As exchanges compete with one another through rival products, their efforts can increase liquidity fragmentation for their users. With the same derivatives contracts being listed in multiple locations, market participants must decide where they want to trade – adding another layer of decision-making to the process.

At the International Derivatives Expo (IDX) conference in London last month, Joseph Nehorai, global head of futures and options execution sales at Goldman Sachs, explained that many clients are likely to choose the exchanges they trade contracts on based on where they already operate.

“Because of the increased use of futures across every asset class in every region, they want to maximise their leverage through optimising their margin,” he said. “[That might be] posting different types of collateral, or forcing prime brokers to provide margin offsets within their own risk models, or choosing to execute the future on an exchange where they have an existing position around the future that gives them a correlated margin offset – choosing ICE or Eurex to trade an MSCI future because they have an existing equities index future exposure in another product, for example.”

ICE, the predominant MSCI futures exchange, offers 161 MSCI futures products to Eurex’s 146. Not satisfied with European dominance, Eurex is challenging the American exchange by launching futures on the MSCI Korea Net Total Return Index.

While Korea has the fourth largest presence in the MSCI Emerging Markets Index, representing 10.73% of the pie, Eurex is the only non-Korean derivatives exchange to provide access to a Korean equity index.

A previous clearing link between Eurex and the Korea Exchange (KRX) angled towards retail investors and market markets was decommissioned effective 5 June this year, following an expansion of KRX’s trading hours.

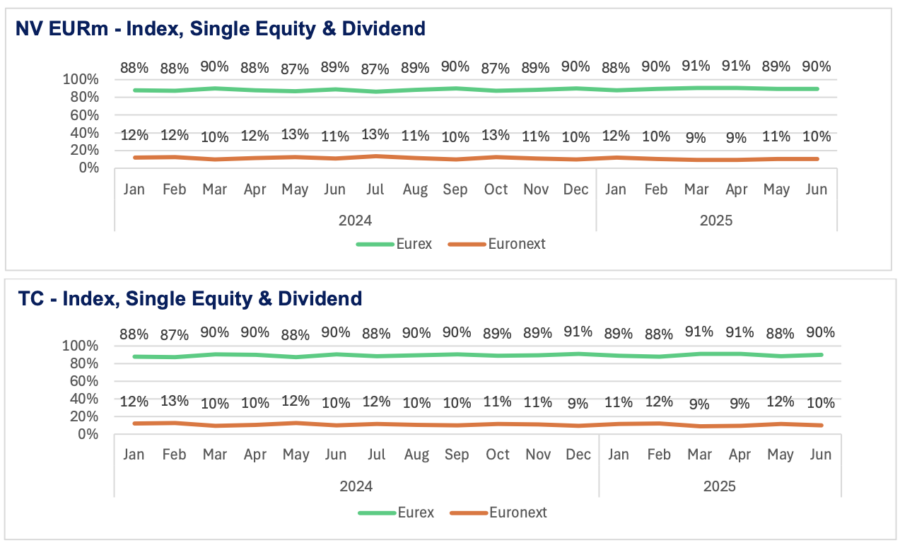

Back on home turf in Europe, rival exchange Euronext has not managed to budge Eurex’s market share in 2025 – despite numerous efforts to encroach on the incumbent’s territory. In fact, its overall market share has declined since January, both in terms of notional volumes and contracts traded.

In June, 9 million contracts were traded on Euronext and 81.8 million on Eurex.

Speaking to Global Trading, Charlotte Alliot, head of financial derivatives at the group, pointed out, “Comparing the market share of Euronext and Eurex doesn’t make sense on some asset classes. For example on equity indices, the underlyings are different – CAC 40 is different from the DAX or the Euro Stoxx, for example. We do not sell the same thing.”

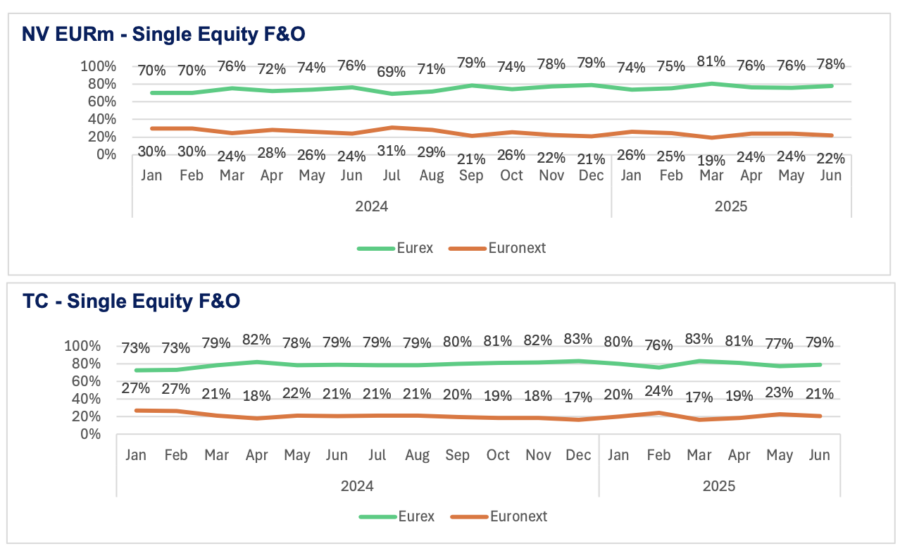

Where they do sell the same thing, however, is in single stock futures and options – which is also where the only bump of note for Euronext took place, at the start of the year.

The group’s market share by notional value jumped up five percentage points to 26% in the first month of 2025 for this category, and took 24% of the market by contracts traded in February. This was short-lived, though, falling back to 19% by volume and 17% by contracts traded in March despite much higher trading activity across the board.

Eurex offers 905 single stock futures, while Euronext provides access to 562.

Alliot argued that Euronext is doing better than it seems on a consolidated basis.

“On single equities, Euronext market share is quite strong. In Q2 2025 it’s above 70% in Italy, 80% in the Netherlands and above 50% in France. France is a more challenging market, but things are improving on our side. This is due to the creation of the liquidity pool of Euronext Clearing which led to the repatriation of market share from some members,” she said.

Euronext’s launch of mini German single stock options in June, following French and Dutch equivalents in April, was characterised as “an attack on Eurex” by Alliot earlier this year. By offering a product that Eurex does not, the exchange aims to claw back market share.

Updating Global Trading, Alliot stated, “Our mini options on Dutch, French and German underlying are doing very well. They have nearly 100k lots traded.”

While the impact of the German offering remains to be seen, the earlier launches did not take the group above the market share highs of February.

There has been an overall decline in notional volumes in single stock futures and options since March – falling from €224.6 billion to €149 billion over three months. However, US uncertainty and related high trading activity have driven up volumes YoY in H1, rising 19% to €1 trillion.

Year-on-year (YoY), Euronext’s overall market share has remained static in contracts traded and declined by one percentage point in overall volumes.

In index futures and options notional volumes, Euronext has broken through the 10% market share barrier just once this year, taking 11% of the pie in January. By contracts traded, its share has hovered between 5% and 6% since last November.

Across dividend futures and options, Eurex has continued its long-standing domination with between 99% and 100% of the market share.

There has been a marked decline in overall activity for the two groups YoY, falling by 38% to 90 billion contacts traded and by 30% to €3.6 trillion in notional volume in June 2025.