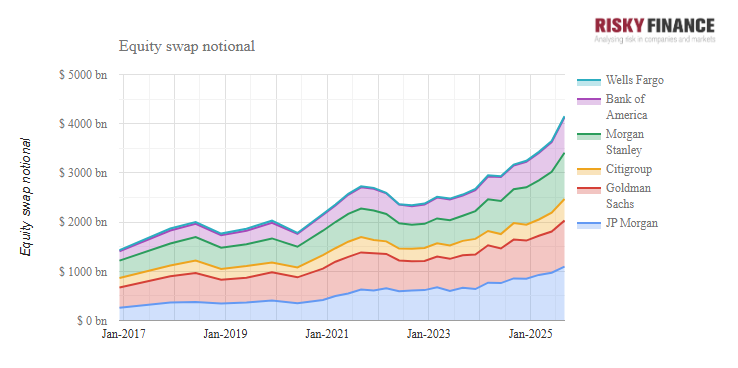

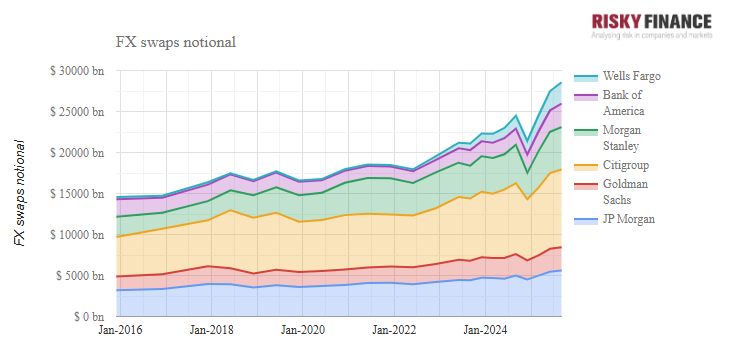

Notional amounts of equity swaps at the largest six US banks reached $4 trillion in September, while FX swaps hit $25 trillion as dealers sidestepped cash trading for bilateral over-the-counter derivatives.

Their use is controversial among the buyside, and the Bank for International Settlements thinks they are a source of systemic risk. But OTC equity and FX swaps keep growing on bank balance sheets, while a summer lull in trading losses appeared to vindicate the banks’ growth strategy.

According to Risky Finance analysis of Federal Reserve filings, the equity swap exposures of JP Morgan, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley reached $4 trillion at the end of September, led by JP Morgan with $1.1 trillion notional of equity swaps and Goldman with $934 billion.

This compares to $800 billion of equity securities held by the same six banks at the end of the third quarter, meaning that each dollar of cash equity exposure was matched by five dollars of derivatives, including long and short positions. This comparison does not include equity futures or option positions.

With non-bank market makers such as Citadel Securities or Jane Street now dominating cash equity trading, bank-owned dealers have an advantage when it comes to derivatives, with their leveraged balance sheets allowing them to post collateral supporting their trillions of notional exposures. This gives them flexibility to noiselessly take on single stock or basket exposures on behalf of clients. However, there is concern among buyside firms that pre-hedging of orders by banks amounts to a form of front-running.

Read more: ‘Front-running’ still allowed under IOSCO pre-hedging recommendations, buyside says – Global Trading

Having conceded much of cash trading to newer competitors, the banks drive to keep up using equity swaps forces them to increase exposures as market valuations reach eye-watering levels on the back of the AI boom. In the past year that has caused some firms like JP Morgan to repeatedly breach value-at-risk limits, attracting the attention of Fed regulators. However, that was not an issue during the third quarter, with none of the top six US banks reporting a VaR breach.

Read more: JP Morgan slapped with capital penalty after banks lose $631m in VaR breaches – Global Trading

Meanwhile, FX swaps also grew to a record, led by Citigroup which had $9.5 trillion of the contracts. The contracts involve an exchange of currencies at the outset along with a forward agreement to swap them back again in the future. They are the most heavily traded FX derivatives in the market, with $4 trillion daily turnover in April 2025, according to the Bank for International Settlements.

FX swaps can be used to hedge the currency risk in equity exposures, but their main use is in yield enhancement for cash portfolios. The BIS has warned about the systemic risk of FX swaps based on their similarity to cross-border repo, although this has been disputed by academics.