TrueFX, an over-the-counter venue, aims to transform foreign exchange trading by allowing asset managers to connect to a credit network through one connection and cutting costs by between 60% and 80%.

Integral, the technology company, and Jefferies announced the launch of TrueFX in November last year.

Harpal Sandhu, founder and chief executive of Integral, told Markets Media: “TrueFX is not just a trading venue it provides a credit network in a single ecosystem.”

Jefferies provides central clearing for the platform.

Brandon Mulvihill, global head of FX prime brokerage at Jefferies said in a statement: “The flow of credit is the lifeblood of the FX market, but market inefficiencies have stalled accessible and affordable credit for many market participants.”

The TrueFX Clearing Member network was launched this week with Axicorp, FXCM and Velocity Trade supporting customer access. Sandhu said: “We will double or treble the clearing members as there a lot of firms in the pipeline.”

Clients can clear through Jefferies FX prime brokerage or can open an account with a clearing member to directly access liquidity on the venue without an intermediary. Firms can provide customized pricing bi-laterally to all customers regardless of direct credit relationships.

A survey by consultancy Greenwich Associates said the “electronification” of FX is not limited to trade execution as there is a focus on increasing operational efficiency, especially in credit intermediation.

“Managing credit limits for individual clients within FX platforms and across banking businesses is a complex and arduous task,” said the report. “Vendors have started the process of automating the credit allocation process—an achievement that could unlock huge efficiencies in balance sheet utilization.”

*New* FX Execution: Competing in a World of Algos https://t.co/h4gY9r9Jdz via @GreenwichAssoc by #SatnamSohal, #FrankFeenstra pic.twitter.com/Y7vPVJzpbu

— Coalition Greenwich (a division of CRISIL) (@CoalitionGrnwch) October 22, 2019

The consultancy said new technology has the potential to revolutionize the FX business far beyond simple trade execution.

“In the coming years, innovations such as distributed ledger technology are also expected to make back-office operations faster, cheaper and more efficient,” added Greenwich.

Reducing costs

“TrueFX is the equivalent of an exchange with a matching engine, clearing house and FCMs,” Sandhu added. “However it is for over-the-counter trading with no central limit order book, and this is the first time this has happened.”

TrueFX is built on Integral’s existing ECN which is used by more than 200 financial services firms according to Sandhu. “We can easily extend our infrastructure to FX and provide cloud-based technology to the buy side at no cost,” he added.

Firms can trade with the same counterparties and use the same workflows on the new infrastructure.

Sandhu continued that two thirds of cost of trading FX is in clearing and settlement. “TrueFX can cut costs by between 60% to 80%,” he added.

TrueFX has been designed for the buy side including retail brokers, macro hedge funds, prime of primes and also regional banks. Sandhu said: “This is transformational for the buy side. We will be successful if TrueFX becomes their primary mechanism for trading FX.”

He continued that the higher costs had previously limited firms’ trading activity but now they have the opportunity to enter new markets and, by using a cleared venue, they can use their capital more efficiently.

“It will change way they manage risk as it is so much cheaper to execute small tickets,” Sandhu added.

Sandhu said that since the platform launched last year, firms have been inviting their counterparties to join TrueFX in order to lower costs for both. “We launched less than two and a half months ago and we are seeing the power of ecosystem,” Sandhu added.

However, Sandhu continued that the sell side is also interested in TrueFX as it lowers their distribution costs to the buy side. TrueFX has initially launched for trading spot FX but Sandhu said the platform could be extended to other products such as non-deliverable forwards.

“We are the equivalent of AWS, Amazon’s cloud computing services ,” he added. “Anyone who has an idea can launch an FX service on TrueFX.”

Electronification of FX

The share of notional FX trading volume executed electronically has hovered around 80% for the past several years according to Greenwich Associates.

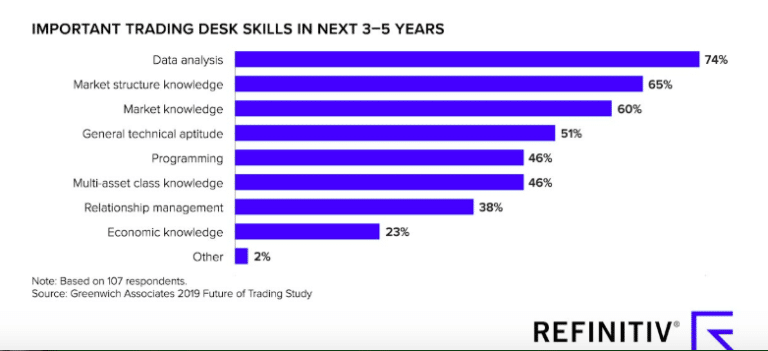

The report said buy-side use of FX execution algorithms is also gaining traction. Greenwich added that in 2018, the use of algos increased by 25% to about one in five FX market participants.

“In a post-MiFID II environment, with increasing adoption of transaction cost analysis and advancements in technology – which in turn is augmenting better pre-and-post trade analytics – it is no surprise that adoption growth was led by real-money accounts, while hedge funds, the market’s earliest adopters, remain consistent users,” added the report. “At the same time, an increasing number of the most sophisticated corporates are also leveraging dealer algos to trade FX.”