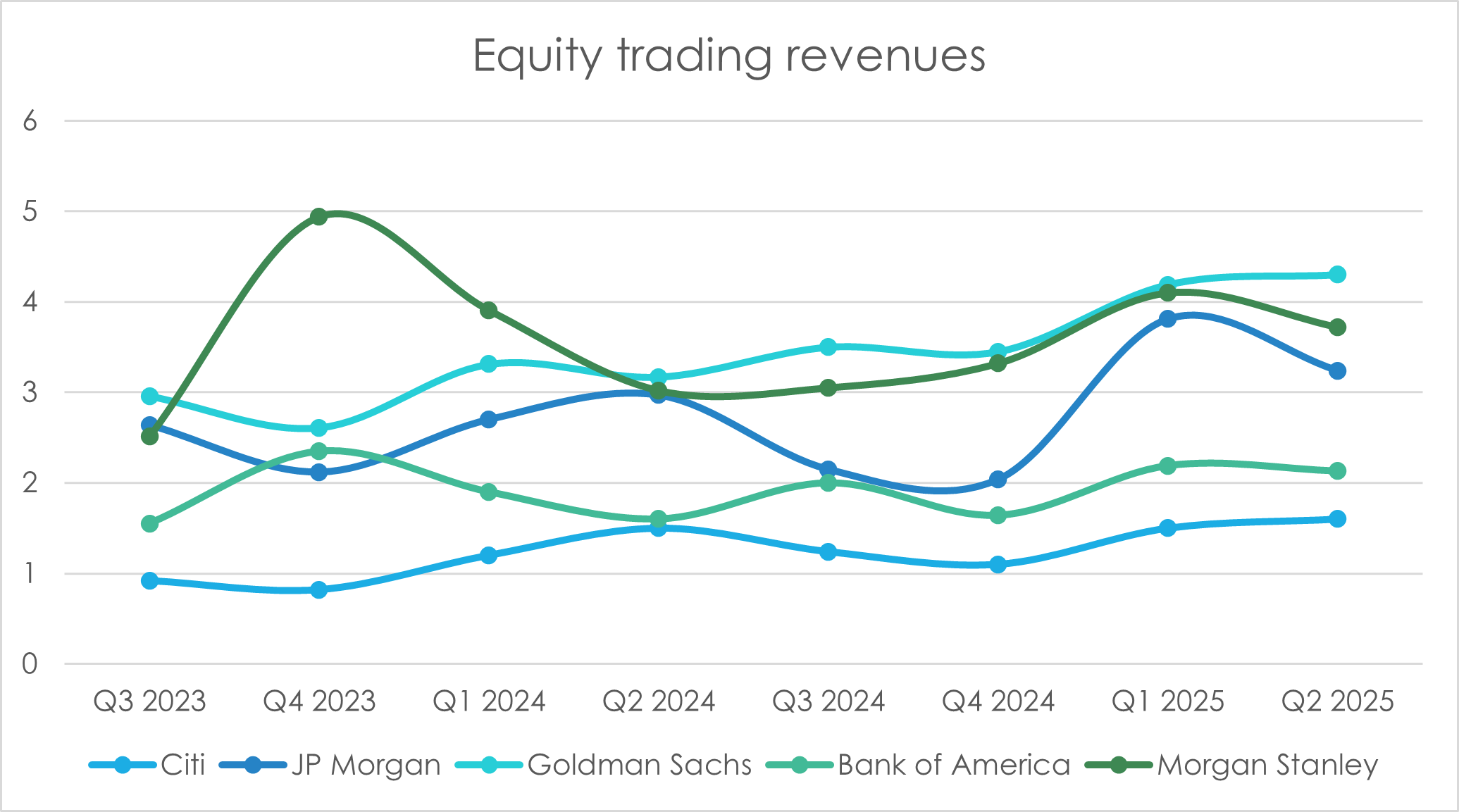

Wall Street’s equity trading desks generated US$15 billion of revenues in the second quarter (Q2) of 2025, helped by strong derivatives trading, record prime brokerage balances, and improved client activity. By revenues, Goldman Sachs took first place, JP Morgan highlighted its derivatives performance, and Morgan Stanley emphasized robust prime brokerage activity.

Goldman Sachs was the quarter’s clear leader, posting a record US$4.3 billion in equity trading revenue, up 36% year-on-year (YoY) and up 3% quarter-on-quarter (QoQ). Chief executive David Solomon highlighted “record equities net revenues and record financing net revenues” driven by “healthy client activity levels” and prudent risk management amidst policy uncertainties.

The bank said, “Equities intermediation revenues of US$2.6 billion rose 45% year over year, driven by strong performance across cash and derivatives, as clients were active in repositioning their portfolios.”

Morgan Stanley also posted a robust quarter, reporting record equity trading revenues of US$3.7 billion, an increase of 23% YoY, yet down 9% QoQ. CEO, Ted Pick, credited the results to “higher client activity,” particularly highlighting the “robust results in prime brokerage” which lifted performance across all product lines within the Institutional Securities division.

Pick said, “In the case of equities, we’ve talked for many years about what it takes to run a global, fully laid out equities business… this quarter in Europe, we had a record quarter in the first half, we’ve had a quite extraordinary half in Asia.”

JPMorgan had lower QoQ equity revenues, down 15% to US$3.2 billion but up 15% YoY. CFO Jeremy Barnum emphasized that the growth was “broad-based, most notably in derivatives,” highlighting significant capital deployment to capture this opportunity. However, Barnum also noted the increased resource intensity, cautioning investors that “the growth isn’t coming for free; the resource usage has also gone up a lot.”

Bank of America generated US$2.1 billion, a 10% increase YoY but down 3% QoQ. CEO Brian Moynihan said the bank benefited from “good momentum in our markets businesses,” highlighting increased client activity and improved trading performance, supported by enhanced capital allocation.

Citigroup’s equity trading revenues climbed to US$1.61 billion, a modest headline growth of 6% YoY but up 7% QoQ; CFO Mark Mason noted this was actually “more than 35%” higher once adjusted for a significant Visa-related gain the previous year. Mason credited the performance to “record prime brokerage balances,” up 27%, alongside healthy activity in cash equities and derivatives.

Looking ahead, JP Morgan’s Barnum expressed cautious optimism, stating that although market revenues “can change overnight,” the bank is increasingly viewing its robust performance as “reasonably recurring.” Citi’s Mason projected “continued client activity,” particularly driven by prime brokerage and derivatives businesses.