A few years ago, Environmental, Social & Governance (ESG) investing was all the rage. Now, investors seem to have changed their views. European managers are rethinking exclusion policies as they have been particularly affected by underexposure to defence stocks, causing significant underperformance versus their non-ESG counterparts.

According to Morningstar Sustainalytics, ESG funds generally underperformed and posted US$57.3 billion of worldwide outflows this year to the end of August. European managers are rethinking exclusion policies as they have been particularly affected by underexposure to defence stocks, causing significant underperformance versus their non-ESG counterparts.

Meanwhile, end investors have adopted the European case for defence stocks faster than ESG funds have changed their allocations. Case in point Rheinmetall, the largest German and fifth-largest European arms manufacturer, was up 138% versus 12% for the Bloomberg 500 European index as of end of November 2025. According to BMLL data, retail trading totalled €71m in November 2024 on European venues but activity ramped up 7 folds to €500m in November 2025.

This newly found investment realpolitik was reflected in an introductory speech at FIX Paris by Laurent Clavel, head of cross-asset at AXA IM. He said investors are becoming more nuanced:

“On defence, if clients have their own convictions and want to invest in the sector, they are not wondering whether defence is ESG. But sustainability and sovereignty should not be seen as opposing forces, and our ESG policies do not exclude the defence sector per se. Our responsible investment policy excludes investments in controversial weapons.”

As of end-August, Morningstar data shows ESG strategies — from large-cap blend equity to diversified bond funds — lagging their non-ESG peers. The sharpest gap is in Europe, where ESG large-cap European equity funds are trailing conventional funds by 3 percentage points, reflecting a persistent underweight in defence and energy stocks. Against that backdrop, global sustainable funds have seen US$57.3 billion in net outflows so far this year, with redemptions accelerating in the third quarter.

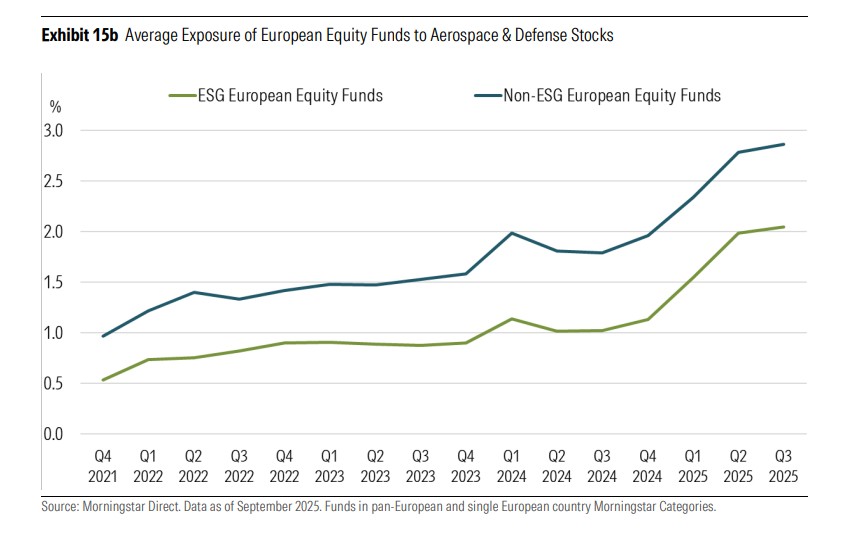

At the same time, exclusion policies are being materially reworked. Research by Hortense Bioy, head of sustainable investing research at Morningstar, finds that while around 92% of Article 8 funds — also known as “light-green funds”, which incorporate some ESG principles but do not have sustainability as their core objective — now state controversial-weapons exclusions in their prospectus, only about 31% apply explicit exclusions to military contracting. In practice, Article 8 funds have more than doubled their effective exposure to controversial weapons and military contracting since 2022, even if involvement remains materially lower than in Article 6 funds.

Bioy said: “Sustainability-oriented investors have had to rethink the role of defence sector companies in their portfolios.” She added: “Some now see financing European defence as part of their social responsibility, alongside concerns about missing out on financial returns.”

For asset managers, and even sovereign funds such as Norges Bank, this is no longer purely an ethical or philosophical debate. Underperformance versus conventional benchmarks, combined with sizeable redemptions and pressure from clients and politicians, is forcing a review of investibility criteria.

In Report No. 22 (2024–2025): The Government Pension Fund 2025, the Norwegian Finance Ministry wrote:

“Exclusions are limited to the gravest forms of ethical norm violations. The threshold for excluding companies from [NBIM] shall be high. The guidelines are forward-looking and concern the risk of ongoing or future unacceptable conditions. Exclusion is not a mechanism based on concluded company actions that lie in the past.”

During a recent review of exclusion policies, Norwegian finance minister Jens Stoltenberg said:

“This review is necessary to safeguard the pension fund and key considerations. We must find a balance between the principles the fund is meant to uphold. The committee has important work ahead.”

Regulators too are changing tack. The new European sustainable finance disclosure regulation (SFDR) has introduced anew ESG category and will lead according to Morningstar to a new wave of fund reclassification. Meanwhile the FCA is launching an ESG consultation on 1 December to better the transparency standings of ESG rating companies.