Euronext reported a 7.5% year-on-year (YoY) data revenue increase. LSEG’s exchange data revenues have been combined with equities, flattering that segment. Deutsche Boerse buries its figures in the footnotes of its accounts. And industry experts are fuming about the lack of transparency.

In LSEG’s H1 results presentation, it revealed that LSE market data and SEDOL, ISIN and LEI reference data sets, previously recorded in the data and analytics (data and feeds) category, would be added to the markets (equities) figures. Revenue from the Millenium Information Technology (MIT) business, previously recorded under data and analytics (workflows), have also been recategorised under markets (equities).

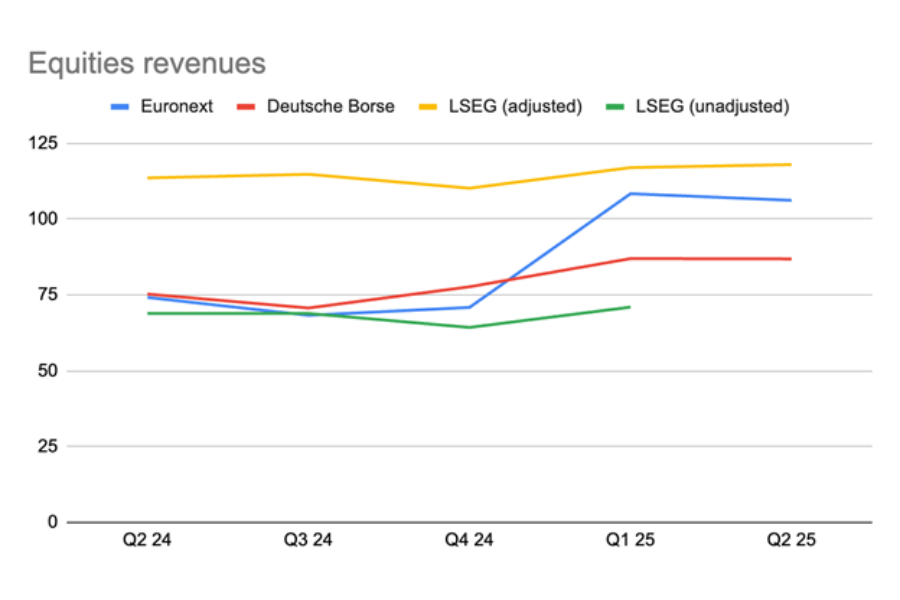

With these adjustments, LSEG’s equity revenues have drastically ‘increased’, overtaking European competitors Euronext and Deutsche Boerse by a considerable margin.

The group has stated that the changes have been made to better reflect how its business sectors are managed operationally.

While its market data feeds are now rolled into the equities business, LSEG’s main data and analytics business is driven by Workspace, a Bloomberg Terminal competitor to replace Eikon from 30th June. The data and analytics business reported €1.1 billion in Q2, down 10% from Q1 and up 1.9% YoY.

The cost of data is a contested topic, with reports by Market Structure Partners and Substantive Research published earlier this year alleging price gouging and excessive fee hikes across European exchanges.

READ MORE: Market data providers seek outsized profit in renewal fees

Niki Beattie, CEO of Market Structure Partners, told Global Trading, “It is quite extraordinary that the regulation allows trading venues to generate data revenues separately from trading but does not expect them to account for it in a transparent manner. Instead, regulators have had to come up with a load of arbitrary guidelines about costs of production and margins but have no data in the accounts with which to reconcile the outcomes.”

The sector was also subject to questions at Euronext, whose advanced data solutions business reported €65.2 million in Q2, up 7.5% YoY.

“This dynamic performance reflects the contribution of Global Rate Set Systems [acquired in 2023], strong appetite from retail and growing monetisation of diversified datasets,” the firm said.

During its earnings call, Euronext’s head of cash equity and data services Nicolas Rivard stated, “Over the last years we have been developing new products based on Euronext proprietary data. Some data providers are competing with our solutions, but our data is valuable for clients. Our data business is very competitive, there is still a strong demand from clients.”

CEO Stéphane Boujnah added, “We have a very strong, robust growing data business, which is based on fundamental needs of clients and not on far and aspirational expectations.”

Deutsche Boerse Group consolidates its market data revenues with other revenues including connectivity fees within the trading and clearing segment, and steers its executives away from mentioning it on earnings calls. In Q2, the ‘other’ category of financial derivatives, which includes “Eurex data and Eurex other”, generated a reported €60.2 million. In cash equities, ‘other’ – including “Xetra data, listing and Xetra other” – contributed €42 million of the sector’s overall €86.9 million in revenues.

Since Beattie’s report earlier this year, she said, “Issues persist and there has been no improvements around transparency. Disappointingly, the general consensus is that the recent European Commission consultation on the regulatory technical standards for the definition of reasonable commercial basis is unlikely to result in any changed language and will be implemented as is.”

She went on to warn that such practices could harm European competitiveness: “Policymakers who say they want innovation should follow through with actions that pave the way for growth. I increasingly speak to innovators who are going to the US to develop financial market products because it is too hard to get the data here.”

At Euronext, equity market revenue and income was up 9.5% YoY to €106.2 million, and down 2% QoQ. Equity markets were the second largest contributor to the group’s profits this quarter, behind the Capital Markets and Data Solutions business. Cash equity trading and clearing made up €93.4 million (a 16.2% YoY increase), while financial derivatives trading and clearing provided €12.8 million – a 22.9% decline YoY.

Although its €1.5 billion in Q2 net revenue was the strongest of the European exchange cohort, Deutsche Boerse’s cash equities revenues fell behind Euronext’s. The group reported €86.9 million, up 15% YoY and down 0.1% QoQ.

Deutsche Boerse stated, “Following a sharp equity market correction at the beginning of the second quarter of 2025 as a result of emerging trade conflicts, cash equity trading benefited overall from a combination of solid corporate data, stable macroeconomic conditions and continued high liquidity in the market. The German blue-chip index DAX reached a new all-time high at the beginning of June before the markets moved sideways in the further course of the quarter.”