In our first Global Trading pre-trade and post-trade buyside survey, respondents from firms with trillions of dollars in combined AUM share their views on workflows, KPIs, vendors and the pain points they want to see resolved.

In a world with myriad, unpredictable liquidity sources, buyside equity trading is increasingly complex business. Deciding when and how to trade involves portfolio managers, who own most but not all of the P&L, and whose time is limited. Automation is essential, but waterfall-type workflows are needed to decide when and where to do it. And informing this decision requires a firehose of data.

And then, supposing that one does manage to trade, how do you evaluate the result post-trade? You don’t have to be a quant to know that trading has a market impact, but how should one measure it and disaggregate the effect of security and index characteristics, venue choice, and execution method or timing? Is it possible to integrate post-trade metrics into pre-trade decisions?

The time-honoured approach to both problems is to use a vendor, for the pre-trade analytics or transaction cost analysis (TCA) post-trade. Rather than simply ask traders for their opinion of such vendors, the buyside firms that spoke to Global Trading suggested a more detailed approach. And that led to our survey, where traders from some of the world’s biggest asset managers and pension funds provide insight into these kinds of questions.

Pre-trade

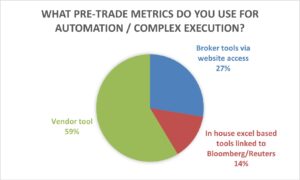

We start with the challenge of automation and complex execution. In terms of pre-trade metrics for this crucial task, 59% of buyside traders use vendor tools, and a significant 29% use tools provided by their brokers. One respondent expanded on this further: “We ask brokers to run pre-trade estimates for various flow scenarios”, as they put it. A smaller proportion – just 14% – responded that they use “In-house excel based tools linked to Bloomberg/Reuters”.

We start with the challenge of automation and complex execution. In terms of pre-trade metrics for this crucial task, 59% of buyside traders use vendor tools, and a significant 29% use tools provided by their brokers. One respondent expanded on this further: “We ask brokers to run pre-trade estimates for various flow scenarios”, as they put it. A smaller proportion – just 14% – responded that they use “In-house excel based tools linked to Bloomberg/Reuters”.

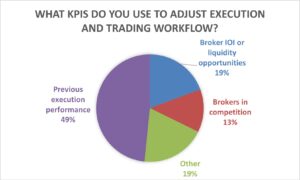

Armed with one of these three types of analytic tools, what kinds of key performance indicators (KPIs) do buyside firms use to adjust their execution and trading workflow? “Previous execution performance” accounted for almost half of responses here. However, a significant minority of 19% adopted a more dynamic approach, using broker indications of interest (IOI) or liquidity opportunities to make adjustments. Another 13% used brokers in competition, while the remaining 19% preferred a mixture of these three KPIs, which they supplement with volume data and portfolio manager discussions. As one trader told Global Trading, their KPIs have to be ‘smart’.

Armed with one of these three types of analytic tools, what kinds of key performance indicators (KPIs) do buyside firms use to adjust their execution and trading workflow? “Previous execution performance” accounted for almost half of responses here. However, a significant minority of 19% adopted a more dynamic approach, using broker indications of interest (IOI) or liquidity opportunities to make adjustments. Another 13% used brokers in competition, while the remaining 19% preferred a mixture of these three KPIs, which they supplement with volume data and portfolio manager discussions. As one trader told Global Trading, their KPIs have to be ‘smart’.

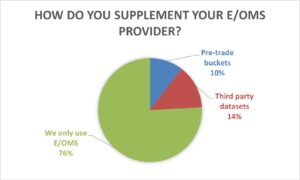

Having passed through the pre-trade metrics and workflow adjustments, traders then arrive at their execution/order management system (E/OMS), a key vendor product. We asked buyside respondents if they felt the need to supplement their E/OMS provider. A whopping 75% answered a clear ‘no’ to this question, while 14% of the remainder said they used pre-trade buckets, and 10% used third-party datasets. One respondent added a clarification: use third-party datasets for creating the trade, but E/OMS only for the trade itself.

Having passed through the pre-trade metrics and workflow adjustments, traders then arrive at their execution/order management system (E/OMS), a key vendor product. We asked buyside respondents if they felt the need to supplement their E/OMS provider. A whopping 75% answered a clear ‘no’ to this question, while 14% of the remainder said they used pre-trade buckets, and 10% used third-party datasets. One respondent added a clarification: use third-party datasets for creating the trade, but E/OMS only for the trade itself.

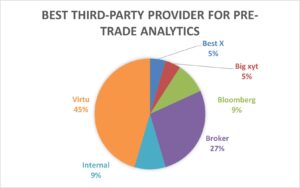

Next, we asked respondents to name their favourite pre-trade analytics provider. Virtu came out ahead with 45% voting for the vendor, which is also a major E/OMS provider. Collectively, brokers were in second place at 27% of votes, and broker-owned analytics products that got mentioned by name included Nomura TradeSpex, Goldman Sachs Marquee, along with JP Morgan’s platform. After Virtu, Bloomberg was the favourite standalone vendor, with 9% of votes, while the same percentage of respondents told us that they used their own in-house analytics for pre-trade. BestX and big xyt trailed the pack with 5% of votes apiece.

Next, we asked respondents to name their favourite pre-trade analytics provider. Virtu came out ahead with 45% voting for the vendor, which is also a major E/OMS provider. Collectively, brokers were in second place at 27% of votes, and broker-owned analytics products that got mentioned by name included Nomura TradeSpex, Goldman Sachs Marquee, along with JP Morgan’s platform. After Virtu, Bloomberg was the favourite standalone vendor, with 9% of votes, while the same percentage of respondents told us that they used their own in-house analytics for pre-trade. BestX and big xyt trailed the pack with 5% of votes apiece.

Finally, we asked buyside respondents to comment anonymously on the most important ‘pain points’ in pre-trade that they wanted to see resolved. “More transparency on all available liquidity” was a widespread complaint, with several respondents highlighting the invisibility of OTC liquidity, amid calls for the long-overdue EU and UK consolidated tape. Trading baskets was another area where the buyside wants more vendor support, with requests for pre-trade analysis of multi-day baskets, along with cross-index futures trades and ETFs, and a plea for “strategy recommendations”.

The discrepancy between pre-trade and post-trade analytics bothered several buyside firms that wanted to leverage their existing TCA systems. One respondent highlighted pre-trade estimates “not matching” post-trade estimates, “making it difficult to justify actions”, while another that used multiple third-party analytics providers complained about the “significant” variance in estimates which “reduces confidence”.

Post-trade

Here, the first question asked buyside trading desks what their biggest constraint was. The responses were fairly evenly balanced, with 41% of respondents answering ‘liquidity’, and 34% telling us that portfolio manager requirements were most important. Surprisingly, ‘cost’ was a fairly distant third at 25%.

Here, the first question asked buyside trading desks what their biggest constraint was. The responses were fairly evenly balanced, with 41% of respondents answering ‘liquidity’, and 34% telling us that portfolio manager requirements were most important. Surprisingly, ‘cost’ was a fairly distant third at 25%.

One explanation might come from the next question, where we asked buyside respondents whether trading was a profit centre at their firm. Just over half (52%) of traders answered with an outright ‘no’ – in other words, for these traders, portfolio managers owned all the P&L. We also allowed partial answers to this question, with 15% stating that block trades were a profit centre, and 11% included cash as an alpha generator. Just 7% of respondents were completely responsible for trading alpha.

One explanation might come from the next question, where we asked buyside respondents whether trading was a profit centre at their firm. Just over half (52%) of traders answered with an outright ‘no’ – in other words, for these traders, portfolio managers owned all the P&L. We also allowed partial answers to this question, with 15% stating that block trades were a profit centre, and 11% included cash as an alpha generator. Just 7% of respondents were completely responsible for trading alpha.

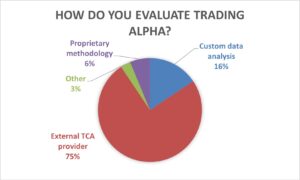

Whoever owns it, trading alpha does need to be evaluated, and the following post-trade question zeroed in on how respondents evaluated it. Three quarters of respondents told us that their TCA provider calculated alpha for them, with 16% using ‘custom data analysis’ and just a handful using proprietary methodology.

Whoever owns it, trading alpha does need to be evaluated, and the following post-trade question zeroed in on how respondents evaluated it. Three quarters of respondents told us that their TCA provider calculated alpha for them, with 16% using ‘custom data analysis’ and just a handful using proprietary methodology.

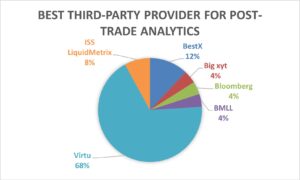

That leads naturally to the following question for the buyside – who is your favourite provider of post-trade analytics (which can be treated as synonymous with TCA)? This time, Virtu’s dominance was more pronounced than the pre-trade vote, with 68% of respondents choosing this provider. BestX was in second place at 12% and ISS LiquidMetrix in third place at 8%. Distant runners up included Bloomberg, big xyt and BMLL.

That leads naturally to the following question for the buyside – who is your favourite provider of post-trade analytics (which can be treated as synonymous with TCA)? This time, Virtu’s dominance was more pronounced than the pre-trade vote, with 68% of respondents choosing this provider. BestX was in second place at 12% and ISS LiquidMetrix in third place at 8%. Distant runners up included Bloomberg, big xyt and BMLL.

Lastly, we asked respondents to describe their post-trade ‘pain points’. Several pinned their hopes on the regulator-driven EU and UK consolidated tape for TCA purposes, while another complained about ‘regulatory overreach’ in this space. Mindful of this wider discussion, other respondents fretted about vested interests, with one plea that “FIX tags consistency should be driven by clients and TCA providers”, and a complaint about the role of HFT firms, which resulted in an “ELP tax from short-term behaviours”, according to one buyside trader.

A sizeable contingent of traders just wanted a better service from their TCA vendors, making specific requests: “% flow concentrations at set pricing times”, “Ease of flagging/excluding outliers where appropriate”, “More dynamic and cleaner venue analysis” and “Easier tagging of contingent trades”, were some of the responses received.

Or perhaps vendors should simply update their technology. “Would love to see AI integration from TCA providers in order to enhance the analysis”, was the comment of one buyside firm.