Schroders has developed its own version of ChatGPT.

Man Institute said many of the wider benefits of generative artificial intelligence can be applied to asset management as Schroders has developed its own version of ChatGPT.

Martin Luk, quant researcher at Man AHL, said the rate of progress of generative artificial intelligence has been rapid since ChatGPT was released in November 2022 . Generative AI is the use of deep-learning models, which have been trained on vast quantities of content, to create new content, including text, images, code, audio, simulations, and videos. His report, The State of Generative AI, said the latest models are becoming increasingly capable of producing realistic outputs.

Luk highlighted that many of the wider benefits of generative AI can be applied to asset management including assisting in software development and coding, and enabling more tailored and interactive sales and marketing campaigns.

“The abilities of large language models (LLMs) in the legal domain are also relevant here as they can help expedite the creation and review of legal contracts, and their capacity to summarise text information can be applied to internal databases to provide answers to questions (such as those in due diligence questionnaires and requests for proposals, or RFPs),” he added.

Schroders

Scott McKay, head of marketing and communications – Americas at Schroders, agreed that using AI to respond to RFPs was a natural fit as they have hundreds of questions.

Schroders has built an internal version of ChatGPT which uses generative AI on the UK asset manager’s own proprietary data, rather than using public information. McKay said the UK asset manager quickly saw the power of AI but wanted to make sure that protections were in place over its data and for its clients, which requires good governance and very tight parameters on how it can be used.

“It’s something that we have been looking at and thinking about for quite some time and I think we are quite innovative in our approach,” McKay added. “You do not survive for over 200 years by not changing and adapting to what is happening in the marketplace, so this is just another opportunity for us.”

One of the asset manager’s first uses for generative AI was for translation, because the Americas region has so many countries where English is not the first language including Chile, Argentina, Brazil and Mexico. Translating content is time consuming, can be expensive and also difficult because, even in Spanish, each country has its own nuances and differences.

“We used AI to help do the heavy lifting when it comes to translation and we are actually getting to the place where we can ask for Argentinian Spanish,” said McKay. “More importantly, we are teaching the model how to get it right.”

As a result, translations have become near perfect and only require minor tweaks. Speed to market has increased as translations that took two days now take just two minutes. Schroders also uses AI to summarise webinars or recorded events, which again speeds up the time to communicate with attendees. However, McKay stressed that there is always a human pair of eyes that looks at the output.

“Much like with an aeroplane, we know the computer flies the plane but I still want a pilot behind the wheel to make sure the computer is doing the right thing,” he added.

Schroders is also experimenting with using AI to create a value proposition. For example, highlighting a list of issues for a certain segment of investors from a disparate range of sources such as sales meetings, presentations and transcripts of conversations.

“One of the most difficult things any human faces is a blank sheet of paper,” McKay added. “AI gives you something to respond to and begin to work with.”

He continued that the model is not yet capable of helping to design products but the asset manager is thinking about how AI can analyse data to help identify future needs. His department has been using AI for several months and getting real comfort. The next stage could be to use the model to segment messaging based on demographics e.g so that content is positioned differently for a 32 year old versus a 52 year old.

“AI is 100% transformative and also of interest to our clients who have been asking us questions,” said McKay. “Any time there is a transformative piece of technology, a company like ours has to pay attention and understand the impact that it may have on our business and clients.”

Luk continued that early evidence also suggests that LLMs can conduct better sentiment analysis and summarise the contents of corporate disclosures to produce targeted summaries that are specific to a particular topic.

Other use-cases are identifying links between conceptual themes and company descriptions to create thematic baskets of stocks and using generative adversarial networks (GANs) to create synthetic financial time series data, generating economic hypotheses to build and evaluate systematic macro trading signals and potentially using ChatGPT as a financial adviser.

“GANs have also been used in portfolio construction and strategy hyperparameter tuning, as well as in creating synthetic order book data,” Luk said.

An increasingly powerful area of development is giving generative AI models the ability to use tools such as the Wolfram Alpha plug-in that allows ChatGPT to reliably perform complex mathematical calculations that it otherwise would not be able to do according to Luk.

“The next frontier could be an ecosystem where a powerful multimodal model with general tool-using capabilities can connect with an API platform of tools for it to use when performing tasks,” he added.

Economic benefits

Consultancy McKinsey has estimated that generative AI could deliver a total value of between $2.6 trillion and $4.4 trillion in economic benefits annually, equivalent to between 2.6% and 4.4% of global GDP in 2022, according to Luk. The majority of this increase in value came from customer operations, marketing and sales, software engineering, and R&D across all sectors, with banking, high tech, and life sciences among the industries with the biggest impact.

Henry Neville, portfolio manager at Man Solutions, highlighted a recent podcast in which Nicolai Tangen, chief executive of the Norwegian Sovereign Wealth Fund, interviewed Sam Altman, chief executive of OpenAI. Tangen said he had challenged his employees to use ChatGPT to deliver 10% productivity growth over the next 12 months and Altman replied that he thought it could be 20%.

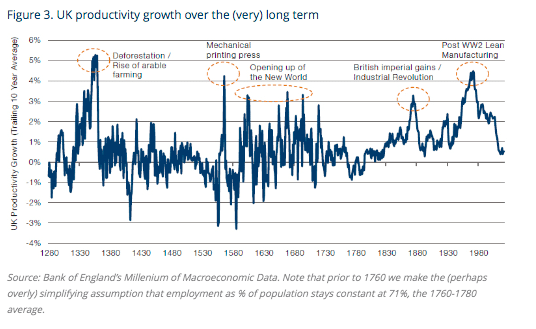

Neville said in a report, The Road Ahead: Is AI Overhyped ?, that an analysis of annual UK productivity growth over roughly 750 years shows that 3% productivity growth is a good rate over 10 years.

“5% is epic and has only been hit once before, in the period of deforestation and rise of arable farming that came through the 14th century,” Neville added. “5% compounded over 10 years would be a 63% productivity increase. See you on the other side.”

Bridgewater Associates said in a research note that it is thinking about the macroeconomic effects of AI, but also has an AI lab, where the hedge fund brings together investors and AI experts to explore use cases which may generate alpha.

In a report, Exploring How AI Will Impact the Economy, Bridgewater said that, so far, the economic impact of AI use looks analogous to other recent technological developments that have only had modest effects on aggregate growth and inflation.

“Most studies that take a view on the time frame of AI adoption forecast that the major productivity impacts will occur in the 2030s or 2040s, not the next few years. These estimates are largely informed by past productivity changes,” added Bridgewater. “Historically, general-purpose technologies that can be implemented widely across an economy—like electricity or computers—had a measurable impact on productivity around one to three decades after the technological capability emerged.”