Jane Street made INR 48.4billion (US$556.7 million) in illegal gains as a result of index manipulation, according to the Securities and Exchange Board of India (SEBI).

Pending further investigation, SEBI is impounding Jane Street’s (JS Group) alleged unlawful gains, requiring the company to deposit the funds in an escrow account at the Scheduled Commercial Bank in India. Any open positions in exchange traded derivatives contracts must be closed within three months or at expiry.

Its interim order states, “entities are restrained from accessing the securities market and are further prohibited from buying, selling or otherwise dealing in securities, directly or indirectly. If the Entities have any open position(s) in any exchange traded derivative contracts, as on the date of this Interim order, they can close out/square off such open positions within 3 months from the date of order or at the expiry of such contracts, whichever is earlier.”

The group has disregarded a caution letter issued by the National Stock Exchange in February, advising against taking large cash-equivalent positions and using certain trading patterns, and continues to run very large cash-equivalent positions in index options, SEBI has said in an interim order.

In December 2024, SEBI stated that it identified abnormally high or low volatility on weekly index options expiry days and that certain entities were running large cash-equivalent risks, particularly on expiry days. This followed an April investigation into Jane Street’s reported unauthorised use of proprietary trading strategies in Indian options markets.

Of the 18 trading days analysed as part of the investigation, SEBI notes that JS Group’s operations had evidence of an intraday index manipulation strategy. On the remaining three days, evidence of extending the market close was reported.

In one such case, on 17 January 2024, actions from the group pushed up BANKNIFTY index prices and it subsequently built large short positions. These were then reversed and sold, pushing down the index and producing larger options positions and profits that offset and intraday cash and futures trading losses.

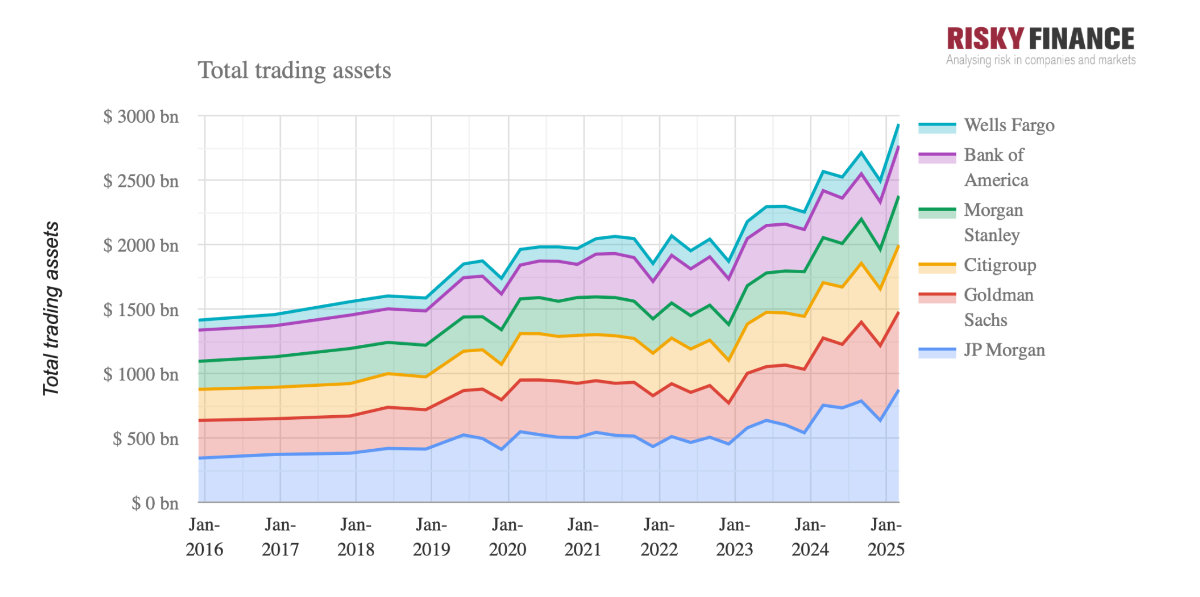

JS Group’s strategy of taking very large trading market share facilitates this price-moving.

READ MORE: Jane Street took 10% of of US equity market in 2024

SEBI comments, “dealing in multiple segments across cash equities, stock futures, index futures, and index options simultaneously is certainly not by itself a breach of any regulation.

“However, what sets apart the trading pattern of the JS Group as described above as prima facie being manipulative, is the intensity and sheer scale of their intervention in the underlying component stock and futures markets, the rapid reversal of these large and aggressive trading in cash and futures without any plausible economic rationale, other than the concurrent activity in and impact on their positions in the BANKNIFTY index options markets.

“JS Group was exploiting its size and sheer volume to move the underlying BANKNIFTY index level, so as to benefit from its much larger actions or positions in the BANKNIFTY index options segment.”

JS Group told SEBI on 30 August 2024 that the trades were executed to remove unwanted delta or manage overall delta, statements which the regulator calls “bland”.

JS Group has previously been involved in a lawsuit surrounding its Indian options strategy, suing Millennium Management and two of its former employees, Doug Schadewald and Daniel Spottiswood, who jumped ship to the competitor in 2024. The group alleged that the traders had taken the strategy with them – a strategy that produced US$1 billion in profits in 2023.

A Jane Street spokesperson commented, “Jane Street disputes the findings of the SEBI Interim Order and will further engage with the regulator. Jane Street is committed to operating in compliance with all regulations in the regions we operate around the world.”

Why Independence Matters

Why Independence Matters

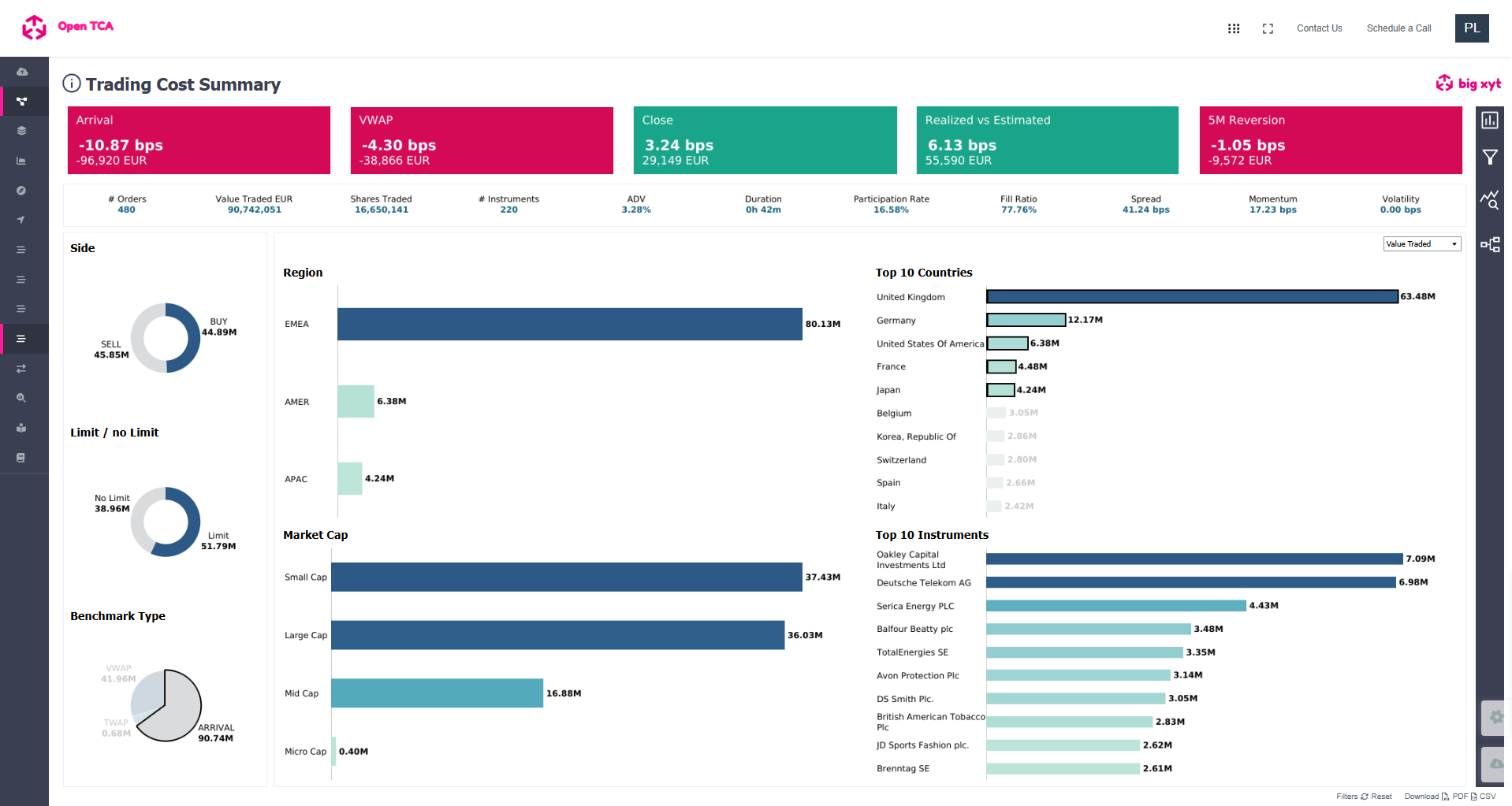

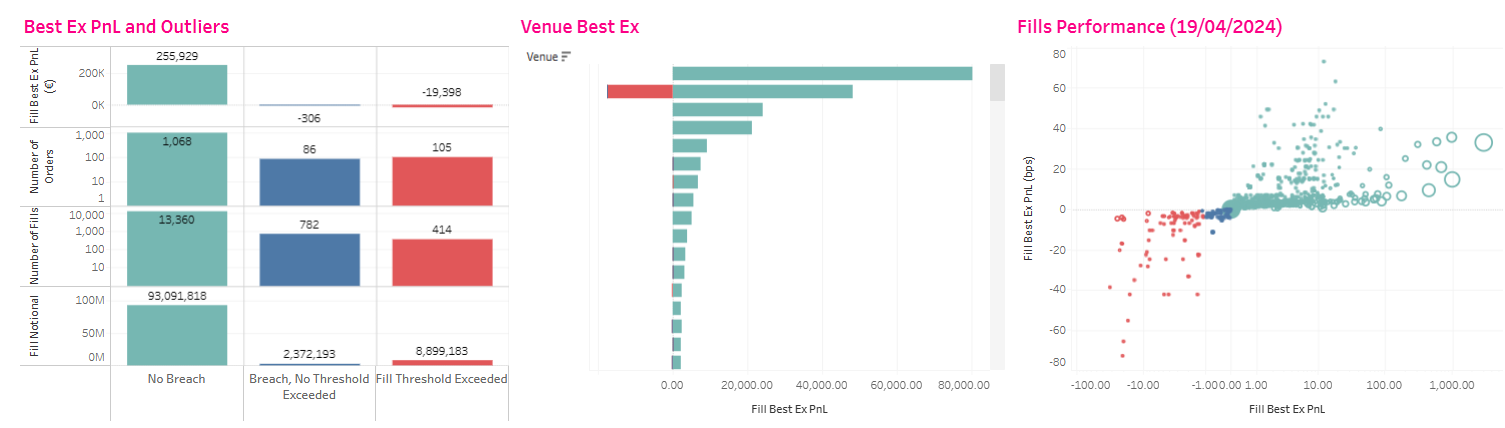

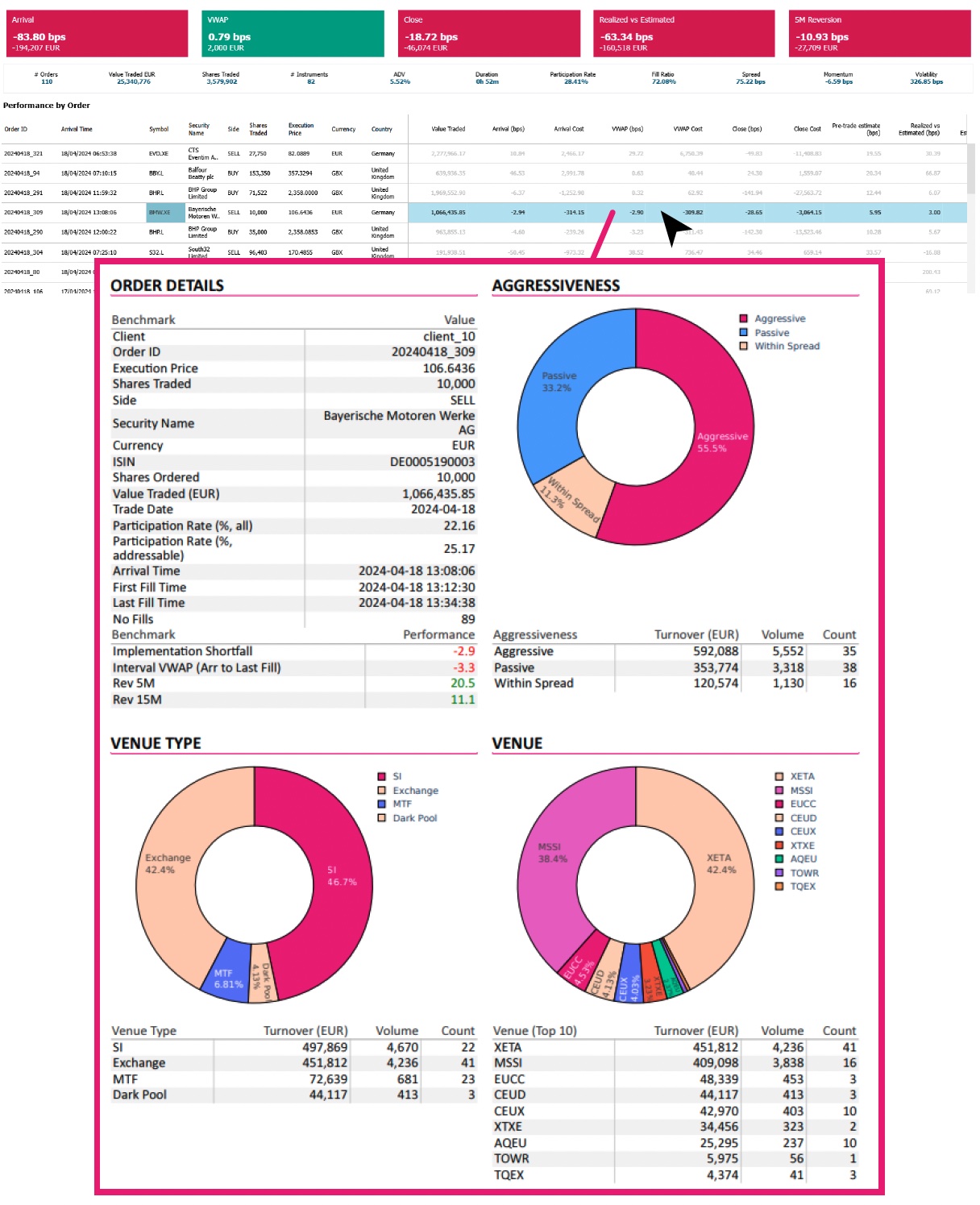

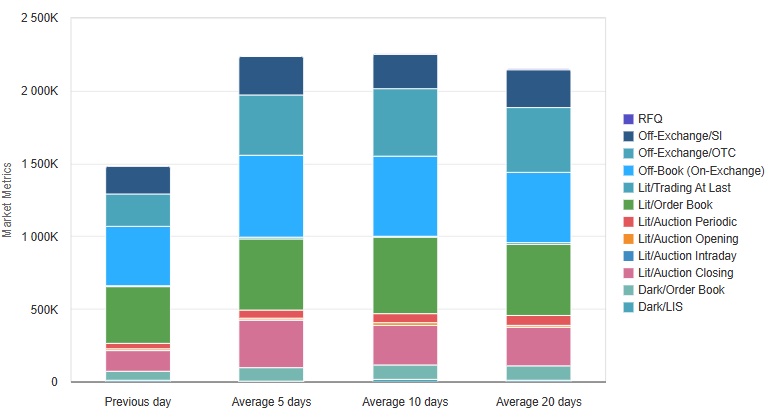

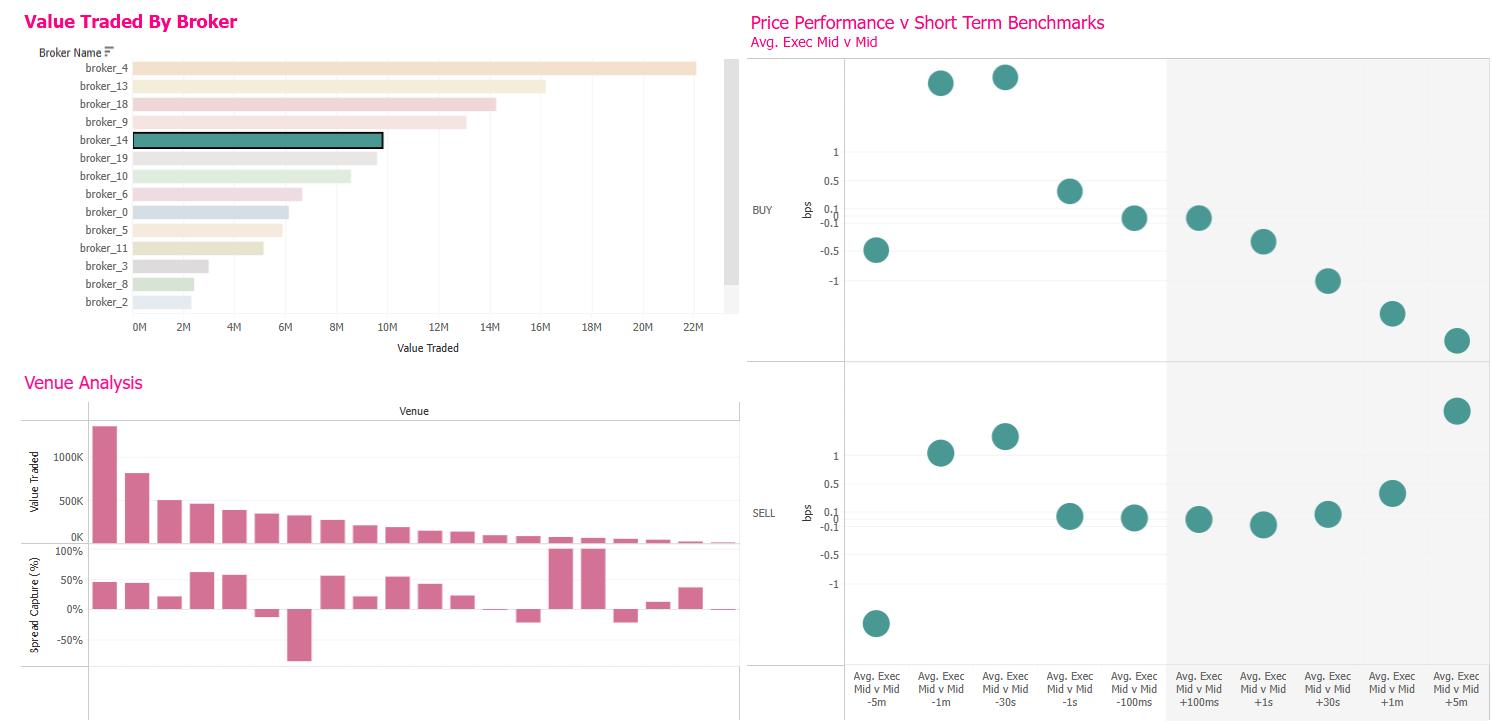

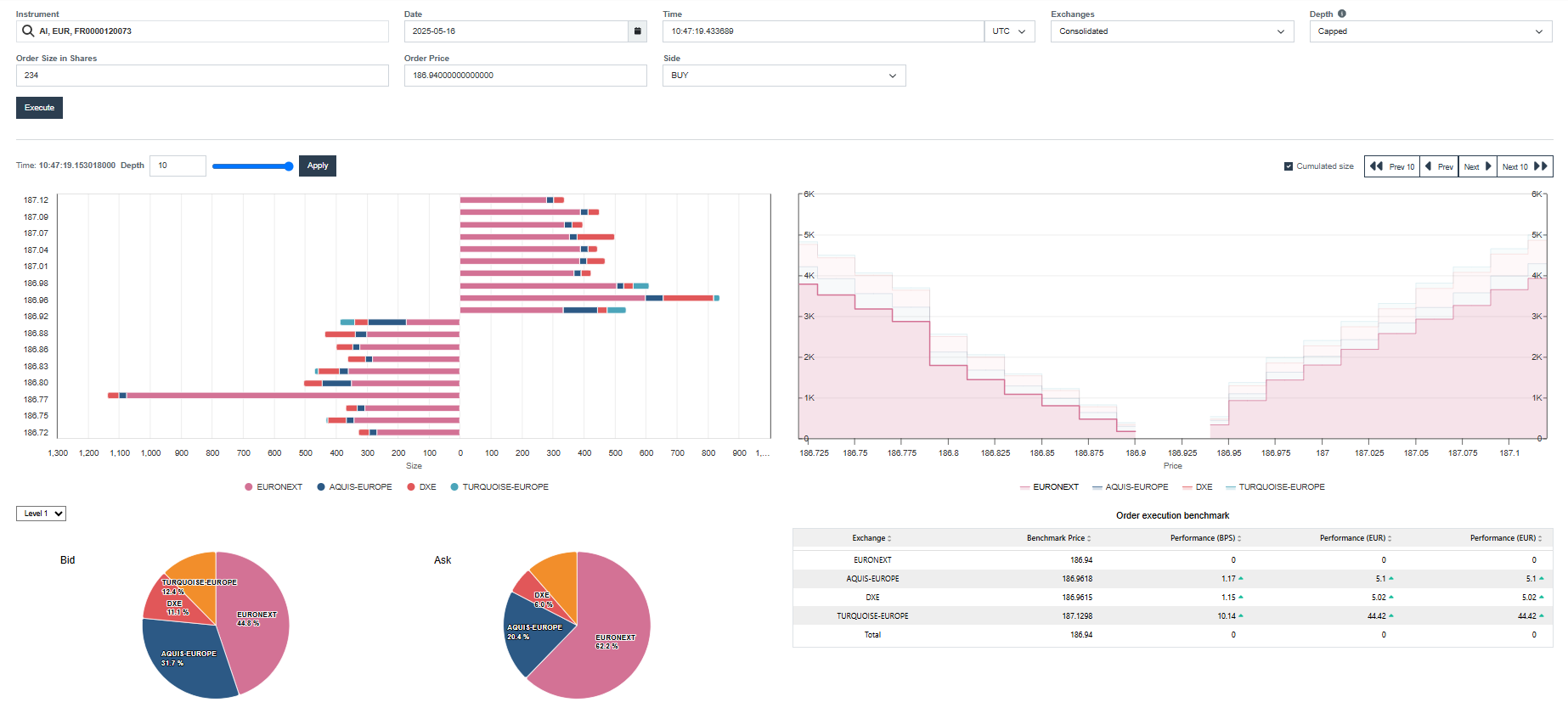

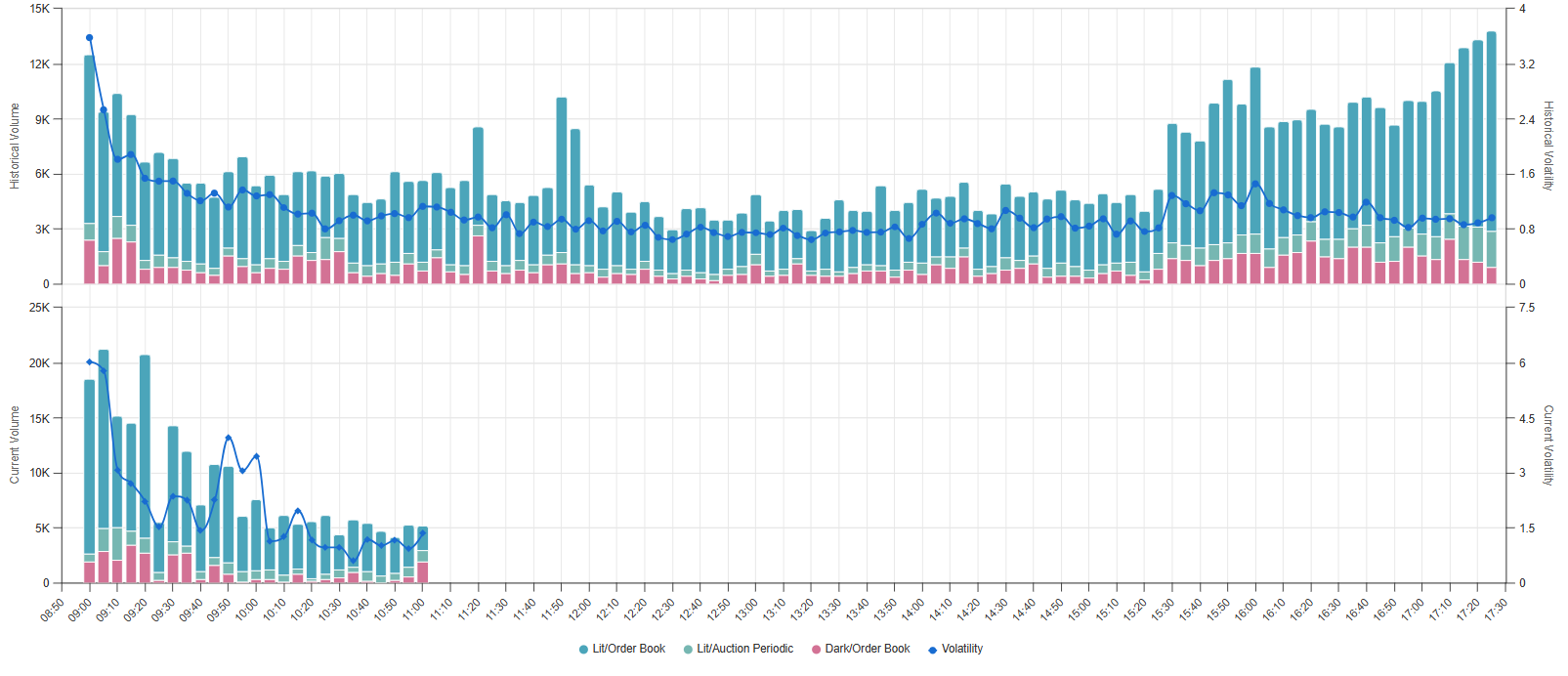

Robust data quality controls are equally essential. With the sheer volume of global trading activity, systematic cleaning, validation and normalisation processes are needed to ensure consistency across venues. Independent analytics platforms that integrate these capabilities reduce the operational burden on trading desks and support more accurate, comparable metrics.

Robust data quality controls are equally essential. With the sheer volume of global trading activity, systematic cleaning, validation and normalisation processes are needed to ensure consistency across venues. Independent analytics platforms that integrate these capabilities reduce the operational burden on trading desks and support more accurate, comparable metrics. This is particularly relevant in volatile market conditions where trade-offs between immediacy and market impact shift rapidly. Intraday alerts on unusual trading patterns or liquidity imbalances can inform whether to pause or adjust execution strategies mid-session.

This is particularly relevant in volatile market conditions where trade-offs between immediacy and market impact shift rapidly. Intraday alerts on unusual trading patterns or liquidity imbalances can inform whether to pause or adjust execution strategies mid-session.