New York may be famous as the city that never sleeps but in reality, equity traders working on the main stock exchanges get to down tools at 4pm eastern time when the sessions officially close. Gill Wadsworth reports.

The main exchanges also shut over the weekend, giving those working in what is often a stressful occupation, much needed recuperation time.

However, all that could be set to change as the New York Stock Exchange (NYSE) considers becoming the bourse that never sleeps.

NYSE is polling market participants on the merits – or otherwise – of trading stocks around the clock as regulators consider the possibility of sanctioning the first 24/7 exchange.

NYSE and NASDAQ are under pressure to keep up with several retail brokers, including Robinhood and Interactive Brokers, that offer 24/5 access to US stocks, providing their own internal liquidity or by matching with a venue that taps into Asian investment pools.

At the same time, the ability to trade cryptocurrencies 24/7 is leading investors to demand the same capability for their US equity allocations.

Dmitri Galinov, CEO at 24X National Exchange, which is seeking regulatory approval to trade round the clock, says demand for continuous trading is high.

“While 24/7 trading has delivered positive benefits to people seeking to trade cryptocurrencies, those same benefits would extend to people who wish to trade the equities of some of the largest global players based in the US. We have seen high interest in 24/7 trading,” he says

Galinov notes that 24/7 frontrunners Robinhood conduct one quarter of trades out of standard hours.

Rolling news

Harry Temkin, chief digital officer at fintech DriveWealth, which offers the technology to support fractional trading allowing retail investors to purchase portions of shares for as little as one pence, says 24/7 trading is valuable to investors who do not want to be penalised for living in outside the US’ time zone.

“Why is there that limitation [to equity trading hours]? Our total volume trading in the overnight session is steadily increasing which is mainly because our Asian clients want to be trading in real time. If something has impacted Apple’s stock price, they don’t want to wait until the next day to trade.”

As investors have access to company news 24/7, it is no surprise that an increasing number of individuals want to act on that information as soon as they hear or read it.

Paul Woolman, managing director and global head of equity products at CME Group, says: “The news cycle that we live in today is much more immediate, and it’s more 24/7 in nature. News can break anytime and people want to be able to react to that and manage risk in a real time manner.”

24/7 trading would, Galinov says, have the potential to alleviate some of the volatility that arises when investors react to reading company news overnight and rush to the markets as soon as they open.

“Morning trading in US equities may become less volatile by enabling investors to react to big news – for example, an Elon Musk after-hours tweet about Tesla – as soon as it happens rather than waiting for the US markets to open,” he says.

End of day dash

There are further arguments for implementing round the clock trading as a means of reducing volatility and improving liquidity.

Research from trading analysis firm BestEx Research finds that a third of all S&P 500 stock trades are executed in the final 10 minutes of the day; an increase from 27% in 2021.

This trend to favouring the closing auction is in part driven by the rise in passive investing and ETFs that are attracted to the price efficiency and liquidity that the close offers.

However, the end of day dash for liquidity is seen by some as detrimental and destabilising.

A report from the National Bureau of Economic Research published in December 2023 states: “The mostly liquidity-driven trading interest of participants in the closing auction might lead to distortions of the closing price and deviations from the fundamental value due to short-term supply and demand imbalances caused by, for example, one-sided order flow from index tracking funds.”

However, while opening markets 24/7 might reduce the issues of over-reliance on the closing auction, it does not mean there would be ample liquidity at all hours.

Woolman says: “If you have a very thin market overnight, it might become less appealing to end users because they’re not sure whether they’re paying a wider or bigger offer, or whether the price on the screen is truly reflective. Our clients want value liquidity not just during the main market hours, but also in the extended trade.”

Market disruption

The technological demands of moving to 24/7 trading are immense and for established firms, it may mean overhauling existing systems, particularly those that rely on downtimes to carry out maintenance.

Michael Hall, head of distribution Spectrum Markets, says “In an older company with legacy infrastructure, you end up bolting things on to something else, and it becomes hard to then adapt one system without impacting another. Different technology will be required for your pricing, risk management; compliance and risk tolerances will be impacted.”

He adds: “Spectrum built brand new technology from scratch with continuous trading in mind, so we are able to scale, and the maintenance is minimal.”

Meanwhile Galinov says that 24X National Exchange will implement “brief trading pauses” to allow for software upgrades and functionality testing.

Trader burn out

Alongside technology, firms will need to find staff who are both willing and capable of trading stocks 24/7.

Further at a time when mental health and wellbeing in the workplace is increasingly important to both employees and employers, there is a risk of a backlash when imposing longer working hours.

The Investment Association (IA) says that the “current long hours culture impacts on traders’ mental health and wellbeing. It has also been identified as a key obstacle in recruiting and retaining more diverse talent.”

Stuart Lawrence, head of UK equity trading, UBS Asset Management, says: “At present, the chances of moving to 24/7 equity markets remain small as there seems to be little demand or necessity for such an extreme change. EMEA already has the longest trading sessions and there have been previous attempts to shorten these hours. When considering extensions, there must be conversations around – and recognition of – the mental and physical health of traders.”

Lawrence adds: “Any changes to our trading days would likely require changes to the coverage model, and they will have to staff their desks accordingly. This will increase costs at a time when costs are in focus. Firms would need to ensure they have the right coverage in place and finding suitable traders willing to work unsociable hours would take time.”

However Temkin says most demand is for 24/5 trading which means less necessity on the buyside to find people willing to work weekends.

Temkin says: “It is just like the futures markets which stop trading on Friday and reengage on Sunday night. Equity trading might go to 24/7 but ultimately weekends are still seen as precious.”

Europe under pressure

European market participants were vociferous in their opposition to longer trading hours back at the turn of the century, with the Investment Association arguing that “it is high time we end the long hours culture, which is detrimental to diversity and mental health, and inefficient for the markets”.

As part of their response to an LSEG consultation on reducing trading hours, IA and the Association for Financial Markets in Europe also argued that a shorter trading day “will improve liquidity in Europe as, rather than being thinly spread over an extended period of time, trades will be more evenly distributed over a shorter trading day”.

However if the US opts to open all hours, the European exchanges will be under significant pressure to follow suit.

Spectrum Markets’ Hall says: “If the APAC regions and Hong Kong exchanges are open at the same time as America’s, that means improved pricing. And if Europe’ doesn’t open its doors too, they will be at a disadvantage and investment will go elsewhere.”

But UBS’s Lawrence believes European exchanges will be able to retain control of their opening hours, even if the US goes 24/7.

“US and European markets have different rules and approaches,” he says. “In the event of a US move to 24/7 there may be some pressure for Europe to follow suit, but I would expect it to have little effect in changing the regional dynamics.”

Moving to continuous equity trading will be a monumental shift for a market that has long been beholden to the trading bell.

For some that shift would be welcome, bringing a freedom that is enjoyed in other sectors and would democratise equity investment. Further the technology already exists and there are plenty of fintechs chomping at the bit to disrupt the status quo.

But 24/7 trading remains controversial and there will be plenty of obstacles to overcome before access to round the clock stocks becomes a mainstream reality.

©Markets Media Europe 2024

TOP OF PAGE

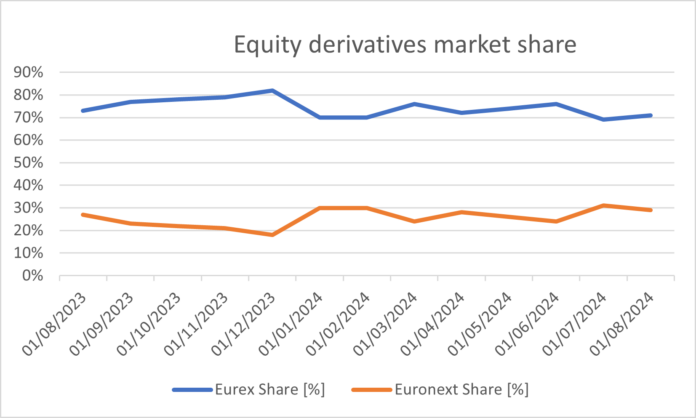

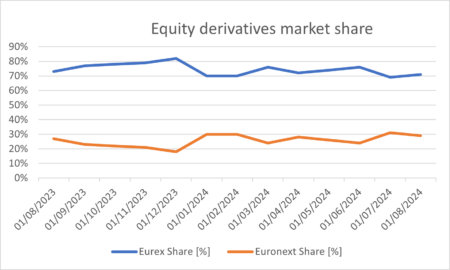

Eurex’s equity derivatives volumes peaked in December last year at €119 billion, with an 76% market share. Euronext’s best month over the past year was April, at €40 billion and a 28% market share.

Eurex’s equity derivatives volumes peaked in December last year at €119 billion, with an 76% market share. Euronext’s best month over the past year was April, at €40 billion and a 28% market share.