Robert Kapito, president of BlackRock, said it is “raining fixed income.”

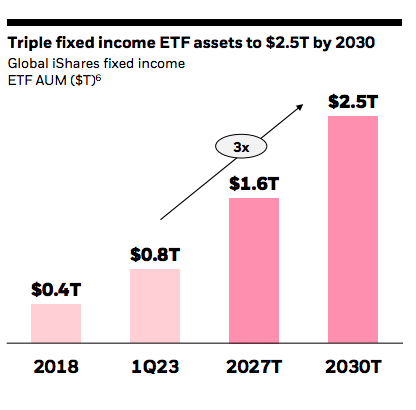

BlackRock is aiming for global fixed income assets under management in its exchange-traded funds to reach $2.5 trillion by 2030, three times more than its $0.8 trillion in fixed income ETFs in the first quarter of this year.

The fund manager held an Investor Day on 14 June in New York. Salim Ramji, global head of ETFs and index investments said at the event that, unsurprisingly, he was optimistic about growth prospects due to the firm’s platform of ETFs and indexing cutting horizontally across clients who want to access all markets more efficiently, transparently and conveniently.

“In the process we are expanding the boundaries of what our platform can do, with far greater customization, more active use cases and far more scale – often blurring the lines between active and index,” Ramji added.

The ETF and indexing platform manages $5.9 trillion on behalf of clients and generates about $6.8bn in revenues, with half of client assets in index vehicles according to Ramji.

The ETF business, iShares, manages half of those assets, $3.1 trillion, but contributes over 90% of organic revenue growth. In addition, 40 million people around the world use iShares which Ramji said is more than double the levels of five years ago and the business offers 1,300 ETFs, twice more than its nearest competitor. He argued that BlackRock has been disciplined about innovation, with twice as many of its recently launched products achieving $1bn in assets as its next competitor.

Ramji continued that iShares has generated over $1bn of net new base fees over the past three years with an 8% margin, which is in line with long-term goals.

“Over the past three years, our ETFs have grown assets by double digits and revenues at high single digits rates that we expect to continue well into the future,” added Ramji.

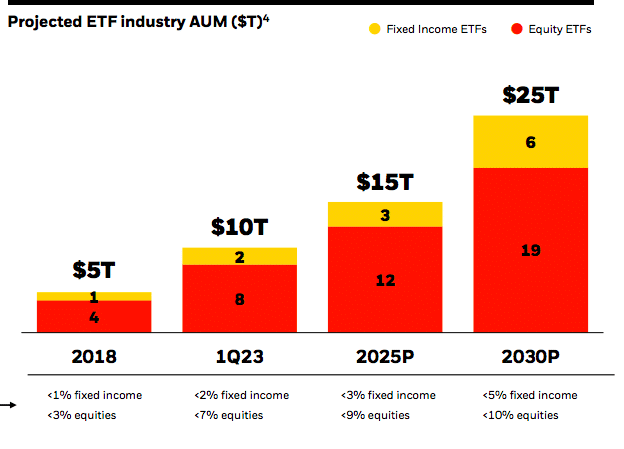

As a result, BlackRock believes that the ETF industry is going to reach $15 trillion in assets by 2025, and $25 trillion by 2030.

Although the 2025 goal looks aggressive, Ramji thinks it is very achievable because ETFs have gained share in every period of market volatility over the past 15 years, including last year when equity and bond markets declined. In 2022 investors deployed $900bn of new money into ETFs, including record inflows into Blackrock’s bond ETFs.

He also argued that the 2030 goal can be achieved because client needs are shifting to ETFs as the vehicle of choice on digital wealth platforms, in model portfolios, and as the bond market modernises to become more digital.

Fixed income ETFs

Fixed income ETFs are modernising access to the bond market itself as it modernises according to Ramji. As cash gets reinvested, BlackRock is optimistic that ETFs will be an even more important way to access markets and increased its target for bond ETFs to be a $6 trillion market by 2030.

“Fixed income ETFs is a business that we could triple to $2.5 trillion,” he added.

In May this year BlackRock launched two active ETFs, including one managed by Rick Rieder, chief investment officer of global fixed income. BlackRock started as an active bond manager in 1988. The BlackRock Flexible Income ETF is designed to complement core bond exposures and leverage the scale of BlackRock’s $2.7 trillion fixed income platform.

Rieder said in a statement at the time: “By staying active, agile, and well-diversified, the BlackRock Flexible Income ETF aims to capture historic opportunities across fixed income markets whenever and wherever they become available.”

Ramji continued that BlackRock more than doubled the choices offered through bond ETFs in the past five years to 500.

“Last year when rates rose even more significantly than they had in decades, we had record inflow, in part, because of a much broader selection of choices,” Ramji added.

Nine of the 10 largest asset managers and six of the 10 largest US insurers are using iShares bond ETFs in their portfolio management process. In addition, several of the largest insurance states including New York and Iowa have changed the regulatory treatment of ETFs so they have a level playing field with individual bonds.

“We see tens of billions of dollars of opportunity,” said Ramji. “ETFs are catalysing the bond market to move from analogue to digital.”

Rieder said at the Investor Day that BlackRock has $2.7 trillion in fixed income assets under management, with the majority, $1.6 trillion, in ETF and non-ETF index fixed income. He is confident that the fixed income will grow. Rieder believes secular changes are going to keep interest rates higher than they have been for the last 10 or 20 years including inflation remaining sticky or increasing; demographics leading to a lack of workers in developed markets and the clean energy transition.

“When the Federal Reserve stops bludgeoning the system, there is a tonne of money coming in because the yield you can capture at lower volatility is extraordinarily low,” Rieder added.

Robert Kapito, president of BlackRock, said at the investor day that he has never been more excited to talk about fixed income investing as 60% of all fixed income is now over 4% and the market has been waiting for this for a very long time.

Kapito continued there has been a change in fixed income market structure so the opportunity to use active, passive and ETFs is bigger than it has ever been.

“Every day we are learning new ways to use active alongside ETFs,” he added. “I think the market is going to explode and it’s raining fixed income, no matter what happens with the Fed. This is a generational change.”

Aladdin

Rob Goldstein, chief operating officer at BlackRock, said at the investor day: “The largest food group of our employees are experts in data and technology. Asset management is an information processing business.”

Therefore, although the firm has many different styles of investing it has one culture, one global markets and trading function, one operating platform, one client function, and importantly Aladdin, one underlying technology platform. BlackRock has over 4500 engineers, financial modellers and data professionals who are constantly updating Aladdin

“We believe this model creates significant scale, and those scale benefits are a core part of the value proposition to our shareholders, our clients and employees,” he added .

For example, a client started working with BlackRock in 2017 for an individual investment strategy in infrastructure debt and private credit and now their entire portfolio is risk managed on Aladdin.

“Fast forward to today, we manage $30bn dollars in fixed income and private markets assets,” Goldstein said. “The client is now using Aladdin Enterprise to manage the entire portfolio and we provide strategic asset allocation advisory to wrap all of these pieces together.”

Sudhir Nair, global head of Aladdin, said at the Investor Day that managing client portfolios is all about data.

“With the right technology and the right business process, an investment manager can literally transform data into alpha,” added Nair.

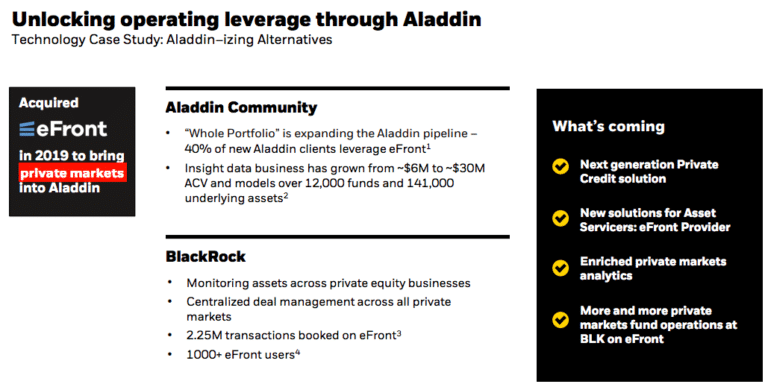

He continued that the Aladdin capabilities used internally at BlackRock are made available to clients in a modular, flexible way. Last year the Aladdin business generated $1.4bn of revenue with a 12% organic growth rate over the last three years. There are nearly 130,000 users located in 70 countries.

Aladdin is expected to continue to grow as end-investors are increasingly looking for customised investment portfolios delivered at scale and it blends fixed income and equity, active and passive, public and private.

“Investment managers need to think about the whole portfolio, bringing together those puzzle pieces of different strategies, mandates and asset classes,” Nair added. “They are facing pressure to operate more efficiently and this dynamic is creating an industry-wide ‘scale or die’ dynamic.”

On the Investor Day, BlackRock and Avaloq announced a strategic partnership aimed at enhancing their investment technology solutions for wealth managers and private banks. As part of the strategic partnership, BlackRock is making a minority investment in Avaloq.

Martin Greweldinger, co-chief executive of Avaloq, said in a statement: “This partnership will help us empower our clients to streamline processes, enhance risk analytics, and make more informed portfolio decisions, ultimately delivering greater value to their clients.”

Private markets

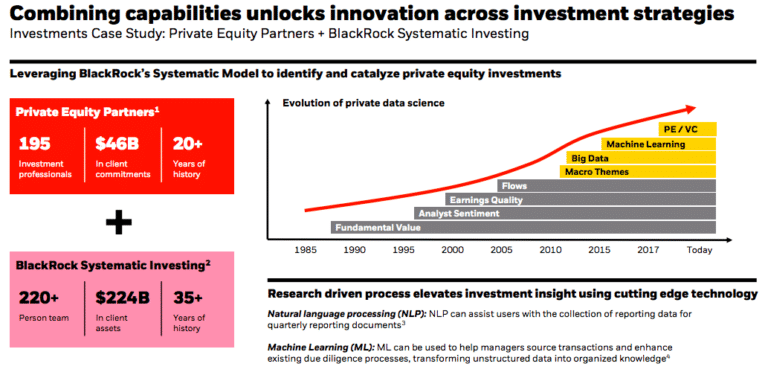

Goldstein also said BlackRock is bringing together the capabilities of the private equity team and systematic investing.

Goldstein argued there is increasing private markets data available which can be used to quickly screen companies. The systematic investing team can therefore quantitatively model the universe of private companies to identify those that are expected to outperform over time.

“From a COO lens this is my dream,” he said. “It is Alpha creating, it is tech- enabled and it generates operating leverage.”

He continued that the firm uses the term ‘Aladdinizing’ to describe bringing all parts of a business onto the platform. Alternatives are a new addition to the technology that was initially designed to support investments in the public markets. In 2019 BlackRock acquired eFront to bring private markets into Aladdin and 40% of new Aladdin clients are now using eFront.

“We now have a data platform in business that covers 12,000 funds, and more than 140,000 underlying assets, which is a significant portion of the private markets funds universe,” said Goldstein.

Edwin Conway, global head of equity private markets, said at the Investor Day that BlackRock has $33bn of dry power, which is likely to result in $260m of future annual base fess when it is deployed. BlackRock is targetting doubling private markets revenue in five years.

Outsourcing

Stephen Cohen, head of EMEA at BlackRock, spoke at the Investor Day about the growth in the outsourcing business as asset owners, and investment and wealth managers, are increasingly looking to focus on core competencies and outsource more of the investment process.

“Outsourcing is one of the biggest trends we are seeing in asset management, and growing two times faster than the industry,” he said. “It is global and impacting every client segment that we serve.”

All clients are facing significant regulatory change which raises costs and requires new investment in propositions and technologies. For example, there are ‘once in a generation’ pension reforms in Latin America and parts of Europe and in Asia insurers are facing the transition to risk-based capital frameworks.

The competitive landscape is also shifting dramatically, particularly for wealth managers and insurance companies, as new entrants are coming into the markets using new technologies to engage and service end-clients. As a result, there is increased consolidation and M&A.

In addition, the investment environment is undergoing a regime shift from a period of steady growth and low inflation to one of heightened macroeconomic volatility. So fund managers are now looking for new ways to manage risk, bridge funding gaps and invest across a broader range of liquid and illiquid assets.

Cohen compared outsourcing to institutions moving to the cloud.

“In the same way that organisations are transitioning from on-premise data and hardware to cloud providers, many clients are now transitioning from in-house investment and technology models to the BlackRock platform,” said Cohen.

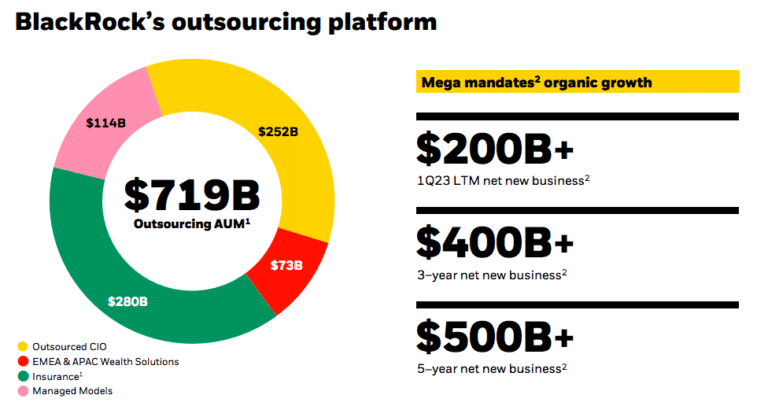

Cohen continued that BlackRock has outsourcing mandates with a total $719bn in assets under management, including gains of $200bn in the last 12 months alone, from clients including wealth managers. pension funds, charities, endowments, family offices and insurance companies.

He argued that BlackRock benefits from the future asset growth of outsourcing clients. For example, a UK wealth manager has a mandate that has grown 10-fold since signing their original contract in early 2020.

“Aladdin uniquely differentiates us in the market,” Cohen added. “We bring a scaled global footprint that combines investment management and technology.”