Laurent Ischi, Director, AiEX and Workflow Solutions (APAC), Tradeweb

When it comes to the increased adoption of electronic trading in interest rate swaps and other derivatives products, 2023 was a truly transformative year for Tradeweb clients across the Asia Pacific region.

More traders than ever before are moving away from voice trading and manual processes and embracing electronic execution. We’ve seen this in the steady increase in clients using our automation tool – Automated Intelligent Execution (AiEX).

What’s behind this massive change in trading habits? As recently as three years ago, use of electronic execution in this product suite was fairly limited and voice trading still dominated in APAC. But once the Covid pandemic up-ended markets, we saw a sea change in habits and a rapid recognition that electronic trading can unlock huge efficiencies, allowing traders to focus on strategy, while at the same time spurring liquidity. Libor reforms also provided a helpful tailwind as we saw activity moving from the old to the new Risk-Free Rates (RFR) indexes across various currencies globally.

Since implementing AiEX into their trading strategies, clients have consistently reported enhanced workflows and a more seamless transaction experience, especially when executing systematic trading strategies. Clients are now trading swaps with multiple line items within seconds and drastically reducing the risk of errors associated with manual input. That’s because AiEX offers total control over every order, as clients are able to fine-tune pre-defined execution rules for a solution that is fully tailored to each trading strategy. What’s more, there is almost zero technology build involved, leveraging the existing FIX set-up for simple and rapid implementation, with no additional set up costs.

The key for Tradeweb has been to ensure that AiEX is intuitive to use, because increased speed and efficiency help traders focus on different strategies, while giving access to a wider and deeper liquidity pool. We have worked very hard in the last few years to boost functionality on the platform to expand upon what’s traded on voice. This includes list trading, two-way pricing, and trading across multiple products and currencies simultaneously.

It’s been remarkable to witness how traders’ perceptions of electronic workflows have changed in short order, since APAC didn’t have the electronic trading mandates that are familiar to market participants in Europe and the U.S., and where the habit of voice dealing has been well entrenched.

New types of participants

Another interesting trend we have seen is how new types of clients are embracing the electronic trading ecosystem, as well as the related emergence of trading strategies across the APAC region that were previously uncommon or non-existent. Four years ago, it was mostly global clients trading on the platform with only a handful of local clients using the electronic solution. Now we have a very different mix of clients, mostly APAC-based, who are actively trading across all regions, electronically.

In addition, while we initially focused our efforts with AiEX on our historical customer base such as asset managers, we quickly saw other client types in APAC emerge as users, particularly sovereign wealth funds and hedge funds.

While many associate automation with the idea of automating a significant amount of smaller tickets, it’s almost the opposite for sovereign wealth funds who tend to deploy a few, relatively large tickets. Hedge funds – driven by systematic strategies in swaps in particular – have started to use AiEX. The tool has allowed them to port execution approaches they use in other markets such as equities, futures or FX, where central limit order books are common to a product range that is request-for-quote (RFQ) based. In this way, as more institutions deploy automation to realise new strategies, AiEX brings new business to market, rather than just automating current workflows.

We have also seen the adoption of “time release”, a function of AiEX that allows traders to choose to put an order in the market when it’s most beneficial or convenient for them, without having to wait around to process the order, for example trading the open or the close. Previously, traders would have picked up the phone to a dealer; now they use automation where possible, to access markets in a more efficient way that suits their way of trading.

Australia and Hong Kong in focus

The automation adoption and usage can vary across clients. Some will do continuous trading throughout the day, some will be focused on a particular point in time. But what they all have in common is that the decision making for their trading is model-based in the background — and we have seen a lot of demand for this out of APAC, for both systematic trading models used by hedge funds, and the index rebalancing models used by asset managers. In terms of product, we have seen very strong adoption of AiEX in Japanese, Chinese and Australian government bonds.

Tradeweb significantly enhanced its ability to seamlessly connect markets in Australia and New Zealand with our global network of clients and dealers through the acquisition in August 2023 of Yieldbroker, a leading Australian trading platform for Australian and New Zealand government bonds and interest rate derivatives covering the institutional and wholesale client sectors. Tradeweb customers worldwide now benefit from improved access to Australia and New Zealand’s growing bond and derivatives marketplaces, allowing them to express nuanced views that include Australia and New Zealand as important parts of their global strategies through the single Tradeweb interface.

Regarding Chinese government bonds, we have seen very strong adoption of AiEX in this product suite out of Hong Kong in the last twelve months, as activity has picked up there after a year in which Singapore had dominated. We see significant pent-up demand in Hong Kong, in fact.

More broadly, we now see that clients in APAC have not just embraced automation but in some instances are going a step further, leading automation in other products. It’s been exciting watching how AiEX has opened a new chapter for trading in APAC, and we believe there are many more clients to benefit from automated workflows.  www.tradeweb.com

www.tradeweb.com

*Industry Viewpoints comprise sponsored content and do not necessarily reflect the views of the editor.

©Markets Media Europe 2024 TOP OF PAGE

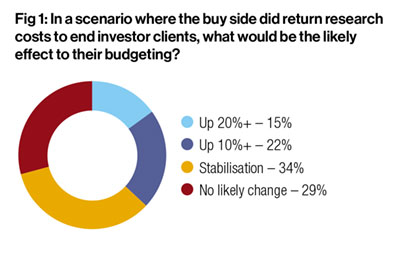

With this in mind it is perhaps unsurprising that a Q4 2023 cross-industry survey by Global Trading, in partnership with Substantive Research, found that 68% of respondents did not expect the UK and EU-based buy side to return research costs to clients once the FCA and the EU implement their research recommendations.

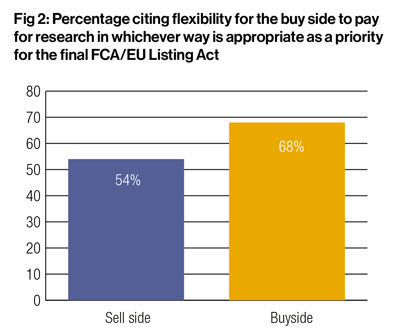

With this in mind it is perhaps unsurprising that a Q4 2023 cross-industry survey by Global Trading, in partnership with Substantive Research, found that 68% of respondents did not expect the UK and EU-based buy side to return research costs to clients once the FCA and the EU implement their research recommendations. More than half (52%) of participants stated that flexibility for the buy side to pay for research in whichever way is appropriate was what they were most hoping to see in the final FCA and EU Listing Act rules. This was by far the most popular choice for the buy side, with 68% selecting this option.

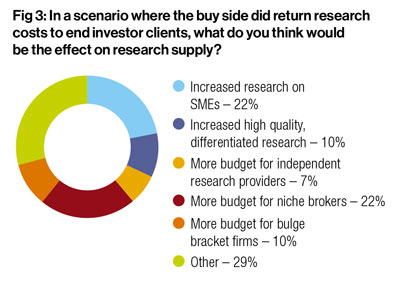

More than half (52%) of participants stated that flexibility for the buy side to pay for research in whichever way is appropriate was what they were most hoping to see in the final FCA and EU Listing Act rules. This was by far the most popular choice for the buy side, with 68% selecting this option. The impact of this on research supply was also considered, and produced far less consistent results. Of those surveyed, 22% expected to see research on SMEs increase. A further 22% said niche brokers would benefit from greater budget availability, an opinion held by 45% of the sell side. The most popular buy-side prediction was that more budget would be available to bulge bracket firms (16%), with none from the group expecting to see independent research providers granted more budget.

The impact of this on research supply was also considered, and produced far less consistent results. Of those surveyed, 22% expected to see research on SMEs increase. A further 22% said niche brokers would benefit from greater budget availability, an opinion held by 45% of the sell side. The most popular buy-side prediction was that more budget would be available to bulge bracket firms (16%), with none from the group expecting to see independent research providers granted more budget.