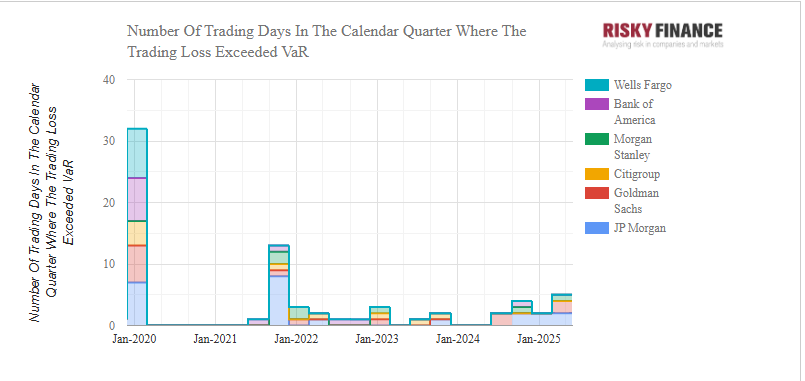

The Fed has started cracking down on bank trading book volatility, forcing JP Morgan to hold billions more in market risk capital. This happened after a quarter in which not only did US bank trading revenues hit a record, but the number of value-at-risk backtest exceptions reached their highest level since 2021.

The largest US banks may have reaped record trading profits in the quarter that started three days before US President Trump introduced tariffs on 2 April, leading to a six-week period of unprecedented volatility. But this performance came at the expense of trading book stability, as measured by the number of VaR backtest exceptions tracked by the Federal Reserve.

Goldman Sachs suffered the most, experiencing two VaR exceptions of $153 million and $142 million, or $295 million in total. This is despite Goldman’s average daily trading revenue being $119 million during the 65-day time period, across equities and fixed income. Statistically, the only way to reconcile these figures is with a highly skewed distribution, that includes ten or more days of $200 million profits, and a few days of extreme losses when markets went haywire.

JP Morgan’s average daily trading revenue was $139 million, but that didn’t stop the bank from also experiencing a pair of VaR exceptions, losing a combined $188 million on two trading days during the quarter. This gives JP Morgan a slightly less riskier profile during the second quarter than Goldman Sachs, with 40 profitable trading days versus Goldman’s 33, according to the banks’ Fed filings.

Morgan Stanley had only 38 profitable trading days during the quarter, but it managed to scrape through with just one VaR exception, losing $87 million on a single day, while making $91 million per day on average.

Although Goldman lost more this quarter, JP Morgan’s third successive cluster of VaR breaches has exhausted the tolerance of the Federal Reserve, which has increased the bank’s capital multiplier to 3.5 as a penalty. By forcing JP Morgan hold more capital against market risk, the Fed may hope to rein in the bank’s risk-taking mentality.

Sources familiar with the banking giant downplay the Fed’s action, noting that the increased multiplier is automatically pre-determined by regulations based on the number of VaR exceptions in a 250-day period. Bankers argue that the increased VaR exceptions are a fact of life given the tariff-driven market volatility.

Read more: Dimon’s ‘fabulous’ traders lost $203m on two days in Q1 – Global Trading

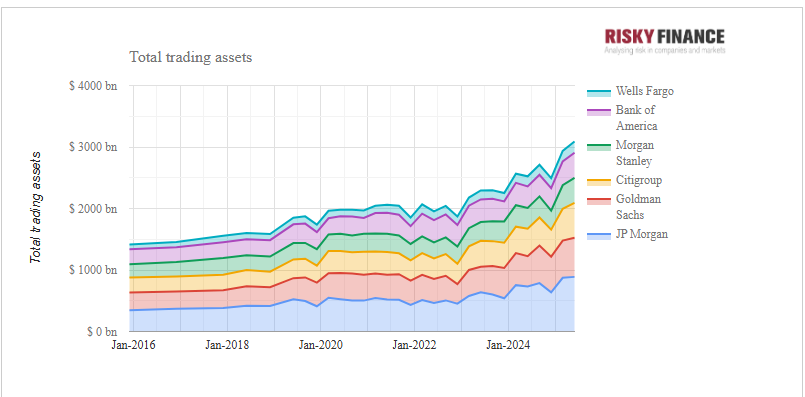

In any case, reducing risk may be easier said than done, since all six big US banks have increased trading book positions and derivatives exposures in order to drive profits. JP Morgan’s total trading assets hit a record high of $888 billion in June, followed by Goldman with $636 billion, while JP Morgan’s equity swap notionals approached $1 trillion for the first time, followed by Goldman and Morgan Stanley in joint second place.

Unwinding such eye-watering exposures may generate the same kind of trading book volatility that the Fed wants to see reduced. JP Morgan declined to comment.