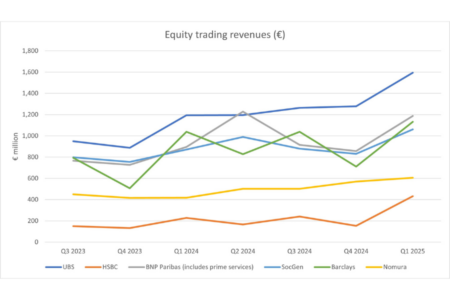

Equity trading revenues rose across the board in Q1 2025 in the buildup to US tariff adoptions. UBS continued to lead the pack with a reported €1.6 billion, up more than a third (34%) year-on-year (YoY).

Increasing revenues across the banks mirror those seen in the US over Q1, where QoQ gains significantly outpaced YoY comparisons.

READ MORE: Rising tides lift all ships in Q1 US bank results

UBS’s success was driven by activity in equities derivatives, the firm stated in its earnings call, along with increases in cash equity and prime brokerage results. The bank’s Q1 2025 results also represented a 25% increase quarter-on-quarter (QoQ).

CEO Sergio Ermotti observed: “As the second quarter kicked off, the unveiling of significant changes to tariffs on trading partners by the US administration increased uncertainty and market volatility, while in some days trading volumes exceeded their COVID-era peak by around 30%.”

On the other end of the scale, HSBC floundered behind the European giants, reporting €431.9 million in the first three months of the year. Despite this marking significant quarterly growth for the bank, up 82%, it still left a more than a half-billion gap between the three banks at the centre of the pack – Societe Generale, Barclays and BNP Paribas.

Questioned on the impact US tariffs have had on client behaviour, Georges Elhedery commented: “Corporate customers are in a wait-and-see mode, so some of the capex or large investments are on hold. Certainly, some of the shipments from China, specifically to the US, have slowed down, but we’ve seen no panic. So there’s been no significant drawdowns. Deposit behaviour has remained normal, so nothing really to call out beyond the wait and see.”

For the firm, he added: “In a plausible downside tariff scenario, we estimate that there will be a low-single-digit percentage impact on the group’s revenues.”

As of Q1 2025, HSBC has ceased breaking out trading revenue into equities and fixed income. Figures for the first three months of the year have been estimated based on 2024 breakdowns.

Barclays, which has seen the most drastic variations in results since Q3 2023, saw equity trading revenues increase 59% QoQ but just 9% YoY to €1.1 billion.

Rising more steadily, both Societe Generale and BNP Paribas equity trading revenue results were up 22% YoY, to €1 billion and €1.2 billion respectively. On a quarterly basis, growth was more pronounced at BNP Paribas – up 43% – than at Societe Generale, up 28% to a record high.

Sitting just above HSBC, Nomura reported €606 million in the first three months of the year – rising just 6% QoQ but 45% YoY, in line with slow but steady growth over recent quarters.