Lit volumes set record lows in April, May, and June.

Equity trading volumes on exchanges in the European Union set record lows in the second quarter, falling to 41% of overall activity in June compared to a higher average of between 50% and 60% from 2018 to 2021.

The following extracts are from Liquidnet’s latest Liquidity Landscape: MiFID II – The beginning of the end?. The report has been compiled by Gareth Exton, Head of Liquidnet’s Execution + Quantitative Services EMEA, in partnership with Rebecca Healey, Redlap Consulting:

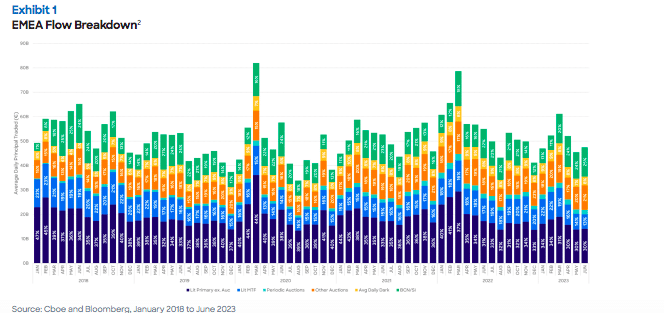

Across global markets, recent rises in interest rates mean fixed income, and even cash deposit accounts, can be competitive with equities for investor’s asset allocations. Despite the technology fuelled rallies, the prospect of higher inflation and an economic downturn has resulted in liquidity in continuous markets remaining light, continuing to challenge participants’ ability to execute in volatile markets. With the Swedish Presidency concluding with the EU Council and Parliament agreement on the MiFID II,1 the regulator’s ability to address depressed secondary market activity continues to challenge. Lit volumes set record lows in April, May, and June, falling to 41% of overall activity in June, down from an average 50 – 60% throughout 2018 – 2021.

What this means for European Markets

Overall, European equity markets averaged €48.1B in daily value transacted in the first quarter, down 10% over the Q1 2023 average of €53.4B.

More importantly, lit primary activity (excluding the close) settled at the 30% mark for the first time in both May and June 2023, reinforcing the need to source liquidity outside of intraday continuous trading.

Despite historic regulatory concerns over the potential growth in the dark market, volumes over the past three years have remained between 9 – 11% of overall market activity. Dark activity in the second quarter remained in the upper half of the historic range, peaking at 11% in April before settling lower near 10% in May and June. However, the ability to execute in thin liquidity means certainty of execution, rather than price improvement in the dark, will ensure the percentage of dark volumes will remain static.

New Policy Objectives

Widely anticipated, the UK Treasury have now announced plans to rebundle research payments. In an attempt to shore up UK Capital Markets, rebundling research is seen as one step in proposals to “increase returns for pensioners, improve outcomes for investors and unlock capital for (our) growth businesses” according to the UK Chancellor, Jeremy Hunt. The plans also include investing 5% of DC funds to unlisted equities by 2030 could unlock up to £50B of investment to provide access to capital for the high growth companies necessary for the transition to a future greener economy.

While many have dismissed rebundling research payments as not feasible—whether that’s due to clients not being willing to pay for research in a competitive environment, or underlying changes in research consumption post-unbundling, Covid, and the surge in ESG investing—the UK proposals echo challenges also being raised in Europe. Spain has now taken over the Presidency of the European Council where advancing the green transition through supporting local industry is a key objective of the new presidency, meaning greater focus on Capital Markets Union.

Given the policy maker’s objective of SME growth to pivot both the EU and the UK economies to greater sustainability, we can anticipate far more regulatory oversight in the months ahead. With further regulatory announcements on the Consolidated Tape both in Europe and the UK, as well as policy guidance on the Trading Venue Perimeter and the definition of a “multilateral system” coming into force on 9 October 2023—MiFID II may finally be over but regulatory overload is definitely not.

The full report can be read here.