficient.” “Everybody has a plan until they get punched in the face” – Mike Tyson

“Everybody has a plan until they get punched in the face” – Mike Tyson

I ask both Poole and Hollingshead what their most valuable lessons have been over the past year – and their answers are startlingly (and perhaps reassuringly) similar.

“People are everything. The importance of failing fast. Celebrating the wins. Having a North Star and making sure people are on the journey with you,” says Hollingshead. “I don’t think there is any ambiguity around our messaging, or what we’re striving towards. This whole automation journey is all about helping people to do their jobs better and it’s really starting to translate now.”

“The importance of relationships,” adds Poole. “Being open with people. Accepting criticism when warranted. Clarity of messaging. It’s OK to get things wrong. Collaboration is key. A year ago, I got into this seat and I said: I want to empower the traders to be able to show their value, shout louder, and tell a story. Today, they are comfortable using data to do exactly that. We’ve got there, and it feels good.” “When I step in the ring, I bring everything I have” – Floyd Mayweather

“When I step in the ring, I bring everything I have” – Floyd Mayweather

“It’s difficult for us to look back and realise how far we’ve come. We’re constantly looking ahead and asking why things aren’t moving faster,” says Hollingshead. “We’re never satisfied.

“But when I do take a moment to reflect on what we’ve achieved over the past 18 months, it’s been a lot. We’ve made some really significant changes – there’s been a cultural change, the level of automation we’ve been able to bring in is amazing, and we’ve got much better access to our data. The amount of time we’ve saved has been really noticeable.”

So where next? Having got the foundations right, the trading team is now more manoeuvrable and more powerful – allowing it to punch well above its weight.

“It feels like we’ve got the right people now,” agrees Poole. “We’ve got the right mindset. We’ve got the right technology. What we’re looking to do now is build upon the foundations we’ve created over the past year to achieve a truly scalable institutional business.”

Although ‘Mr Broughton’s Rules’ were superseded in 1838 by the ‘London Prize Ring Rules’ that remain in modified effect today, ‘Gentleman Jack’ Broughton was the first to introduce a framework of courtesy, collaboration and codified competition to the sport – moving it away from manual fisticuffs towards the more methodised, systemised and sophisticated approach of the modern game. Concepts that, it would appear, remain as relevant to the desk today as they were in the ring almost 300 years ago.

Photos by Chris Mikami with kind permission of Repton Boxing Club

©Markets Media Europe 2024