‘Making Sense of Chaos’ by J. Doyne Farmer (Penguin Books)

As any student will tell you, no doubt armed with chat GPT, economics is defined as “The study of the allocation of scarce resources”. But a more difficult question is this: what is economics for?

As any student will tell you, no doubt armed with chat GPT, economics is defined as “The study of the allocation of scarce resources”. But a more difficult question is this: what is economics for?

To its critics, much of academic economics appears to exist in an ivory tower vacuum, where the daily work involves tweaking elegant yet simple models of the economy, or polishing estimation techniques in a doomed attempt to improve the accuracy of these models. This is fine if economics was like theoretical mathematics, a field where the search for pure knowledge is all that matters, and elegance is highly prized. Or perhaps it’s okay for economists to be like historians, explaining with hindsight what precisely went wrong in the near or distant past.

But to be actually useful to society, economists should be good at making forecasts about the future. They can either do so for the public good, telling governments and central banks what actions they should take that will result in a better future. Or they can do so for private benefit, forecasting the future direction of the economy so that companies can maximise their profits, or so that speculators can make better bets on the market. The evidence strongly suggests that economists are not particularly good at any of these jobs. As Queen Elizabeth II said of the 2008 financial crisis, “Why did no one see it coming?”

This question of the purpose of economics occurred to me whilst I was reading a new book by J. Doyne Farmer, “Making Sense of Chaos”. Farmer is better equipped than most to address this issue. He is a physicist rather than an academically trained economist: probably a good thing in this context. As a graduate student he built primitive computers to beat roulette, and has subsequently had a range of eclectic interests including artificial life, theoretical biology, chaos and complexity theory. He also started a highly successful quantitative hedge fund, which was substantially better at forecasting markets than pretty much any economist.

Unsurprisingly, Farmer is not a fan of the relatively simple models beloved of orthodox economists. Of course, simple models have many attractive qualities. They are easier to intuitively understand, which makes them good for explaining the past. Most models have relatively few degrees of freedom which means their estimated parameters are more robust. This is vital in macroeconomics where data are sparse and noisy, in contrast to the microsecond resolution of financial market prices. Furthermore, simple equations can be solved to find “the answer”; often some equilibrium level where supply equals demand, and unemployment is as low as it can be without creating undue inflation.

However, as Einstein probably said “Everything should be made as simple as possible, but not simpler”. These models are indeed too simple to make accurate forecasts. Firstly, because they are often linear. Linear equations are easier to understand and solve, but empirical evidence suggests that the economy is usually very non-linear. Secondly, they amalgamate the millions of people, firms and other entities in a typical economy into a very small number of representative agents. Thirdly, they make heroic assumptions about the ability of these agents to know what is going on in the economy and to rationally calculate the best possible action they could take. They also assume that every agent shares the same unrealistic opinion of what ‘best’ is. Finally, they do not model the feedback effects that occur when agents interact. With this feedback, it’s extremely unlikely that any real economy will ever be in a state of equilibrium.

Fixing the flaws

Instead of these crude models, Farmer prefers the approach of simulation and agent-based modelling. Here there are a large number of agents, whose interactions are individually simulated, using more realistic models about what agents know and what actions they will take given that knowledge. This results in highly non-linear behaviour that more closely matches what we see in reality. Instead of equilibria, we see the models lurch from boom to bust without the need for the artificial exogenous shock required to make traditional economic models plunge from steady state bliss into sudden recession.

A professor of traditional economics would find it easy to criticise this approach. The well-known ‘butterfly effect’ means that small changes in the initial conditions of complex non-linear models can result in significant differences in the final result. Also, unlike a simple model, these simulations are not intuitive. They are also impossible to calibrate using quarterly or monthly economic data. The relatively small number of data points in a typical macroeconomic data set is dwarfed by the number of parameters required for even a few dozen agents in a simulation. Even if it was theoretically possible to fit these models, the result would be highly over fitted to the data and useless for prediction.

In their defence, the behaviour of individual agents in these simulations is quite intuitive, and perhaps more so to the average person than most theoretical macroeconomic equations. But it is true that understanding the behaviour of many interacting agents at an aggregate level can be hard, and requires good diagnostic tools. The initial conditions problem can be solved by running multiple simulations with slightly different parameters, and looking at the distribution of outcomes. This is a useful exercise in its own right; since forecasting is never an exact science it is better to calibrate the uncertainty of our predictions.

The problem of fitting these models is more difficult. Rather than using macro data, we require micro level data about how real firms and people behave. To get the advantages of agent-based modelling we need to model at least one firm in each industry and ideally more. Finding this data is not easy, and probably represents the main challenge to adopting these methods, now that computing power is able to simulate very large numbers of interacting agents without too much difficulty. Nevertheless, even without correctly calibrated agent behaviour, these models can be very useful. So called ‘zero intelligence’ models can still produce more realistic simulations of the economy than most traditional economists, no matter how carefully their equations are fitted.

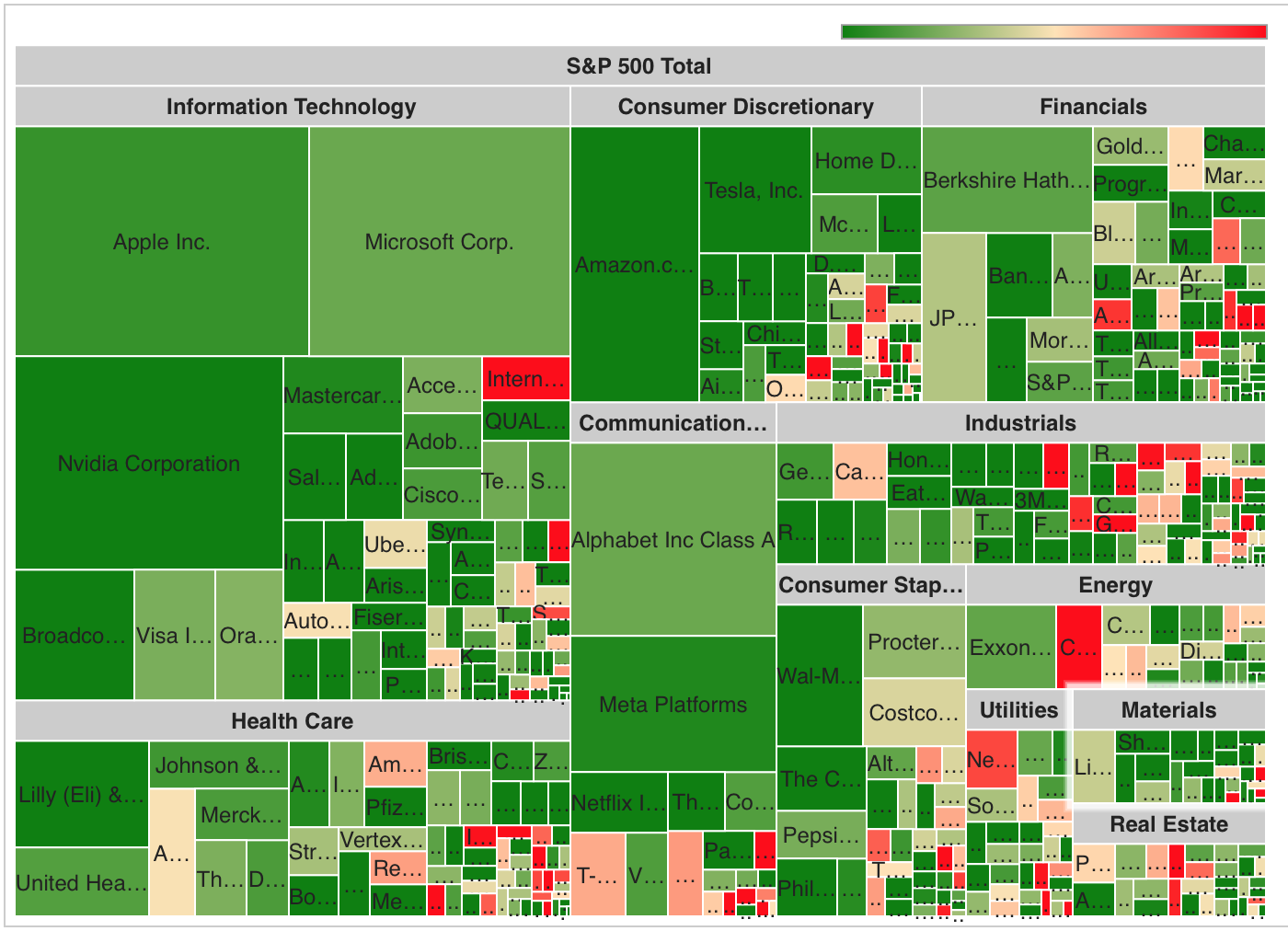

As well as macroeconomics, Farmer spends some time examining the dismal record of traditional financial economics. I had hoped that the book would contain an explicit guide to beating the markets using complexity theory, but I was disappointed. Instead, there is an interesting discussion around market efficiency and the theory of market ecology. Those looking to model the non-linear dynamics of stock prices for profit will need to look elsewhere.

Tackling the big problems

The chapter of the book on credit crises was more satisfying. If Her Majesty the Queen was still with us, she would be pleased to know that more realistic models do a better job of predicting market crisis, although it’s always easier to predict the last crisis than the next. These models also have important implications for how regulators should act to prevent banks from using excessive leverage. I have long believed that the Basel regulations on capital requirements were responsible for exacerbating if not actually causing the 2008 crisis, and I was pleased to see that my prejudice could be justified by a neat model of banking behaviour.

Perhaps the most refreshing element in this book is that Farmer’s work is not restricted to the typical economists’ tasks of betting on markets, or determining monetary and fiscal policy. He also spends time on what he describes as ‘Our Big Problems’; inequality, recovering from disasters like the COVID epidemic, and the ultimate existential crisis of our planet – climate change. Economists would certainly be more useful if they were more ambitious and considered more of the issues facing wider society.

However, Farmer is perhaps too ambitious in using weather forecasting as an example of what can be achieved with more complex modelling. Given enough computing power, it is theoretically possible to almost perfectly forecast any physical system (at least until we get to the scale of quantum mechanics). This is not true of human society. Although the number of air molecules is vastly greater than the number of economic entities in the world, air molecules are unlikely to change their behaviour on a whim or start behaving differently for no apparent reason. Unlike Farmer, I do not think it will eventually be possible to accurately simulate every person and firm in the global economy. Nor do I think it is necessary.

This excellent book finishes with a call for action that is mostly a call for assistance. Using these novel approaches to solve these big problems requires new datasets for calibration, but also significant computational resources to allow a larger number of agents to be modelled more realistically. Personally, I think we should listen to Professor Farmer. This is clearly a much better use of our global cloud computing infrastructure than using generative AI to cheat on your economics homework.

Robert Carver has two degrees in economics, and in the past has worked for an economics think tank and for a quantitative hedge fund. He now trades independently. Robert’s homepage is www.systematicmoney.org

TOP OF PAGE

As any student will tell you, no doubt armed with chat GPT, economics is defined as “The study of the allocation of scarce resources”. But a more difficult question is this: what is economics for?

As any student will tell you, no doubt armed with chat GPT, economics is defined as “The study of the allocation of scarce resources”. But a more difficult question is this: what is economics for?