After years of stagnation, Japan’s equity market is booming and alternative trading system providers are flocking in. Buyside traders now hope that the stranglehold of HFT firms will be broken.

With its first female prime minister and the stock market at a record high, Japan is attracting a new influx of domestic retail and foreign investment. But first, the country’s buyside giants want to see aspects of Japan’s creaking markets infrastructure to be fixed.

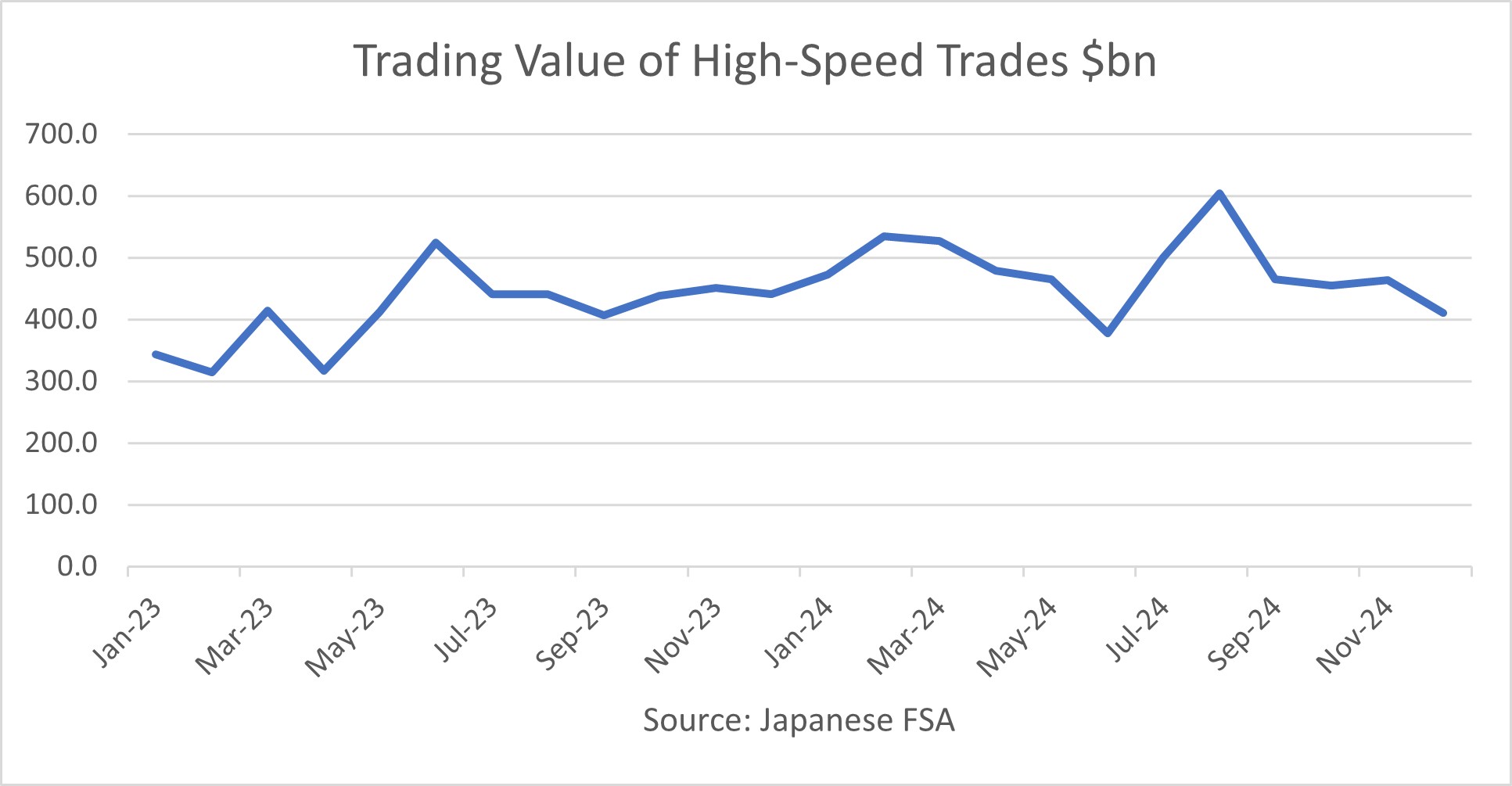

Chief bone of contention is the dominance of high-frequency traders in Japan’s lit equity markets, a development encouraged by the Tokyo Stock Exchange, whose Arrowhead system allows low-latency access to its matching engine. According to the Japan Financial Services Authority (FSA), which regulates HFT firms and compiles data on their activity, HFTs accounted for 35% of TSE volume at the end of 2024. That compares to 17% on HFT-friendly Eurex, based on Global Trading analysis.

Chief bone of contention is the dominance of high-frequency traders in Japan’s lit equity markets, a development encouraged by the Tokyo Stock Exchange, whose Arrowhead system allows low-latency access to its matching engine. According to the Japan Financial Services Authority (FSA), which regulates HFT firms and compiles data on their activity, HFTs accounted for 35% of TSE volume at the end of 2024. That compares to 17% on HFT-friendly Eurex, based on Global Trading analysis.

Read more: The need for speed – Global Trading

For buyside traders who submit orders via brokers, the result is a chronic information leakage problem. “We place great importance on brokers with abundant liquidity” Kenji Takeda, head of equity trading at Nomura Asset Management told the audience at the FIX Japan Electronic Trading conference in Tokyo on 8 October.

“However, I think that the key factor behind this is how to prevent prices from fluctuating, so I think that a clean flow is an absolute requirement. However, when it comes to Japanese stocks, there is a lot of HFT and it is a market that is prone to gaming, so I feel that this is an important point”.

This perception about HFT is shared by non-domestic buyside firms that trade Japanese stocks. “When I execute this alongside other Asian stocks, I feel that it is very difficult to ensure liquidity in the Japanese market” said Ako Nishi, a trader at JP Morgan Asset Management based in Hong Kong. “One factor is the high market share of HFT. In terms of ensuring liquidity, I think it is very difficult to interact with.”

These difficulties often lead Japanese buyside equity traders to explore non-order based liquidity such as indications of interest (IOIs). Yet here too, problems with information leakage are rife. “When we send IOIs, the market moves, which is very strange”, one trader told Global Trading. According to Nomura Asset Management’s Takeda: “I feel that IOI has become much more transparent than it was in the past, but at the same time, I still feel like some parts of it are fake”.

Acknowledged as having a more systematic approach than domestic buyside firms, JP Morgan Asset Management’s Nishi told the FIX Japan conference that her firm quantified broker liquidity using data such as past reverse IOI hit rates. “All transactions, including IOI crosses, are incorporated into our broker evaluations, enabling us to analyze the impact of each trade on overall performance”, Nishi said.

New solutions coming to Japan

But improved analytics won’t solve a problem that is endemic to Japan’s trading venues, according to former Blackrock senior trader Junya Umeno, who recently was appointed CEO of OneChronos Japan. “The challenge for buy-side traders is that all the existing trading venues are based on price-time priority”, he told Global Trading. “That means first come, first serve. So buy-side traders don’t always have the budget to invest in their trading infrastructure, while algorithmic traders are investing a lot.”

Now, a new game is coming to Japan in the form of US-style Alternative Trading Systems (ATSs), that include Intelligent Cross parent company Imperative Execution, which is acting as a fintech in Japan, as well as OneChronos. Umeno explained what his firm was offering. “By conducting randomised periodic auctions roughly 10 times a second, we can remove the time factor from matching mechanisms as well. By doing that, the playing field is levelled for all participants, fast or slow”, he said. “OneChronos is addressing the specific needs for large institutional traders that have a goal to minimise information leakage.”

Conditional order matching is also growing in Japanese equity markets, though still far less prevalent than in Europe and the US. According to Umeno, “We support conditional orders, which allow participants to express intent to trade under defined conditions. Once those conditions are met, the order becomes firm – a transparent and efficient alternative to traditional IOIs.”

Meanwhile, the country’s markets regulator is moving to rein in the HFTs, and poor sell-side practices by imposing much larger penalties, with the Japanese Securities and Exchange Surveillance Commission (SESC), a division of the FSA, proposing changes in June 2025 according to its website.

A source familiar with the SESC said, “We would like to strengthen deterrence against unfair trading using accounts in other people’s names, raise the level of the surcharge for submitting large-scale holding reports, and, as cases of unfair trading involving HFT have also emerged, establish a method for calculating surcharges that corresponds to these new forms of trading”.