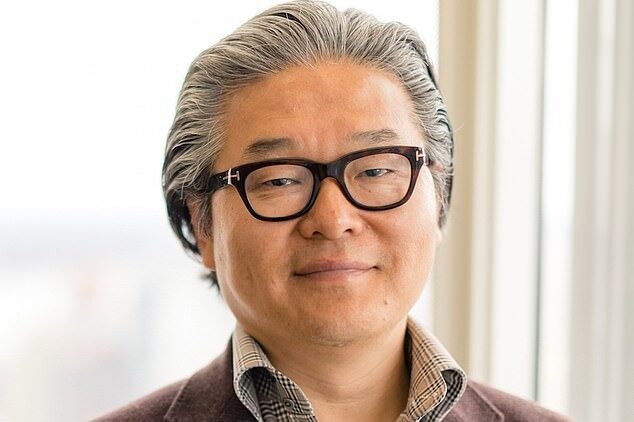

In 2021, amid the panic of Covid and weakened markets, wealth management firm Archegos Capital Management collapsed. Now, more than three years on, founder Bill Hwang is facing the Manhattan Federal Court on charges of racketeering, securities fraud, wire fraud and seven counts of market manipulation.

Scott Becker, head of risk management for Archegos, stated in court this week that he “lied to banks to induce them to make loans to Archegos to pursue its trading,” following instructions from Hwang and chief financial officer Patrick Halligan. This included false statements around the size of Archegos investments, cash balances, and the time it would take to liquidate the firm’s portfolio. These lies have been corroborated by members of the firm’s counterparties, including UBS Group and Jefferies.

On the stand, Becker highlighted Hwang’s preference to invest in swaps rather than buying shares directly – which had the benefit of not needing to be reported to the SEC.

Archegos’ trading strategies have been described as aggressive and risky, with Becker stating that Hwang was trading “nonstop, all day, every day” between 2020 and 2021. Hwang was amassing leveraged positions in a number of securities using total return swaps, using a number of banks as payers. Archegos did not share its other positions with each dealer, leading it to accumulate up to 1000% leverage.

In early 2021, the family office had reached trading capacity at certain banks it was using as payers, and was required to pay up to 100% margin rates in some cases. In court, Becker stated that at this point he was instructed to lie to banks in order to increase capacity caps.

When the share price of Viacom CBS, one of the companies Hwang was invested in through multiple banks, began to fall in 2021, Archegos was in danger of being unable to meet margin calls. Despite attempts to stall the calls, the banks began to sell off the underlying stocks.

Alongside the question of what Hwang’s sentence will be, the question of how a comparable situation can be prevented in the future is also key.

In 2022, the SEC issued a proposed rule change that would require a public disclosure of positions in credit default swaps, total return swaps, security-based swaps based on equities securities and other security-based swaps with positions exceeding specified thresholds. Following a second comment period on the rule last June, it has not yet been implemented.

This is not the first time Hwang has faced the US wheels of justice. In 2012 he was fined US$44 million by the SEC and told to stay away from investment advisory after being found guilty of insider trading. Tiger Asia Management and Tiger Asia Partners, founded and managed by Hwang, short sold three Chinese bank stocks based on information from private placement offerings, and separately attempted to manipulate the prices of publicly traded Chinese bank stocks.

Following his conviction, Hwang converted his firm into a family office – exempt from SEC regulation.

The trial of Hwang and chief financial officer Patrick Halligan is expected to last multiple months.

©Markets Media Europe 2024

TOP OF PAGE