The exchange has offered to buy SimCorp and is also combining Qontigo and ISS.

Deutsche Börse has made an offer to buy SimCorp, a Danish front-to-back investment management platform, and also combine its data & analytics subsidiaries Qontigo and ISS into a new unit which will potentially be taken public in the medium term.

On 27 April Deutsche Börse said it will make an all-cash offer to buy SimCorp in its largest ever acquisition. SimCorp provides investment management software-as-a-service (SaaS) and business-process-as-a-service (BPaaS) solutions at scale.

Theodor Weimer, Deutsche Börse

Theodor Weimer, Deutsche Börse

Theodor Weimer, chief executive of Deutsche Börse, said on a call about the acquisition that the announcement marks an important milestone on a strategic journey that the group embarked on a couple of years ago to move closer to the buy side. As a result the group purchased Axioma, which added buy-side orientated portfolio and risk management tools based on a strong trend toward sustainable investing, and ISS, an ESG data provider.

Weimer said: “Today we take a quantum leap forward to further accelerate the development at the forefront of the dynamic capital markets infrastructure industry that will contribute significantly to further secular growth of Deutsche Börse.”

The acquisition is intended to deliver rapid expansion into highly attractive total addressable markets, further diversify Deutsche Börse’s business mix and increase share of recurring revenue.

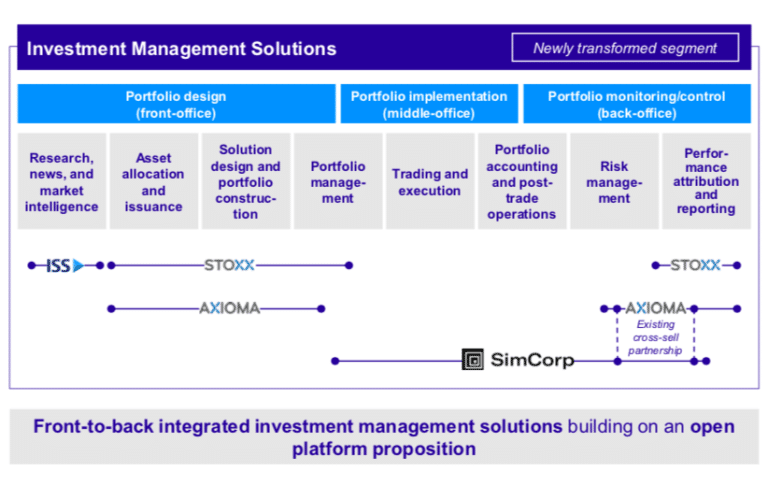

Weimer continued that the investment management industry is undergoing fundamental changes, driven by the shift from active to passive, a focus on systematic investing to deliver alpha and a trend to more digitisation. In addition, the industry is seeing rising demand from asset managers for customisable front to back platform solutions, which helps them to replace legacy systems and transform operating models.

He added: “Simcorp perfectly complements our existing capabilities by bridging the gap between the front and the back office.”

Simcorp’s flagship product is a scalable modular platform with more than $30 trillion of assets under management which supports all asset classes, and enjoys strong global recognition for its investment accounting services according to Weimer.

He said: “Simcorp has demonstrated an exceptional track record of growth with double-digit revenue growth over the last five years. They are currently in the process of transitioning towards a subscription-based business model.”

Investment Management Solutions

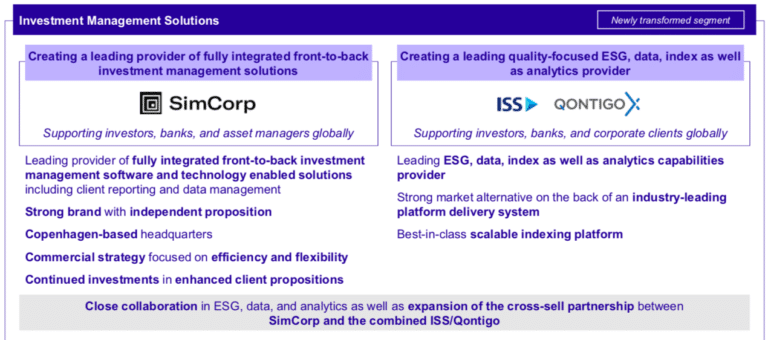

In parallel to the purchase SimCorp, Deutsche Börse also intends to combine Qontigo and ISS under the leadership of Gary Retelny, chief executive of ISS.

The combination of Qontigo/ISS and SimCorp will be grouped within a new Investment Management Solutions subsidiary.

Weimer said: “We plan to build out an ESG data index and analytics proposition in the broader context of strengthening our investment management solution segment.”

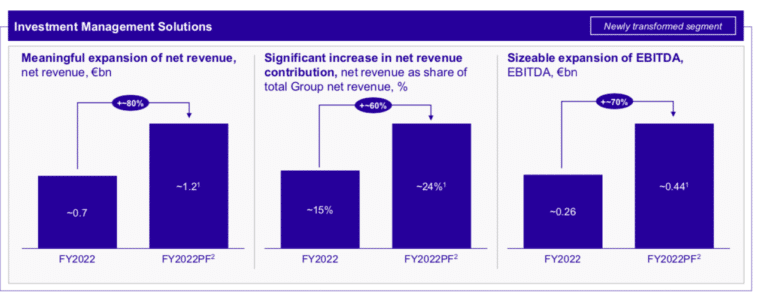

Investment Management Solutions is expected to have a more important relative size within the group, contributing roughly one quarter of total net revenues with a strong growth trajectory.

General Atlantic will become the sole minority shareholder with a stake of around 20% in the combined Qontigo/ISS.

“Both Deutsche Börse and General Atlantic strongly believe in the potential of the combination and its long term-success,” added Weimer. “To underpin this conviction General Atlantic will invest fresh funds in the combined business.”

Deutsche Börse has an agreement with General Atlantic for an eventual IPO of the combined business, which is not expected before 2025.

When analysts challenged the new structure as introducing complexity into the business, Wiener responded that the group always intended to integrate ISS and Qontigo due to their synergies.

“It makes sense to have an integrated offer on the analytics side, on the index side and on the ESG side, given the ESG bonanza in the last two years,” Weimer added .

Financing

The offer for Simcorp is priced DKK 735 per share valuing the firm at €3.9bn ($4.3bn). The SimCorp board has unanimously decided to recommend that shareholders accept the offer, which is a 38.9% premium to the previous closing price.

Investment Management Solutions is intended to accelerate Deutsche Börse’s growth trajectory and is expected to deliver total annual run rate EBITDA synergies of approximately €90m.

Deutsche Börse has appointed Morgan Stanley and Deutsche Bank as financial advisors. Plesner Advokatpartnerselskab, Hengeler Mueller Partnerschaft von Rechtsanwälten, Linklaters (financing), and Cravath, Swaine & Moore LLP (U.S. counsel) are legal advisors in connection with the transactions.

The acquisition will be fully financed with cash and debt. Deutsche Börse has entered into a fully underwritten bridge facility with Morgan Stanley, which is expected to be refinanced by a mix of existing cash and debt capital market instruments.

The offer is due to be launched in May and complete in the third quarter of this year, subject to regulatory and shareholder approvals.

The envisaged funding of the proposed transactions is expected to result in an AA- rating at Group-level and maintaining AA at Clearstream-level.