After leaving the European Markets Choice Awards with the Instinet Positive Change: best company for diversity and inclusion award earlier this year, Bloomberg’s Paula Fry and Kat Furber talked to Global Trading about their work in the space and shared their advice for other companies looking to follow suit.

Bloomberg has always led by example when it comes to DEI. Can you talk about how you’ve worked to build on that work as part of your focus on increasing diversity in electronic trading?

Paula Fry: Building community within the electronic trading space and on trading floors as a whole has been important to me since I started my career in the 1990s, working as one of the only female traders on a sell-side trading desk at a bank. Women are still under-represented in many businesses we speak to, so connecting them with both women at Bloomberg and other clients has really opened up many important conversations on this topic. It’s been a privilege to help develop Bloomberg’s Women in Electronic Trading community with the backing of Bloomberg’s D&I team.

Kat Furber: I’m proud of Bloomberg’s reputation as a leader in the D&I space. During my 14 years at the firm, I’ve witnessed the ongoing transformation in the make-up of our business and I’m proud to say I’ve been a part of it. Our Women in Electronic Trading community provides a supportive environment for individuals to connect and share experiences in pursuit of a working environment that respects and encourages our uniqueness. From mentoring programs and the company’s commitment in supporting new parents to organising client events, our focus is on helping to lead change by example whilst learning from the world around us.

What are you most proud of about your efforts, and how do they fit into Bloomberg’s DEI strategy? What has been your biggest accomplishment to date?

Paula Fry: I’m proud of the various events we’ve hosted, which bring together all genders across electronic trading! We’ve addressed issues through challenging conversations and involved our allies on panels and Q&As to have insightful and impactful discussions. My own personal accomplishment has been spreading the word around perimenopause and menopause in the City — something that hasn’t been openly discussed in workplaces, but affects everyone. It’s a tricky subject matter to tackle, but I’m glad I was able to use my own experiences to help and to educate others.

Kat Furber: I’m especially proud of the work we’ve done in supporting new parents to navigate parenthood and the workplace. Becoming a parent turns your world upside down overnight, and it’s easy to lose your sense of self and for your confidence at work to take a knock in the process. At Bloomberg I’ve seen parental leave as an opportunity for career advancement, both through leave cover and through promoting individuals into new roles upon their return from leave. I’m proud to have helped support and encourage individuals who were in this phase of their lives.

DEI is more than just gender diversity, although this is of course crucial. Can you speak to your approach on ensuring a broader range of inclusivity?

Paula Fry: When we began building the Women in Electronic Trading community, we were deliberate in engaging everyone who might need the types of support we mentioned earlier. Our events are attended by a diverse group of people and our panels cover a varied range of topics because the only way we can make meaningful progress is together. It’s making sure you cast your net wide and being thoughtful as to your message and who needs to hear it.

Kat Furber: We firmly believe that diverse teams foster a more innovative approach that ultimately yields better results as well as a more inclusive working environment. We often invite authors who focus on diversity and inclusion topics to participate in our events, drawing on a new perspective to keep the discussion as open as possible.

What have you found to be the most effective strategies to encourage and support DEI in electronic trading, and what advice would you give to other companies looking to implement similar programmes?

Paula Fry: My simple advice would be to build a community and be consistent. It’s important to continue nurturing those relationships by making sure you continue to meet and work on your connections. You can start small – our first event was internal. Figuring out what people wanted to talk about has led to engagement across the electronic trading community.

Kat Furber: Don’t underestimate the impact of your individual contribution to create a network effect, lifting others up and bringing them along. Also, don’t be afraid to call on allies and ask for their help. All of us have been helped at one point in our careers, and in my experience, people really do want to pay it forward – invariably they will be happy to have been asked and will feel included in helping you succeed.

What does this award mean to you and what do you hope to achieve in promoting increased diversity in electronic trading going forward – where would you like to be this time next year?

Paula Fry: We don’t do what we do for awards, but it’s so nice to be recognised for all the work and effort we’ve put into developing this community. We’re not stopping here – there is lots of ground to cover, so much to do, so much change needed at so many levels, and of course still more need for diversity in businesses across financial services. The list goes on.

Kat Furber: It means a lot to us both! I care deeply about being part of the change that I wish to see in the City and beyond, for women and for all. I’m realistic about the pace of change but continue to challenge myself, my colleagues and clients and my organisation on how we can all move forward faster. A year from now my goal is to have made progress, of course – the results we’ve seen are a huge motivation to continue to press on, bolder and louder than ever.

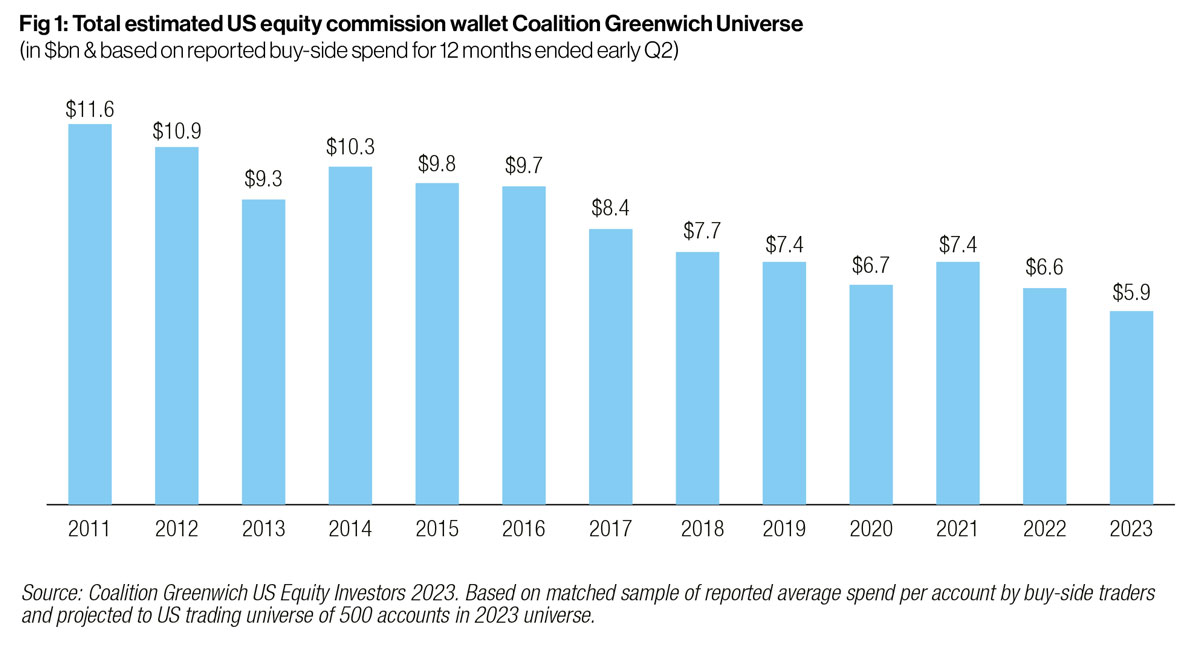

Cut-throat commission rates are hurting both sides of the street, writes Jesse Forster, head of equity market structure at Coalition Greenwich – and it’s the clients who are ultimately losing out.

Cut-throat commission rates are hurting both sides of the street, writes Jesse Forster, head of equity market structure at Coalition Greenwich – and it’s the clients who are ultimately losing out.