John Dantona, editor of Traders magazine and Dan Barnes, editorial director of Markets Media Europe, discuss the latest news in the cryptocurrency trading space, including the bitcoin ‘halving’ process and its impact on investors.

CityUK calls for clearer fintech regulation

In a new report – Enhancing the UK’s approach to innovation in Financial Services – lobby group TheCityUK calls on the Financial Conduct Authority, HM Treasury and Department for International Trade to work closely together to better co-ordinate oversight and develop a more consolidated, user friendly fintech rule book, particularly if the UK wants to maintain its global leadership.

Although regulators have shown leadership in driving forward a progressive approach to innovation in financial services, challenges around resource, delivery of support, integration and overseas expansion could be limiting the pace of change, according to the report, which was published in collaboration with PA Consulting. Moreover, it found that the UK’s regulatory materials are difficult to interpret which has made it difficult for fintech firms to effectively engage with the country’s policymakers.

The report estimates that the UK, which has roughly 1600 fintech firms and 76,500 workers, could reach 105,500 by 2030. The research was based on interviews with approximately 20 individuals holding senior roles at UK, European and US fintech firms, financial institutions and UK and US regulators.

To remedy the current situation, the report proposes creating guidebooks to UK rules, producing more easily navigable websites for officials and creating a “forum or alumni network” for sharing experiences of regulatory support. In addition, it suggests developing a broader set of accreditations for fintech companies as well as a regulatory sandbox suited to mid-sized and larger firms plus smaller start-ups.

The report also advocates strengthening the resources available to firms looking to expand overseas, to help them better understand regulatory frameworks and tax regimes

Miles Celic, Chief Executive Officer, TheCityUK, says “With the Covid-19 pandemic likely to fast-forward technological trends and adoption in all parts of the economy and globally, it is clear that the sector needs further regulatory support to take its growth to the next level.”

He adds, “The UK’s regulatory sandbox approach has been hugely successful and internationally acclaimed, but is starting to show limitations as the sector grows and matures. A broader framework needs to be developed with industry to reflect the expansion of the FinTech sector and ongoing regulatory development of maturing firms.”

©BestExecution 2020

[divider_to_top]

Maker rebates dampen crypto opportunities

A new report on Bitcoin by recently launched digital assets derivatives exchange, ZUBR, showed that under the “maker-taker” pricing models, best execution practices are being stifled while disadvantaging long-term investors according to newly launched digital assets derivatives exchange ZUBR, reveals that best execution practices are being smothered while disadvantaging long-term investors.

ZUBR’s report, covering data from 2010 to 2020, examines asymmetric fees, current and future implications for traders and the effect the maker-taker pricing model has had on Bitcoin and market maturity.

Key findings from the report include that asymmetric fees diminish traders’ profits. While maker rebates increase liquidity initially, the benefits diminish as more high-frequency traders compete against each other, reducing profitability and order book size. This leads to less effective markets. Moreover, maker-taker model does not keep spreads close during high volatility. Price discovery becomes an obvious problem as liquidity providers account for their net trade after rebates. This skews the trading spreads, and the real value across exchanges differs primarily due to fee structures. For example, up until March 12, just before markets began experiencing high volatility, BitMEX spreads went from an average of 0.28% to 4%.

Moreover, the report notes that takers pay up to 0.05% more than makers. Maker rebates are akin to marketing tactics employed by exchanges to win over liquidity from competitors. The net revenue earned by exchanges is the same as the taker is burdened with the higher cost of trading. Actual volume and pricing also limit trading strategies, Maker rebates force passive investors to trade more aggressively in order to access liquidity as spreads are artificially narrowed.

The US Securities & Exchange Commission has questioned the economic theory and incentives of maker rebates and is piloting a programme that could possibly end the model.

“Our data shows the fundamental issues with the maker-taker pricing model – which has been a standard practice both in the traditional and digital asset spaces for many years,” said Ilgar Alekperov, CEO, ZUBR. “As a new exchange, we understand more than most the need for liquidity to boost trading in the first weeks and months after launch.

He added, “However, we are now acutely aware that rebates not only put traders at a disadvantage, but they force traders to be more aggressive and take on unnecessary cost and risk in order to chase liquidity across fragmented markets. The crypto world cannot fully mature until maker rebates are revised, and trading environments create equal opportunities for all market participants.”

ZUBR came to the market at the end of March with the aim of becoming the arbitrage hub for digital asset derivatives and to offer clients permanent contracts on cryptocurrencies with 20x leverage, execution speed, London-based colocation and an algorithmic trading infrastructure. It also publishes regular reports and analytics examining price fluctuations, volumes, price discovery, trading patterns and other market issues.

The exchange recently selected Avelacom, a connectivity and infrastructure solutions firm, to provide low latency and resilient connectivity services across major cryptocurrency markets in Europe and Asia Pacific.

Through Avelacom’s network, the ZUBR platform will offer direct connectivity to crypto exchanges, as well as the ability to scale its ecosystem and connect clients via Amazon Web Services, Alibaba, Google and Microsoft Azure clouds to crypto exchanges in Dublin, Hong Kong, Tokyo and other locations.

©BestExecution 2020

[divider_to_top]

Over $18trn wiped off global markets in February and March, according to WFE report

Global stock markets, which suffered from unprecedented levels of Covid-19 induced volatility, saw over $18 trn wiped off their values during February and March 2020, according to the first quarter report card from the World Federation of Exchanges (WFE), a global industry group for exchanges and central counterparties (CCPs).

As the dust settled after the first three months, domestic market capitalisation was down around 13.6% to $73.14 trn compared to the same period last year. All regions were equally affected with the Americas losing the most – 17.28% of its value followed by Asia-Pacific, down 12.76%, and Europe Middle East Africa (EMEA), off 7.11%.

The decreases were even more pronounced versus the fourth quarter in 2019 when markets had fully recovered from the end-of-2018 low. Globally, markets fell 20.75% with the Americas: -22.18%; Asia-Pacific: -17.48% and EMEA: -22.79%.

The report also showed the volatility pushed the value of trades to $32.5 trn globally, an increase of 36.13% against the first quarter of 2019. All regions were positive with the Americas leading the way with a 42.29% hike while Asia-Pacific had a 25.97% uptick, and the EMEA region, a 42.16% increase.

“Although Covid -19 had a huge impact on markets, they were resilient and performed their role as intermediaries of financial flows to the real economy,” says Dr. Pedro Gurrola-Perez, head of research at WFE. ‘For example, there were around 220 IPOs in the first quarter and even in March, which was the most impacted month of the quarter, we still had more than 70 IPOs worldwide, raising over $9 bn in capital.’

He adds that one of the drivers was the exchanges stayed open and their business continuity plans were effective and passed the test. “In a short space of time they found the solutions to operate efficiently at a time when volumes were spiking,” he says. “Also, the industry came together. We saw this on the webpage where exchanges shared their experiences and information which also helped them see what each other was doing.”

ESMA approves registrations for four trade repositories

The European Securities and Markets Authority (ESMA) has approved the registrations of four trade repositories (TRs) for the Securities Financing Transactions Regulation (SFTR).

The four which are already registered with the European regulator comprise DTCC, UnaVista TRADEcho, Krajowy Depozyt Papierów Wartościowych and REGIS-TR. They are now authorised to handle all types of securities finance transactions, including repo, securities or commodities lending and borrowing transactions, buy-sell back or sell-buy back transactions and margin lending transactions.

“We’re pleased with this decision,” said Val Wotton, Managing Director, Repository & Derivatives Services at DTCC. “With less than three months remaining before SFTR’s implementation deadline for banks, investment firms, CCPs and CSDs, we are encouraged by the level of their preparations. We look forward to continuing to work with our community in support of their regulatory reporting efforts.”

Mark Husler, CEO, UnaVista added, “We are delighted that UnaVista has been approved by ESMA as a trade repository for the new SFTR. UnaVista’s approach to SFTR is to simplify things as much as possible for our community, that means making easy to prepare, test and connect and then providing tools to help firms improve their reporting once live.”

In March, ESMA offered a grace period of three months to 13 July 2020 due to the disruption wrought by COVID-19 which meant that many firms would not be able to meet the April deadline. The regulator recommended that national competent authorities (NCAs) apply a risk-based approach in relation to non-compliance with SFTR and exercise their supervisory powers in a proportionate manner.

The key objective of SFTR is to improve transparency and regulate the structured reporting of transactions such as securities lending, repos and buy-sell backs across EU capital markets. It also aims to mitigate the risks associated with shadow banking.

Firms will have to declare all in-scope instruments to an authorised TR in addition to any requirements under the European Markets Infrastructure Regulation and MiFID II.

TRs are commercial firms that centrally collect and maintain the records of SFTs reported to them. To be registered, a company must be able to demonstrate to ESMA that it can comply with the requirements of SFTR, including, most importantly, operational reliability, safeguarding and recording and transparency and data availability.

MarketAxess to Expand Open Trading in Emerging Markets

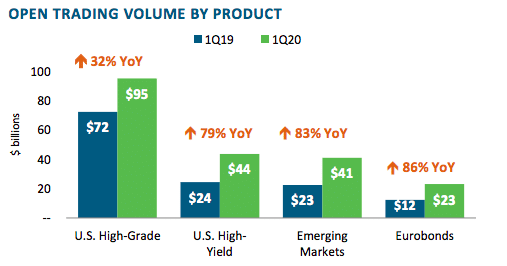

MarketAxess, the electronic platform for fixed income trading and reporting, is going to extend Open Trading to some markets in Latin America and Asia this year as the protocol had record volume in the first quarter of this year.

Open Trading is an all-to-all trading mechanism allowing multiple parties in a network to come together to trade, rather than the traditional model of only banks supplying liquidity to the buy side

Craig McLeod, head of emerging markets at MarketAxess, told Markets Media that all-to-all trading represented 40% of emerging market volume on MarketAxess, and has remained constant through the market turmoil but with greater cost savings of 85 cent versus 25 cent pre-crisis.

“Open trading is available in four local debt markets in central & eastern Europe, Middle East and Africa and we intend to roll it out to a few markets in Latin America and Asia later this year,” he added.

MarketAxess reported in its results for the first quarter of this year that Open Trading reached $208.6bn (€189bn), up 55% from a year ago.

Rick McVey, chairman and chief executive of MarketAxess, said in the results statement: “We believe Open Trading liquidity was essential to the functioning of credit markets during the quarter, and MarketAxess played a valuable role keeping our clients connected to the market as traders moved from their centralized trading floors to home offices.”

McLeod added that clients providing liquidity have jumped 40% from pre-crisis, as they could take contrarian positions efficiently and anonymously via Open Trading.

“We have also been providing clients with more data such as CP+ which they can use as a market standard reference price,” he said.

Composite+ is the firm’s algorithmic pricing engine that uses artificial intelligence to price corporate bonds using a variety of data sources including public reports and proprietary MarketAxess data.

Emerging market volume

Emerging markets also reached record trading volume in the first quarter, alongside US high-grade, US high-yield, Eurobonds, munis and US treasuries.

We reported revenues of $169 million, operating income of $91.1 million and diluted EPS of $1.96 for the first quarter of 2020. Join us for our first quarter 2020 earnings call today at 10am EST. https://t.co/spDZNI6PBP #earnings #fixedincome #electronictrading $MKTX pic.twitter.com/9YdYrz85Sq

— MarketAxess (@MarketAxess) April 29, 2020

McLeod added that emerging markets also had a record month in March as volatility increased due to the Covid-19 pandemic.

“Taking Asia as an example, the number of unique active clients rose 30% and dealers taking liquidity in Open Trading also rose 60% versus the same period the previous year, as we have become the go-to liquidity pool, even more so in times of volatility,” he said.

He continued that trading from clients in Asia increased 225% alongside 40% in Latin America, as MarketAxess has built out the network of regional dealers who are additive to liquidity.

Auto-execution

McLeod said emerging market auto-execution also continued to rise throughout the quarter.

“One unique feature of our Auto-X product is that it enables the trader to take control in flight on troublesome bonds, which is exactly what we observed during the extreme volatility,” he added.

MarketAxess wants to focus on helping clients provide liquidity more efficiently, so will be adapting its automated technology to systematically respond to Open Trading inquiries by setting parameters and, by doing so, enabling clients to become dealers.

“This enhancement will be available at the end of the year,” said McLeod.

Macroeconomic conditions

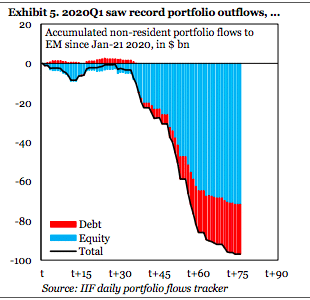

The Institute of International Finance said in a report on April 9 that its tracking of portfolio flows in emerging markets showed unprecedented outflows and there is some risk of further outflows in the second quarter.

The IIF said the COVID-19 shock and the drop in the oil price had resulted in a pronounced sudden stop in capital flows to emerging markets.

“Our daily tracking of nonresident portfolio flows shows that the first quarter of 2020 witnessed the largest emerging market outflow ever, exceeding the worst points of the global financial crisis,” said the report.

The study continued that total foreign investments in emerging markets, excluding China are expected to be $304bn, the lowest since 2004 and that investor positioning increased sharply in recent years, which may contribute to large outflows.

“We forecast debt flows to be negative in both Latin America and emerging market Europe, with the former seeing outflows of more than $16bn and the latter of $5bn,” said the IIF.

McLeod added that the US Federal Reserve and the European Central Bank are backstopping developed credit markets.

“Central bank intervention is not homogeneously available in emerging markets especially as we are approaching a downgrade cycle for the first time in 10 years,” he said. “However, when there is uncertainty, our trading platform performs stronger.”

David Lubin, head of emerging markets economics, at Citi said in a report this week that risk appetite towards emerging markets seems higher than it did at the same point of the global financial crisis.

“Although the rise in public debt in emerging markets might win an ‘ugly contest’ with developed markets, a key question for emerging markets is whether investors, both domestic and foreign, have any confidence that these countries can grow out of their debt, and on this issue we are pessimistic,” added Lubin. “Low interest rates in developed markets might help push capital towards emerging markets, but that’s not a reason to be confident about the future of the asset class given the uncertainties that now afflict the global economy.”

BlackRock last month downgraded emerging market local debt on currency concerns, although the fund manager is still overweight equities and credit in Asia ex-Japan, with China gradually restarting its economy and readying more policy support.

The fund manager continued that liquidity in developed markets is likely to spill over to emerging markets as yields compress in developed markets.

“Many investors will likely seek out alternative sources of coupon income such as higher-quality emerging market debt,” added BlackRock. “Another potential positive: China is gradually restarting its economy after stringent lockdown measures, and is set to deliver a large stimulus package.”

Neidenbach Transforms LSEG, Cloud-First

There is a saying that the third time is the charm. Ann Neidenbach has returned to live in London for the third time in her role as global head of LSEG technology and chief information officer, capital markets, for London Stock Exchange Group.

Neidenbach has more than 25 years of industry expertise and joined LSEG almost two years ago.

She told Markets Media: “When the opportunity at LSEG arose in 2018 it excited me because a key objective for the role was to lead the charge for a cloud-first program and transform the infrastructure.”

This is also the third time that Neidenbach has led the transformation of infrastructure to the cloud.

“I knew it would be impactful for LSEG,” she added. “This journey is different as we have had really good input from our regulators to ensure we remained safe and secure as a critical financial market infrastructure provider. The regulation has evolved to embrace the cloud and that has been very powerful.”

Neidenbach is responsible for both the infrastructure of the group’s capital markets operations including London Stock Exchange PLC, European multilateral trading facility Turquoise, and Borsa Italiana; and the Technology Products & Services division which supplies technology across the trade lifecycle to more than 40 organisations and exchanges.

She continued that LSEG is making good progress on its cloud-first approach, which is a large focus for this year and 2021.

“Turquoise Nylon was launched last year in the cloud and there are many data initiatives that present exciting opportunities,” Neidenbach added. “We will see business-led innovation with new products in the cloud.”

Turquoise Nylon brings together Turquoise SwapMatch, which matches large blocks in over-the-counter total return swaps, and Turquoise CFD.

Neidenbach continued that external clients who use LSEG technology have shown a lot of interest in using the cloud-based platforms to benefit from greater agility and lower total cost of ownership.

“Last year AAX digital asset exchange chose to use our matching engine in the first deployment of Millennium Exchange in the cloud” she added.

https://twitter.com/_thorchan/status/1250349835682635777

Thor Chan, chief executive and co-founder of AAX, said in a statement: “LSEG Technology’s Millennium Exchange matching engine provides the performance and reliability to power AAX’s 24-hour trading platform all in a cloud-based environment. AAX is setting the standard for the next generation of cryptocurrency exchanges, offering much higher levels of trust, integrity, performance and security than has previously been available to retail and institutional investors.”

Covid-19

The Covid-19 pandemic has restricted movement leading to staff across the financial industry having to work from home but still needing access to data and systems.

“The current environment has led to an uptick in the number of clients accelerating their move to the cloud, thereby reducing the total cost of ownership of their technology,” added Neidenbach. “We are having conversations across multiple regions and countries.”

She explained that the technology team was already very used to working remotely as they operate 24/7. As a result, the transition of LSEG to operating remotely went very smoothly.

“Recent market volatility has been extraordinary but we, and our external clients, have lots of headroom,” she said. “We are committed to resilience and have invested in the robustness and capacity of our systems.”

For example, this month the group launched a new equity clearing platform for EquityClear at LCH, the clearing arm of LSEG.

#LCH EquityClear successfully goes live with new @LSEGTechnology post trade platform. EquityClear can now process trades on a real-time basis with high throughput and low latency with LSEG Technology’s Millennium Clearing & Risk technology.

— LSEG Technology, An LSEG Business (@LSEGTechnology) April 7, 2020

Read more at https://t.co/TDMkPntLbx pic.twitter.com/HJIY4YbcSB

“The platform successfully processed EquityClear’s largest ever volumes with nearly 80 million trade sides cleared in the first five days of operation,” added Neidenbach.

Career

Neidenbach began her career as a junior developer and explained that she has since worked at both exchanges and banks, and so come to understand the needs of the buy side.”

Prior to joining LSEG Neidebach was chief information officer at Cowen, the investment bank. Her previous roles include being chief information officer at Nasdaq Europe and senior positions at Nasdaq Stock Market between 1986 and 2006.

“I started my career in Washington D.C. so didn’t have the traditional Wall Street experience,” she said. “I have always worked at companies that have female leaders who are very senior, highly regarded and have been great role models. I have been fortunate to have had both male and female mentors.”

She advised that it is important to build a network outside your own workplace.

“I am a full-time working mum with two kids so know it is not easy to go to evening receptions or conferences,” Neidenbach added. “However it is still important to meet people and there are online tools that now make this easier.”

Her advice is also to work hard and do your best, and that if you are passionate you will get the best results.

Diversity

Neidenbach expressed concern that the number of young women and girls pursuing studies and careers in science, technology, engineering and mathematics (STEM) still needs addressing.

She continued that LSEG supports initiatives, such as Girls Who Code, as it is really important to teach techniques that spark ideas, such as building an app.

Our girls are changing the world so much—even Harvard is talking about them 💪

— Girls Who Code (@GirlsWhoCode) April 24, 2020

Today @reshmasaujani & our CMO @deborahjsinger spoke with a @HarvardHBS class about their case study on our girls, our programming, and how we're going to close the gender in gap in tech—together. pic.twitter.com/M00jClx196

“LSEG is tremendous at including diversity as a big part of the hiring agenda,” she added,

The group has a goal to reach 40% female representation, including women in senior roles, and currently has 35% overall.

Neidenbach spoke about giving a speech at the Security Traders Association in Washington DC where the the vast majority of the audience were men.

“When executives ask how their daughters can get into the industry I tell them the answer is ‘you, as a hiring manager you can make a difference,’” said Neidenbach. “Everyone has the responsibility to increase diversity in hiring and change the dynamics of the industry.”

Staying Flexible Through Covid-19

With the vast majority of financial market participants working from home until further notice, the focus has turned to how technology best supports investment managers, hedge funds, banks, and other such firms amid the redrawn landscape.

Gone are the days when business continuity plans would be simply having an office in another location. In 2020, critical elements of a sustainable BCP include a robust distributed infrastructure, utilization of information technology as a service (ITaaS), and a multi-cloud strategy.

“It’s not just about hosting meetings via video conference, it’s about having a full-stack approach to remote working,” says Anya Boutov, Chief Revenue Officer at Beacon Platform, a global capital markets technology firm, which has helped global banks, insurers, asset managers, and energy companies modernize their infrastructure through cloud-enabled solutions.

COVID-19 has forced lockdowns around the world, particularly in major financial centers. Regulatory bodies around the globe have instituted work-from-home guidelines for the near term, and even after economies reopen, many expect longer-term impact as to how and where people work going forward.

From a financial technology perspective, COVID-19 follows 9/11 and the 2011 earthquake in Japan as major BCP events. But each situation’s challenges are unique. “There’s no playbook for this environment, but we’ve been able to help our clients adapt. Beacon has made sure that our clients have continuity of access to systems, are able to on-board new users quickly and securely, and have the flexibility to scale up infrastructure on demand,” says Boutov, who spent nine years in fixed income sales at Goldman Sachs and three years as a senior policy advisor at the U.S. Department of the Treasury before joining Beacon in 2017.

“As financial industry leaders take stock of the lessons learned in this environment, there will be a lot more value in having a platform that provides the resiliency to weather the next storm and enables collaboration between business and technology teams,” Boutov added.

For financial firms, one commonality when an exogenous shock causes market stress is a heightened emphasis on risk.

“When markets move fast, you need to see your risk intraday. No one wants to fly blind,” says Boutov. “In times of stress you need to move at the speed of relevance, so your risk system must be flexible enough to handle different scenarios, and at scale,” she said. “This isn’t the time to put in a request for hardware and wait six months for delivery. With Beacon, our clients are spinning up capacity within minutes on the cloud provider of their choice, and then automatically shutting it down when they’re done.”

BlackRock, which manages $7.4 trillion in assets, outlined the importance of technology infrastructure on its April 16 earnings conference call. BlackRock COO Rob Goldstein noted that the week of March 16 presented the highly extraordinary scenario of 95% of the firm’s employees working from home, while equity trading volumes were 65% higher than the firm had ever experienced.

The challenge was to process record volumes and to provide transparency into portfolio risks amid rapid change, high volatility, and high stress. “Market shocks and market volatility just underscore the need for robust enterprise operating and risk management technology,” Goldstein said.

Across industries and government, cloud technology has distinguished itself through the COVID-19 lockdown, according to researchers from Forrester Research, Gartner, and Syracuse University. One tech journal mused about the cloud being the “superhero” of the global pandemic. Whether or not the cloud has a shield or superpowers, the technology has at least moved from ‘nice to have’ to ‘must-have’ for capital markets firms, Boutov notes.

COVID-19 will dissipate at some point, but its impact on capital markets technology will endure. “Established companies will have to rethink BCP procedures that were developed with physical infrastructure in mind,” Boutov said. “For new businesses, choosing IT as a service will be more compelling than ever.”

Markets Choice Awards – Part 1

The 2020 Markets Choice Awards kicked off with a webcast on the afternoon of Thursday, April 30.

Congratulations to the winners announced today:

- Instinet Positive Change Award for Philanthropy: Nasdaq

- Excellence in Trading: Ed Nebens, First Pacific Advisors

- CEO of the Year: Bob Santella, IPC

- Neil DeSena Market Advocate Award: Brad Levy

Stay tuned for details on Part 2 of the 2020 Markets Choice Awards, which is scheduled for Thursday, May 7.

PLEASE JOIN INSTINET & MARKETS MEDIA IN DONATING

PROVIDING HEALTHY MEALS TO OUR NEW YORK FRIENDS AND NEIGHBORS IN NEED