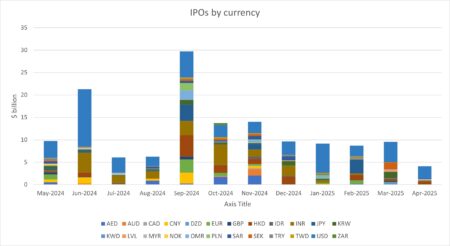

IPO issuance was down 56% in April, closing out the month with US$4.1 billion across currencies according to Bloomberg data.

A total US$9.3 billion was issued in March.

The market bounced back somewhat in the final week of April, rising from US$2.3 billion as of 24 April.

The bulk – US$2.6 billion’s worth – of IPOs were issued in USD, while the Saudi Riyal took a distant second place with US$202 million.

Secondary offerings fell in tandem, with a reported US$10.4 billion across currencies as of 24 April. This figure was US$62.6 billion in March.

In the secondary market, the last offering exceeding US$1 billion came from broker-dealer LPL Financial on 31 March. The US$1.5 billion in common stock was listed on the Nasdaq Global Select Market. Slightly earlier, on 24 March, a US$5.5 billion offering of Class B shares was made in Hong Kong dollars by technology company Xiaomi Corp, making the currency the second most used over the month.

The total value of IPOs year-to-date is US$63.2 billion. One of the largest contributors has been the Swedish Krona, which represented US$1.6 billion in IPOs since January. SEK was also the currency of the most recent IPO in excess of US$1 billion, issued on 27 March by Asker Healthcare.

Across European exchanges, IPO values fell by 36% year-on-year (YoY) to €3.2 billion in deal value over Q1 2025 according to the Association for Financial Markets in Europe (AFME) – significantly below the Q1 average of €6.4 billion that has been held since 2015. Secondary offerings, by contrast, were up 31% YoY to €30.3 billion.

Between October 2023 and 2024, Europe accounted for 10% of all IPOs globally. Considering the last 12 months, this figure has fallen to 7.4%.

On average, year-to-date European and UK exchanges have represented 10% of IPO issuance each month. In March they took almost a fifth (19.4%) of the pie.

This trend may be proving AFME right in its claims that the listing act introduced by the European Council in October last year, designed to keep IPOs in Europe, is not effective.

READ MORE: Listing act not enough to keep IPOs in Europe, AFME says

Considering the impact of US tariffs introduced at the start of April, AFME stated that, for the first half of the month: “IPO issuance and M&A activity have not been visibly impacted by the introduction of tariffs so far, as IPO and M&A deal values for the first part of April continued at levels similar to those observed in previous years.”

When questioned by Global Trading on this conclusion, a spokesperson for the association commented: “There was indeed a pause in the first half of April. However, it’s very challenging to attribute this only to tariffs since the European market has been quite subdued for several years now. One might have expected that the price dislocation would cause a significant drop in IPOs, but it’s hard to see a sharp decline in something that has already hit rock bottom! Interestingly, the number of IPOs in April 2025 is the same as in April 2024.”

Globally, 2024 data indicated that IPOs were concentrating in India and the Middle East.

READ MORE: India, Middle East are new IPO hotspots as Europe and China flag

According to Bloomberg data, year-to-date Indian rupee-denominated IPOs have contributed US$1 billion to the global total in 2025, surpassed by the Japanese yen (US$3.2 billion) and the South Korean won (US$1.8 billion).