Jatin Vara, co-head of global trading at BlackRock, spoke at FIA IDX in London.

Jatin Vara, co-head of global trading at BlackRock, said the asset manager loves data and uses as much data as possible to make its execution and trading processes more sophisticated.

Vara spoke at the FIA IDX conference in London on 20 June in London about leading a team of 220 people in 11 offices around the world. BlackRock trades in excess of $15 trillion each year, and executes approximately 60,000 trades on a daily basis for a diverse set of clients across index, active, systematic and fundamental strategies.

“The most important is that the client tells us how their exposure should be put into place,” he said. “We will implement that strategy in the best possible way at scale.”

The increase in scale is the biggest change since Vara started his career over 20 years ago.

BlackRock has one single order management, Aladdin, which allows the trading team to manage exposures seamlessly globally across all asset classes. Vara highlighted its importance in providing the ability to port orders around the system irrespective of whether the transition is a bond, a swap or an option.

“We call it global order routing as we can pull orders from from Singapore to San Francisco to Atlanta,” he added. “If we see liquidity in a certain asset in a certain area, we should be able to pivot to put an order there.”

The trading team is organised on a hub and spoke basis with centres of excellence in New York, San Francisco, London and Hong Kong. Personnel include an e-trading technical team who look after Aladdin, the fast growing market structure team and a data and analytics team.

One of the important market structure trends is the change in technology and data organisation according to Vara, especially in bond markets over the last two or three years.

“We love data and using as much data as possible,” Vara added. “Broad advances in technology and data processing are allowing more sophistication in our execution and trading processes as we adapt to the data.”

The traders use data to manage execution, manage risk and monitor execution quality and provide feedback to counterparties or liquidity providers. There is a rules-based decision making process for the execution process, which allows traders to focus on the transactions that need more high-touch attention.

“We deliver thick books with details of every product, every channel that we use, every execution pipe that we have,” Vara said. “We have a relentless process, but hopefully it is hugely rewarding for the other side because they really want to improve.”

🧵THREAD:

(1/2) We have officially kicked off #FIAIDX 2023 in London! @WaltFIA pic.twitter.com/dEB9p8xJAk— FIAconnect (@FIAconnect) June 20, 2023

As a result, when recruiting Vara the firm thinks about employing coders who want to trade and teaching traders how to code. He believes that risk management improves when coders and traders are mingled together.

Another trend that Vara highlighted is the redistribution of risk as the firms come under pressure to use capital as efficiently as possible.

Vara said: “Alternative liquidity providers are becoming much more prevalent in the marketplace. We are very much paying attention in terms of how this looks across the products and regions where we trade.”

Other trends are changes in regulatory regimes around the globe and the changes in the macro environment with more spikes in volatility and higher interest rates.

“The great moderation is coming to an end,” he added. “The world is also less global than it used to be so we have to think about that that means from a geopolitical, supply side and technology perspective.”

Fixed income execution management systems

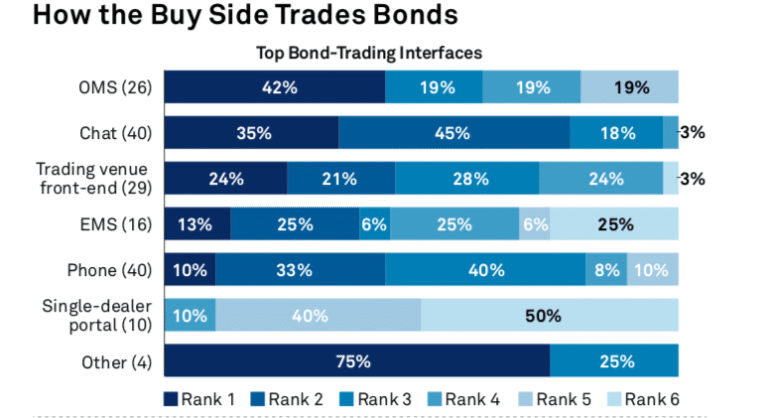

Increasing amounts of fixed-income day and changing market dynamics are making traders rethink their execution strategies and technology according to a report from consultancy Greenwich Associates, Fixed Income EMSs: The Time is Now.

Audrey Blater, senior analyst on the market structure & technology team at Greenwich Associates, said in the report: ”The tipping point for fixed-income execution management system (EMS) adoption is upon us.”

Audrey Blater, Coalition Greenwich

Audrey Blater, Coalition Greenwich

Coalition Greenwich surveyed 41 senior fixed income trading professionals in US asset management firms, hedge funds and insurance companies with combined assets under management of more than $22 trillion between March and May this year. Only a minority, 39%, of respondents currently use an EMS but Blater said the evolution of electronic trading in the U.S. corporate bond market and the increasingly competitive investing landscape suggests that things are starting to change.

“The burgeoning EMS movement is becoming galvanized by the growing need to enhance trader capabilities as market structure evolves,” she added. “The number of data-producing channels has expanded over the past five years and now includes a multitude of execution protocols, dealer prices, evaluated prices, liquidity scores, a plethora of communication pipes, and enhanced post-trade regulatory reporting.”