JP Morgan twice breached its VaR limit and lost US$203 million on two trading days, as the bank’s markets revenues, trading assets and derivative exposures reached record highs during the first quarter.

“Our folks did a fabulous job trading this quarter”, declared JP Morgan CEO Jamie Dimon on an 11 April earnings call, as the banking giant reported record markets revenues of $9.7 billion. But there were two trading days for which JP Morgan’s results were less than stellar.

According to Federal Reserve filings published in May, the banking giant twice exceeded its value-at-risk limit during the three months ending on 31 March, suffering losses of $116 million and $87 million on two trading days. The figures are disclosed because the Fed requires large banks to report their worst trading results as a percentage of regulatory VaR.

This is the second consecutive quarter for which JP Morgan has reported VaR breaches, with $231 million of losses on two days in the fourth quarter of 2024. Like the latest results, this pair of losses occurred amid a backdrop of strong overall trading results for the bank.

JP Morgan, BofA, Morgan Stanley lost $473m on six trading days in Q4 – Global Trading

Regulatory VaR is measured at the 99th percentile, meaning that breaches of VaR limits are predicted to happen on one in 100 trading days on average. Multiple breaches can indicate unusual market conditions, as well as a problem with a bank’s risk model.

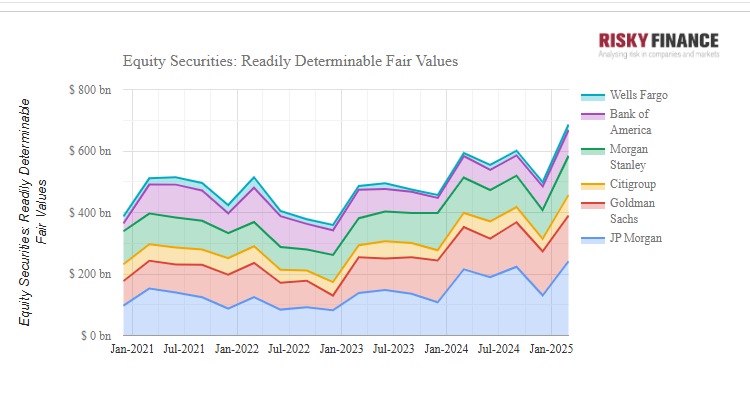

The trading volatility comes as the top six US banks reported record levels of trading assets and derivatives exposures in the first quarter. In particular, JP Morgan reported its largest ever holdings of cash equity securities at $241 billion, and largest ever equity swap notional exposures of $926 billion. These over-the-counter derivatives are increasingly used alongside cash equity positions and traditional short selling using prime brokerage.

Responding to Global Trading, a JP Morgan spokesman said, “As a reliable market-maker, we were well-prepared for those temporary – and manageable – losses while supporting clients during volatile markets. We fully recovered those losses, and our Markets business recorded a best-ever first quarter.”