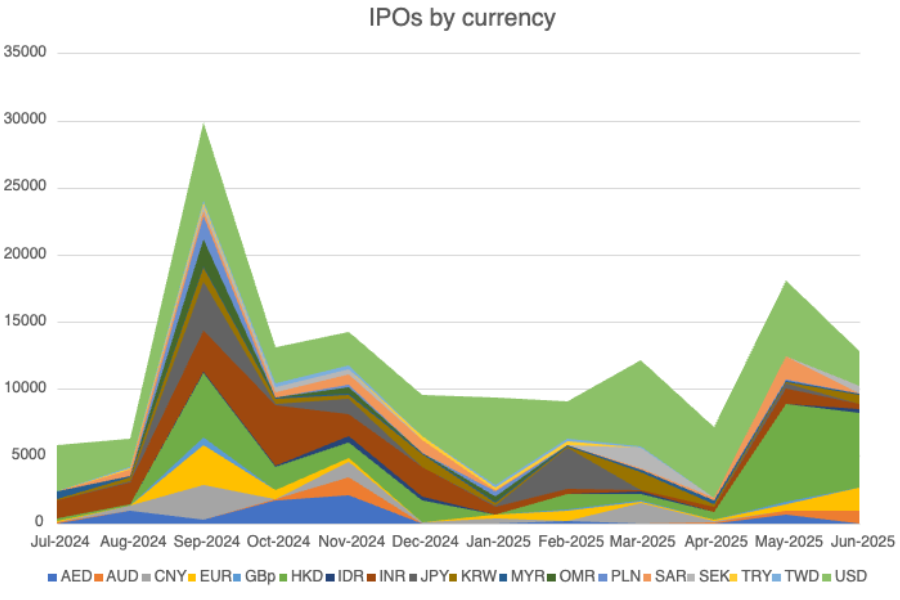

Hong Kong has surged ahead as the IPO currency denomination of choice, going from US$623 million in April to US$7.4 billion in May and US$5.6 billion in June – more than double the US$2.5 billion issued in USD.

Year-to-date (YTD), a total US$15.2 billion has been issued on the Hong Kong Exchange (HKEX), compared with US$28 billion across US exchanges.

Spiking the figures in May were a USD$5.3 billion IPO from Chinese battery manufacturer Contemporary Amperex Technology Co and a US$1.5 billion IPO from Jiangsu Hengrui Pharmaceutical, also a Chinese firm. In June, this was bolstered by a US$1.3 billion IPO by Chinese seasonings manufacturer Foshan Haitian Flavouring & Food Co.

The Chinese yuan lost further influence following April’s Liberation Day tariff announcements, with no CNY-denominated issuances made in May or June. Over the last 12 months, CNY has taken 4% of the IPO market. Since January, this has dropped to 3%.

A US$2.9 billion issuance by JX Nippon Mining & Metals Corp in Japanese yen in February pushed the currency to take a third of the IPO market over the month, with US$3.1 billion of the US$9.1 billion total, but there has been little JPY activity since.

The Indian rupee, which was the headline IPO issuance currency in 2024, has fallen out of the race in the first six months of 2025. Aside from a brief boost in May, the INR’s influence has been minimal – taking just 4% of the market year-to-date with US$2.9 billion.

READ MORE: India, Middle East are new IPO hotspots as Europe and China flag

Middle Eastern issuances in Saudi Riyal (SAR), United Arab Emirates Dirham (AED) and Omani Rial (OMR) since January clock in at US$3.1 billion – 5% of the global total, and far behind the region’s total 2024 performance of US$12 billion.

The UK’s attempts to revive its IPO market, with changes to listing rules made last summer, do not appear to have had the intended impact. Aside from its contribution to the September 2024 global issuance boom, the currency has remained just a sliver of the global market – 0.8% (US$1.14 billion) of the US$147.7 billion globally since last July.

READ MORE: Public market liquidity hampering IPO appetite, industry warns

By contrast, the euro has slowly increased its market share since April, going from US$112.4 million to US$437.4 million and US$1.7 billion in each month to June and taking 13% of the market.

Secondary offerings continue to be dominated by the US dollar, which maintained its hold over the market by a considerable margin. In May, which saw the highest global issuance of the past 11 months, 71% of the US$85.2 billion issued was USD-denominated (US$60.5 billion).

GBP’s strongest month YTD in the secondary market has been January, where US$5 billion was issued – about 20% of the global total. Since January, US$13.9 billion in GBP-denominated issuances have represented just under 5% of the totalUS$307 billion secondary market.