Powered by new computer chips, high-frequency trading (HFT) has reached nanosecond timescales. Fierce competition has prompted a new wave of speculative orders, prompting allegations of market abuse.

HFT used to be measured in milliseconds, with traders using microwave towers to exploit latency in exchange feeds. Those days seem quaint today.

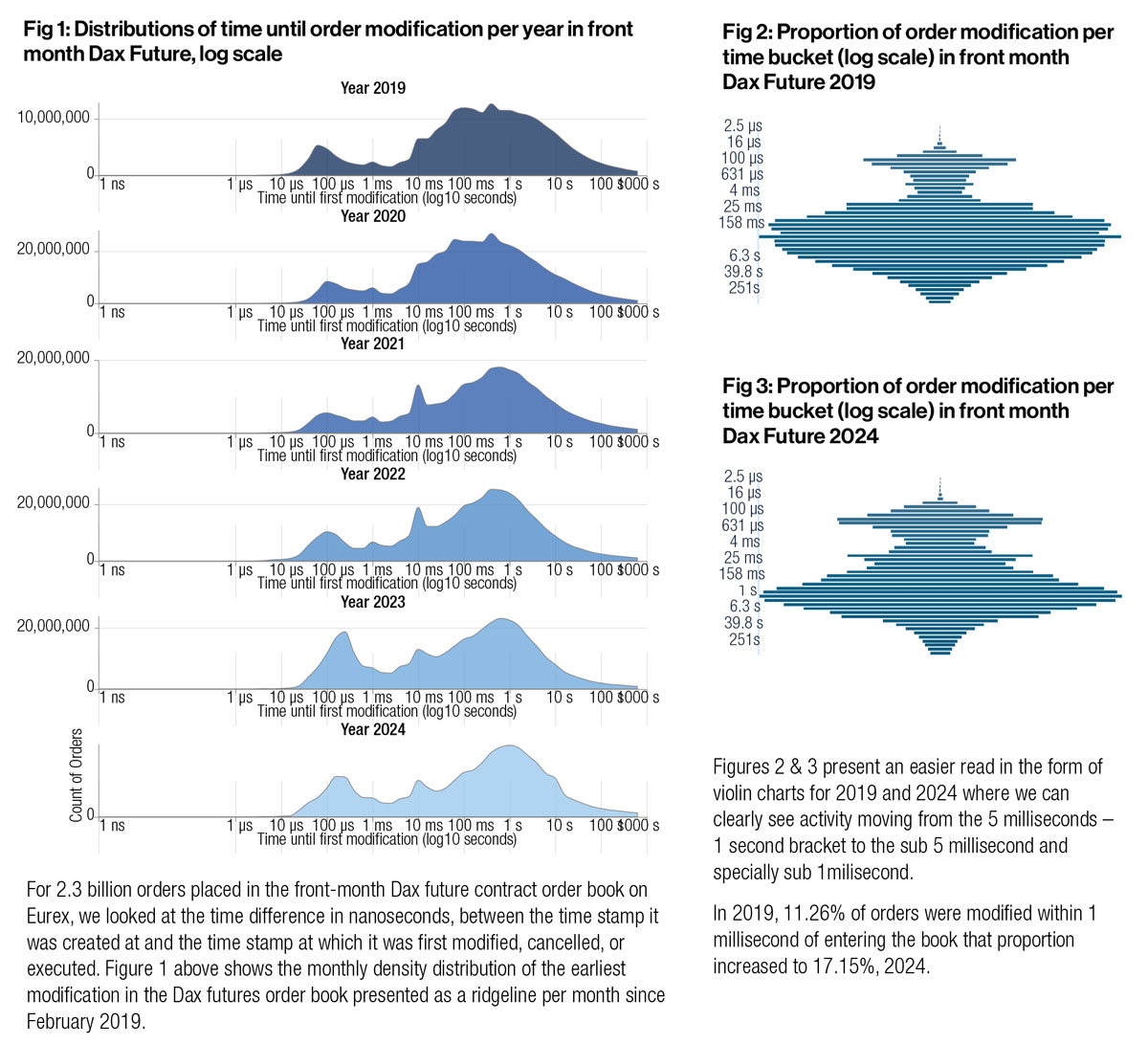

Using a platform provided by BMLL, we analysed 6 years of data starting in February 2019. Our own analysis of 2.3 billion DAX futures orders on Eurex reveals a striking trend: the share of trades modified within one millisecond has risen from 11% in 2019 to over 17% in 2024 [see box]. At Euronext, analysis of a single stock – BNP Paribas – shows an almost threefold increase in sub-100 microsecond order modifications during the same time period.

The hardware arms race and speculative triggering

The earlier generation of HFT relied on technology such as microwave networks to reduce latency between multiple trading locations. But in a competitive environment, even microseconds proved too slow. Specialised computer chips called Field-Programmable Gate Arrays (FPGAs) have now become the industry standard for cutting latency from microseconds to tens of nanoseconds.

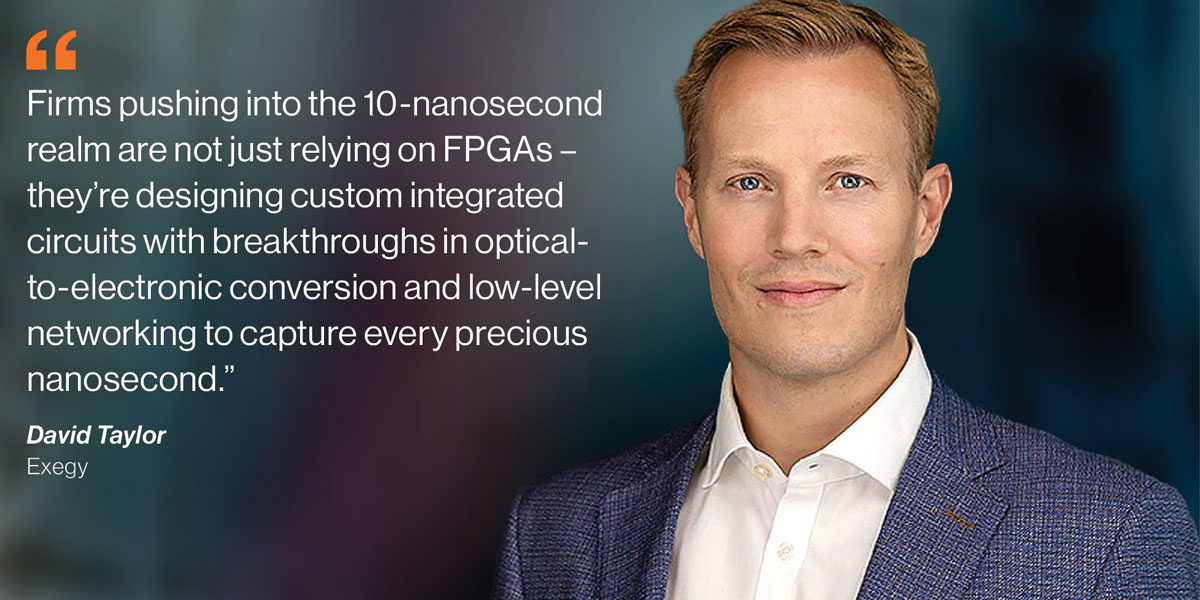

As more firms entered the race, vendors stepped in offering custom integrated circuits and optimised networks. David Taylor, CEO of specialist HFT vendor Exegy explains: “Firms pushing into the 10-nanosecond realm are not just relying on FPGAs – they’re designing custom integrated circuits with breakthroughs in optical-to-electronic conversion and low-level networking to capture every precious nanosecond.”

This arms race has led to some creative tactics. Until 2018, Vincent Akkermans was a senior developer at Optiver and is now co-founder at TenFive AI, a company that develops advanced multi-agent AI applications. Before he left Optiver, Akkermans worked with the pioneers of “speculative execution” or “speculative triggering” in HFT, whereby FPGA chips allow orders to be initiated, and then, based on sub-microsecond signals, cancelled by leaving them incomplete before they have been processed by the exchange.

“Using FPGAs to begin processing and transmitting orders before the complete market message is received represents a paradigm shift in trading speed – pushing the limits of how fast orders can be executed,” Akkermans says.

“It’s crazy how much brain power is devoted to shaving off nanoseconds – showing that in a competitive market, even the tiniest advantage is pursued relentlessly.”

European exchanges have incorporated features to allow speculative execution by HFTs – within certain limits. “Speculative triggering refers to certain latency arbitrage strategies when market participants start to send an order before they have fully processed the incoming market data,” explains Jonas Ullmann, Frankfurt-based Eurex board member and COO.

To exploit the strategy, HFTs have to occupy a grey area between raw messages and fully-fledged orders to the exchange, where nanoseconds count. “We’ve built in features such as the “discard IP” and “DSCP” field to prevent detrimental effects on market integrity and provide a clear technical framework. Messages sent to the “discard IP” will not reach the trading system gateway and matching engine, so this can be seen as a trash bin,” Ullmann tells Global Trading.

“These packets will be discarded at the Access Layer switch port and no other participant is influenced,” he added. “Packets sent to the discard IP address are not considered to be orders and are not forwarded to the exchange. Due to the nature of where the IP address is specified in the message, you need to decide very early whether to send it to the exchange or discard IP.”

Speculative execution has recently attracted controversy. In March, a Paris-based market maker, Mosaic Finance, accused Eurex of allowing the practice to explode on its venue. Mosaic claimed that Eurex was being flooded by millions of corrupted orders per second, in violation of its rules. HFTs were doing this in order to push their way to the front of the order queue, Mosaic complained.

Eurex strongly disputes the accusations. “There are strict limits in place,” insists Ullmann, highlighting the difference between raw messages and actual orders. “For instance, participants are allowed to send up to 30,000 ethernet frames per second and no more than 600,000 ethernet frames per minute across the network.” Mosaic’s allegation that it was able to breach these limits by sneaking corrupted data past Eurex’s own monitoring system is “incorrect,” Ullmann says. “The allegations from this individual trading participant are unfounded and all substantive concerns raised have been repeatedly reviewed by Eurex. None of the issues raised proved to have merit.”

Akkermans is inclined to accept Eurex’s side of this argument. “It would surprise me that if lots of invalid network traffic were sent that the exchange wouldn’t notice, although I cannot say with any certainty – I’m not a network engineer. Additionally, the discussions I heard about the speculative execution were always grounded in the desire to only send valid messages. They were well aware that it would be possible to make the message invalid at the final moment, but also that this would contravene the rules and shouldn’t be done. I do believe the culture was such that this was a genuine intent,” he says.

A spokesperson from Optiver declined to comment on whether the firm still conducted speculative execution, and whether it deployed the strategy at Eurex.

The value of technology

Even so, the controversy highlights the competitiveness of the new environment.

Milan Dvorak, CEO of Magmio, an FPGA software provider, agrees that even a moderate jump in speed can bring rewards.

“By moving decision logic from software onto the network via FPGA technology, traders can reduce latency from microseconds to tens of nanoseconds, giving them a competitive edge even if they’re not the fastest in absolute terms,” Dvorak says. “There’s a market for every latency bracket. Even if you’re not the absolute fastest, having a robust strategy means you can still profit from the opportunities available at your speed level.”

At the same time, these technologies require deep expertise. Programming an FPGA takes specialised skills, especially if you want to tweak the hardware’s logic.

According to Milan Kratka, CTO of broker Trading Block who started at Citadel in the early 1990s, “I was one of Citadel’s first quant – and that early experience taught me that in trading, speed isn’t just about quoting; it’s about being the first to respond to a market event.”

He tells Global Trading that while many traders know they must quote quickly, the real edge appears when markets suddenly shift. If you can pull or modify your quote a split-second faster, you either avoid a bad fill or seize a profitable one. Or, as he puts it: “Programming an FPGA is a rigorous process – but once optimised, it delivers decision speeds measured in nanoseconds, offering a decisive edge in today’s fast-paced markets.”

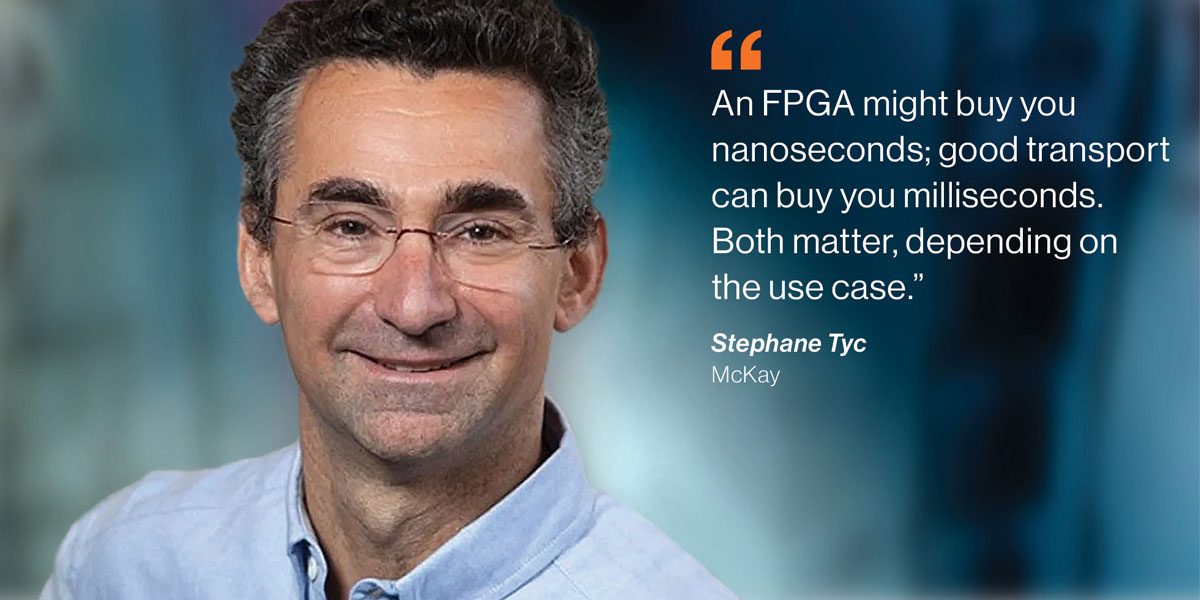

However, HFT vendor McKay Brothers warns about a level of hype over the technology. “We use FPGAs where deterministic behaviour and extremely low jitter are critical,” according to CEO Stephane Tyc. “But they’re not always necessary. An FPGA might buy you nanoseconds; good transport can buy you milliseconds. Both matter, depending on the use case.”

McKay says its approach has broadened beyond latency-obsessed clients. “Many of our recent products are built purely in software,” Tyc adds, noting that “flexibility now rivals raw speed. This isn’t a religious debate for us, it’s a question of fit-for-purpose design.”

Hardware and Integration

There is also competition to provide specialised FPGA hardware. Chipmaker AMD has emerged as a leading provider of FPGA-based hardware, offering chips that support everything from sub-10 nanosecond trades to high-volume analytics.

AMD sales director Alastair Richardson envisions chiplet architectures enabling more modular designs: “By using a chiplet process – breaking a processor into smaller pieces – instead of the traditional large piece of silicon, monolithic method, we can build complex processors, with more capabilities and more efficiency. This includes things like 3D stacking of chips or pushing the boundaries of core counts in a single processor.”

In practice, large trading shops might combine an FPGA for the ultra-fast “tick-to-trade” loop with additional GPUs or CPUs for broader risk modelling and artificial intelligence-based prediction. The net effect is a hybrid computing approach that merges microsecond-level decision-making with bigger-picture analytics – something unattainable until recently.

Fragmented Markets and Regulatory Nuances

In the US, the Regulation National Market System (Reg NMS) has forced firms to route to the best price across multiple venues, making speed crucial for updating quotes instantly and picking off mispriced orders. Europe mirrors this fragmentation under the Market in Financial Instrument Directives (MiFID I, and II), albeit with more complexity around data fees and pan-European connectivity. Firms must link to multiple exchanges to remain competitive, each link adding cost.

According to Exegy’s Taylor: “Market fragmentation in Europe is a significant challenge, connecting to all relevant markets can be two to three times more expensive than in the US.”

Despite these hurdles, a European consolidated tape is on the horizon, potentially lowering entry barriers.

Taylor says: “The current phase of the European Consolidated Tape is just a consolidated trade report – it isn’t directly tradable yet. However, many in the industry are bullish that it will eventually evolve into a tradable tape. This would lower the cost of achieving pan-market visibility and drive more innovation.”

Fast but secure: Protecting trading DNA

Given the stakes at play, safeguarding proprietary strategies, and intellectual property is crucial for trading firms. Vendors like Exegy and Magmio emphasise frameworks that let clients deploy code without exposing it to the vendor.

Exegy’s Taylor says: “We empower our clients to innovate without compromising their secrets – whether through a configurable software interface or a sandboxed FPGA where their proprietary code remains completely private.”

Milan Dvorak of Magmio echoes this: “We deliver our solution as a framework without ever seeing the actual strategy. Our clients maintain full control over their code, ensuring their competitive edge remains completely confidential,”

According to former Optiver developer Vincent Akkermanns, high frequency trading firms embed structural risk considerations in their systems and their operations. Developing teams are close to traders:

“The usual routine was to get in early, listen in on the traders’ briefing, and then get to work on the market links and trading software for which I was responsible. I liaised with traders, assistants, and mid-office and compliance to get requirements. Our team sat on the trading floor, so it was easy pretty noisy, but also easy to get a sense of what was going on.”

For him, “The entire system is engineered so that every role – from the trading floor to the back office – contributes to a high level of technological sophistication, ensuring the market functions more efficiently.”

Tyc agrees: “That’s been a quiet success story over the past decade. The firms operating in these environments today have developed robust internal controls, risk frameworks, and strong engineering ethics. McKay itself is not a trading firm, but we work closely with some of the most sophisticated market participants in the world, and we see firsthand the care they take to build systems that are both high-performing and well-governed.

One of the key concepts that has emerged as a result of low latency investment is determinism. Deterministic systems – those that behave in highly predictable ways – can support more precise risk management, but like anything, too much of a good thing has trade-offs. We’ve seen exchanges that pushed determinism to extremes and inadvertently created unintended market structure effects. A small amount of jitter can help level the playing field; too much, and you get chaotic, inefficient markets. Some venues that could be extremely deterministic have chosen to introduce intentional randomness to prevent predictability from becoming an exploit.

It’s a balancing act – much like the question of private fills printing before public trades. There’s no universal answer. What matters most is transparency: clearly disclosing how systems behave and how access is granted. If disclosure is fair and access is equitable, the market can and will adapt. We don’t need to prescribe a singular model, if the rules are visible and access is open, competitive pressure will do the rest.”

When a single glitch can devastate even established firms, like was the case at Knight Capital. HFT are rightfully obsessed not just with speed but also reliability – a balancing act that shapes internal processes and controls.

Lawsuits and regulatory filings reveal how fiercely competitive the sector is. Consider the lawsuit by Skywave Networks against leading HFT players Virtu and Jump Trading that alleged fraud in the use of experimental shortwave licences (the defendants dispute the allegations). Or the complaint by McKay Brothers against Nasdaq, which forced the exchange to stop offering preferential low latency access to high-paying clients. All market participants are racing to compete.

Can the market keep up?

Proponents argue that high-speed competition narrows spreads, boosting liquidity and benefiting all investors. Critics label it an expensive arms race, with diminishing returns and potential negative externalities when markets become “too fast.” Regulators in the US and Europe have taken incremental steps – such as imposing licensing for HFTs, demanding kill switches, or endorsing “speed bumps” in certain venues – but nothing has fully reversed the move to ever faster speed.

The future may see more frequent usage of AI. Although neural networks can be too heavy for the tightest loop, they can assist in slightly upstream decision-making or in scanning large data sets for predictive signals. Meanwhile, talk of quantum computing hovers at the edge of possibility, but immediate breakthroughs remain speculative.

AMD’s Richardson hints that more integrated hardware solutions – combining FPGAs, GPUs, specialised network adapters, and even novel high-performance computing (HPC) techniques – will likely define the next wave.

“We’re now witnessing a new latency race that involves AI, with some tasks still best served by a dedicated FPGA or ASIC, while others lean on CPU’s, GPUs or NPU’s to do more complex AI inference.”

If anything can slow the chase, it might be the laws of physics. Market data cannot traverse distances faster than the speed of light, leaving only network design and extremely clever hardware optimisations to squeeze out incremental gains. Still, as the last decade has shown, major leaps – from microwave relays to shortwave transatlantic signals – can arise when profit potential is high enough.

Exegy’s Taylor points to the stratification forming in this space: “While the top-tier HFT players operating at nine nanoseconds are few and stable, the dynamic next layer – trading at deep sub-millisecond speeds across multiple assets – is where fierce competition and innovation are truly unfolding.”

Most technology vendors are pushing in this direction, Tyc tells us that McKay has been working with exchanges like Euronext to allow firms to reroute connectivity with no hardware changes, “a seismic shift,” as Tyc puts it, in how infrastructure is accessed.

He adds, “That plug-and-play simplicity destroys the barrier to entry,” Tyc says.

Even if the absolute fastest tier remains exclusive, broad adoption of low latency technologies – from microwaves to FPGAs – has high-speed tactics permeating all corners of trading. And that reality, though it continues to spark debate, is almost certain to persist. As innovations, from AI integration to chiplet architectures, make once-exotic technology more widely accessible, the race to zero won’t be stopping anytime soon. Speed, in all its minute increments, has become part of the market’s DNA.