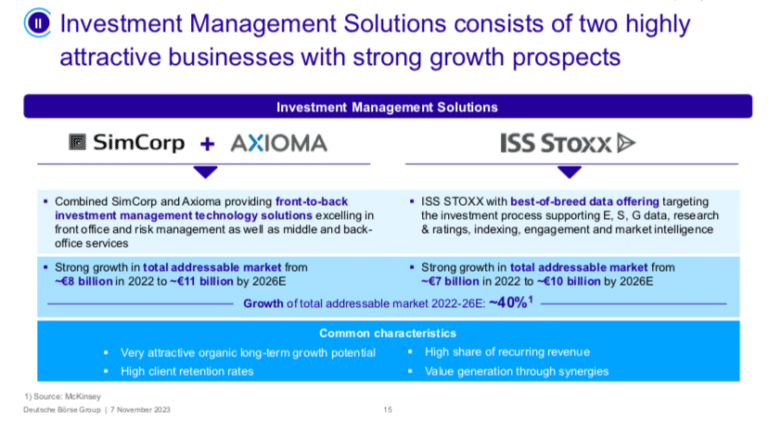

The new Investment Management Solutions segment bundles together offerings for the buy side.

Theodor Weimer, chief executive of Deutsche Börse Group, said the firm will be able to offer a European alternative to BlackRock’s technology platform Aladdin, following the launch of the new Investment Management Solutions segment which bundles together offerings for fund managers and asset owners.

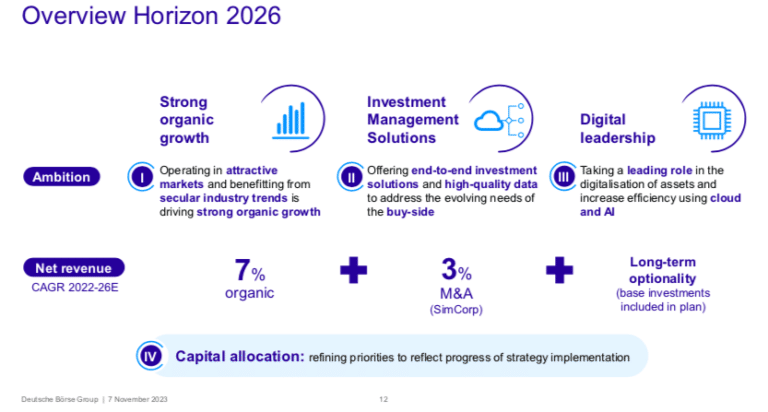

Weimer presented the German exchange operator’s new strategy, Horizon 2026, at its investor day on 7 November. He said Horizon 2026 has three strategic imperatives – the continued delivery of strong organic growth; the success of the new Investment Management Solutions (IMS) segment and expansion of its margins; and taking a leading role in setting up new digital asset ecosystems.

“Our strategic path is very clear and now it is all about execution,” added Weimer. “Since 2017 we have evolved our business model significantly into areas of higher growth and recurring revenues, and reduced our decency on transaction-related businesses which are much more volatile.”

Theodor Weimer, Deutsche Börse

Theodor Weimer, Deutsche Börse

Investment Management Solutions is forecast to contribute 25% of overall net revenues by 2026, compared to 5% in 2017, which was solely from the index business.

One of the most important industry trends which the new segment addresses, according to Weimer, is the increasing importance of the buy side and the need for asset managers to become more efficient, increase automation and use high quality data and analytics to support investment decisions.

The new segment has been formed after Deutsche Börse completed its acquisition of SimCorp, which was announced in April. Deutsche Börse now owns 100% of the Danish front-to-back investment management platform following a successful squeeze out of shareholders. SimCorp provides investment management software-as-a-service (SaaS) and business-process-as-a-service (BPaaS) solutions at scale and its flagship product is a scalable modular platform which supports all asset classes and supports more than $30 trillion of assets under management.

The integration of SimCorp with Axioma, Deutsche Börse’s buy-side orientated portfolio and risk management tools provider, is due to be completed in the first quarter of next year.

In addition, Investment Management Solutions will include the combination of existing subsidiaries, Institutional Shareholder Services (ISS) which provides environmental, social and governance data, and STOXX, the index segment.

On 7 October ISS said it had completed its transaction to add Qontigo’s index business under the newly created “ISS STOXX” group of companies, which is majority owned by Deutsche Börse Group. The ISS STOXX umbrella includes the STOXX index businesses, which includes STOXX and DAX indices, as well as ISS’s four existing business lines: governance, ESG, corporate solutions, and market intelligence. The combination of ISS’s ESG business with STOXX’s index business aims to use high-quality data to develop new indices for institutional investors.

Wiemer said Investment Management Solutions now has access to more than 3,000 asset managers. He continued that the addition of SimCorp gives Deutsche Börse all the necessary ingredients to provide a leading end-to-end buy-side oriented proposition from front office portfolio management and risk management to superior investment book of record, accounting and reporting solutions

“We can offer a true European Aladdin alternative,” Wiemer added. “Through the combination of ISS and STOXX we have also created a more credible MSCI challenger.”

Aladdin is BlackRock’s end-to-end investment management and operations platform used by institutional investors.

Stephan Leithner, Deutsche Börse

Stephan Leithner, Deutsche Börse

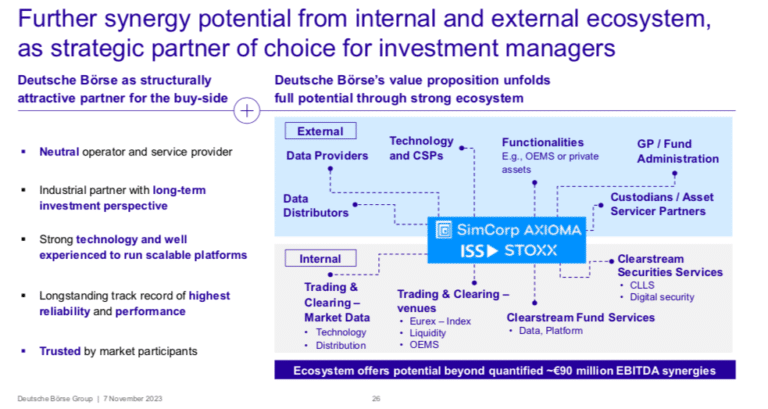

Stephan Leithner, member of the executive board of Deutsche Börse, responsible for pre- and post-trading, also spoke about Investment Management Solutions on the investor day.

Leithner highlighted the additional synergies between Investment Management Solutions and other parts of Deutsche Börse Group, such as Clearstream and collateral management and securities lending, as many buy-side firms already use Simcorp.

“Investment Management Solutions is very much powered by its external partnerships,” Leithner said. “The most impressive thing for me was the momentum and support we had from the day of the Simcorp announcement from the global custodian community, which Simcorp has worked with for many years.”