More of the industry is coming together to test beyond their own individual four walls.

SBI Digital Markets and WisdomTree have both been involved in Project Guardian, an initiative from the Monetary Authority of Singapore to explore tokenizaton, and stressed the importance of partnering with other firms.

In 2022 SBI Digital Asset Holdings, the digital asset arm of the Japanese financial services firm SBI Group, announced its participation in Project Guardian to explore the institutional trading of tokenized bonds and deposits to improve efficiency and liquidity in wholesale funding markets.

In November 2023, UBS, SBI and DBS launched the world’s first live repo with a natively-issued digital bond on a public blockchain as part of the project. The transaction automatically and instantly settled a repo, digital bond purchase and redemption using regulated digital payment tokens across regulated entities in Japan, Singapore and Switzerland. The transaction demonstrated benefits including real-time 24/7 settlement, and operational and capital efficiency while ensuring compliance and security requirements.

Winston Quek, chief executive of SBI Digital Markets and SBI Digital Asset Holdings’ head of capital markets centre of excellence, told Markets Media that Project Guardian has demonstrated that tokenization has a direct benefit in fixed income.

Winston Quek, SBI Digital Markets

Winston Quek, SBI Digital Markets

Quek said: “We need to start commercialising tokenization in 2024 and we have a pipeline of potential deals.”

SBI Digital Markets is also running projects to tokenize other asset classes including real estate, private equity and structured products.

“We are hopeful of seeing tokenized issuance across asset classes by the end of next year,” Quek added. “Our first mantra is don’t tokenize for the sake of tokenizing as it has to fulfil a purpose, and we also look at investors and delivery.”

For example, private equity is illiquid and tokenization can reduce operational friction. The business is also very careful about democratizing access to assets as Quek said private equity should not always be focused on the man on the street.

“Tokenized assets should go to family offices, or platforms that are accredited and qualified to hold these assets, rather than for mass distribution,” he added. “We are purely B2B and very careful about the partners that we work with.”

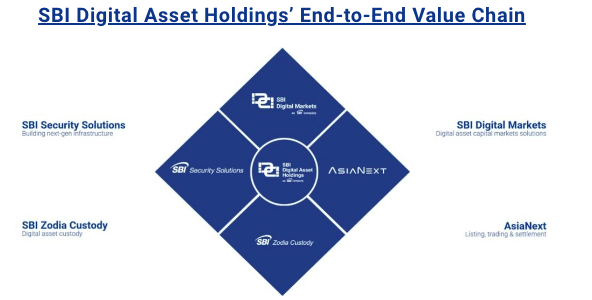

SBI Digital Markets is a subsidiary of SBI Digital Asset Holdings, backed by SBI Holdings, which has created end-to-end digital asset ecosystems for institutions under five pillars of businesses – fintech; digital markets; crypto exchanges; crypto custody and strategic investment.

“We are one of the few financial institutions trying to build digital assets into a mainstream product that is able to actualize that into a commercial roadmap,” said Quek. “We realise that we will never be able to do this by ourselves and we are going to need motivated partners who can also bring buy-side interest, their technology and knowledge of the local jurisdictions.”

He expects tokenization to be a multi-year journey and expects 2025 to be the inflection point once a regulatory framework is in place across jurisdictions.

“Tokenization started in 2017 and has taken a while but acceleration has stepped up in the last 10 months,” Quek added.

Operational efficiencies

Project Guardian has created efficiencies in native digital products by reducing layers in the trade lifecycle according to Quek.

“We have seen efficiencies translate into real cost savings in bond issues and fund management,” he added. “We are also seeing the removal of layers of intermediaries, such as registries going on-chain.”

Financial institutions said axing the number of traditional financial intermediaries was the primary benefit of tokenizing real-world assets, according to a survey in November from SBI Digital Assets Holdings, especially as the high rate and low return landscape forces financial institutions to seek ways to cut costs.

Fernando Luis Vázquez Cao, SBI DAH

Fernando Luis Vázquez Cao, SBI DAH

Fernando Luis Vázquez Cao, chief executive of SBI Digital Assets Holdings, said in the report: “While reducing traditional intermediaries is the top priority in these cost-conscious times, faster settlement, enhanced transparency, reduced costs, better liquidity and the potential for safer digital asset transactions can only become a reality with a trusted ecosystem. As the digital asset ecosystem continues to mature, institutional-grade infrastructure coupled with regulatory certainty will be pivotal to shaping the future of financial markets.”

The lack of institutional-grade market infrastructure, lack of wider market adoption and regulatory clarity were cited as key barriers restricting institutions from investing in digital assets.

Quek explained that adoption of tokenization has not really picked up on the buy side because it is easier to buy a bond, a fund or a private equity deal in traditional formats. Buy-side clients do not want to have to hold lots of wallets or to use different token protocols that are not fungible.

He described SBI Digital Markets as creating a hub and spoke model where the business is a hub for connections to private platforms to help them channel and distribute into other platforms.

“We see ourselves as a blockchain agnostic platform that can connect one exchange to another and act as a bridge,” he added. “We can look after security token offerings across their full lifecycle, including corporate actions, and add value.”

WisdomTree

In another use case in Project Guardian, US ETF issuer WisdomTree, alongside JPMorgan and Apollo, announced a new proof of concept on the institutional use cases of tokenization and smart contracts for model portfolio rebalancing.

Maredith Sapp, director of business development, digital assets at WisdomTree, told Markets Media: “Tokenization of funds is a really critical part of blockchain-enabled finance and the focus of what we are building out is to deliver funds in a tokenized wrapper.”

The proof of concept demonstrated the feasibility of using smart contracts to rebalance model portfolios that included WisdomTree tokenized digital funds and Apollo’s tokenized alternative investments, with JP Morgan acting as the portfolio manager and the bank’s Onyx Digital Assets serving as the base chain. It also demonstrated the ability to use permissioned public blockchain infrastructure to mint and transfer assets to other private or public blockchains.

WisdomTree offers tokenized funds through its blockchain-native direct to retail platform digital wallet, WisdomTree Prime, which was launched in the US in July.

“We see the tokenization of funds as the next evolution,” Sapp added.

WisdomTree was a pioneer in ETFs and Jonathan Steinberg, the asset manager’s chief executive, asked the digital asset team about four years if it could do to ETFs, what ETFs had done to mutual funds.

“If you think about ETFs, you think about transparency, liquidity and standardization that anyone with a brokerage account can access,” said Sapp.

She continued that WisdomTree sees the same three themes as benefits of blockchain technology, as well as the transparency in terms of transaction history, ownership records, asset performance or even portfolio holdings. End clients can access tokenized funds and model portfolios and customize to a specific risk tolerance and profile, and rebalance on a quarterly or monthly basis.

There is a lot of friction today in the process for rebalancing model portfolios and Sapp said the proof of concept showed how that could be eliminated. In addition, the proof of concept demonstrated interoperability because it used JP Morgan’s Onyx as the base chain to connect to other chains.

“We believe interoperability is key for liquidity, access and to be able to move assets within a broader ecosystem,” she added. “What has really shifted is more of the industry coming together to do these types of proofs of concepts and test beyond their own individual four walls.”