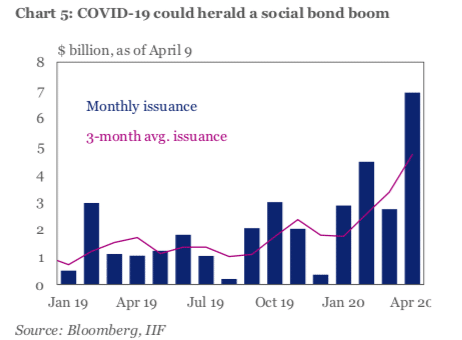

Sovereigns, financial institutions and corporates could issue COVID-19 focussed social bonds as volumes this month have reached more than $7bn (€6.4bn), compared to a monthly average of $1.2bn in 2018/19.

The Institute of International Finance, the global association of the financial industry, said in a report last week, IIF Green Weekly Insight: ESG in the Time of COVID-19, that social bond issuance is set to surge.

The African Development Bank launched a $3bn “Fight COVID-19” social bond, which was the world’s largest dollar-denominated social bond transaction to date according to the IIF. The report said investor bids were more than $4.6bn.

The AfDB bond pushed issuance for April to near $7bn versus a monthly average of just $1.2bn in 2018/19.

“This is a remarkable achievement given market volatility and given that this is the largest dollar benchmark the AfDB has ever issued,” added the IIF. “With leaders around the world under pressure to respond (prompting a record $2.1 trillion in government bond issuance last month) the AfDB’s landmark bond could open the door for sovereigns across both mature and emerging markets to issue COVID- 19 focused social bonds.”

Congratulations to @AfDB_Group on the display of the first “Fight Covid-19” social bond on #LGX!

— Luxembourg Stock Exchange 🇱🇺 (@LuxembourgSE) April 3, 2020

The USD 3bn bond’s proceeds will support African countries and businesses to overcome the challenges caused by the Covid-19 outbreak.

To find out more visit: https://t.co/aXwUFgHWKQ pic.twitter.com/vL3p0Rkvuq

The IIF continued that social bond markets could provide debt managers with a more diverse investor base as government deficits are set to sharply increase,

The AfDB issued a second social bond this month, which also listed on the Luxembourg Stock Exchange.

The @AfDB_Group has returned to #LGX to display their second #socialbond specifically issued to mitigate the impact of #Covid_19!👏

— Luxembourg Stock Exchange 🇱🇺 (@LuxembourgSE) April 16, 2020

The SEK 2.5bn bond will be used to finance projects related to poverty reduction, job creation & access to financing.

↪️ https://t.co/bTirZvKIfX pic.twitter.com/hTo8cT46de

LuxSE is waiving the listing fee for social and sustainable debt instruments that are issued to address Covid-19.

📢#LuxSE is happy to announce that it will waive the listing fee for #COVID-19 response bonds eligible for display on #LGX until 30 September 2020.

— Luxembourg Stock Exchange 🇱🇺 (@LuxembourgSE) April 15, 2020

Our intention is to support financing efforts to fight the pandemic & its overwhelming ramifications.

↪️ https://t.co/NMtyAe7TNP pic.twitter.com/Pu8mg1EDRk

Julie Becker, deputy chief executive of LuxSE and the founder of LGX, said in a statement: “Many issuers have focussed mainly on issuing green bonds over the past years, but given the current pandemic, we expect to see a steep increase in social and sustainability bonds in the coming months. Significant funding will be needed to mitigate the impact of COVID-19, and LGX will continue to provide the necessary visibility to the response bonds and their issuers.”

The Luxembourg Stock Exchange established LGX in 2016 as a contribution to the Paris Climate Agreement and the UN Sustainable Development Goals. LGX is a platform for sustainable instruments and aims to redirect capital flows towards sustainable investment projects.

Nasdaq has also said it will waive fees on bonds that respond to the pandemic.

A special thanks to @NIB for issuing Response Bonds.

— Nasdaq Exchange (@NasdaqExchange) April 6, 2020

To further support, @Nasdaq is waiving listing fees in Copenhagen, Helsinki and Stockholm for bonds issued on projects that alleviate the negative impact of the pandemic.

Read more: https://t.co/oLLCtAIAf7 pic.twitter.com/wgsiwjxTv8

Italy

Cassa depositi e prestiti (CPD), the Italian Development Bank has also issued a €1bn ($1.09) Covid-19 Social Response Bond, the first of its kind for the country.

The proceeds will be used to help corporates, mainly small and medium-sized enterprises access banking and financial services; provide local authorities with financial support and finance facilities, equipment and technologies for the improvement and protection of public health.

BNP Paribas said in a blog: “The issuance follows a number of recent sustainable bond transactions from development banks in response to Covid-19, such as the Nordic Investment Bank (NID), European Investment Bank (EIB) and African Development Bank (ADF), and marks a significant deal for Italy.”

The Italian Development Bank @GruppoCDP issued a €1 billion Covid-19 Social Response Bond, the first of its kind for Italy 🇮🇹.

— BNP Paribas CIB (@BNPParibasCIB) April 17, 2020

Scroll down to understand how it works and how it will help fight the #covid19 pandemic 👇 pic.twitter.com/jO5MEgN1iU

The French bank was joint lead manager of the deal.

The €500m Italian bond attracted orders of more that €1.9bn mark, with a meaningful participation of socially responsible investors.

Fabrizio Palermo, chief executive of CDP, said in a statement: “Thanks to this transaction, CDP will further support enterprises and public administrations to foster their ability to cope with the current crisis and recover. The demand registered is proof to the growing attention investors are paying to initiatives of high social and environmental impact and is a positive signal for Italy.”

BNP Paribas continued that recent weeks have seen a strong supply of social bonds as in response to Covid-19. “Financial institutions and corporate could also start issuing Covid-19 response bonds in the coming weeks and months and highlights their collective role in responding to the pandemic,” added the bank.

Social bond principles

The International Capital Market Association has issued guidelines on social bonds.

The case studies shared by this @IFC_org document demonstrates how the existing guidance delivered by the Green Bond and Social Bond Principles for social and sustainable bonds is immediately applicable to efforts addressing the COVID-19 pandemic. https://t.co/VNbQ0TYll2 https://t.co/djssITCirA

— ICMA (@ICMAgroup) April 17, 2020

ICMA said in a statement: “All types of issuers in the debt capital markets can issue a social bond related to COVID-19, as long as all the four core components of the Social Bond Principles are addressed, and that the use of proceeds of the bond go exclusively towards addressing or mitigating social issues wholly or partially emanating from the coronavirus outbreak.”

Social bonds finance projects directly aim to address or mitigate a specific social issue and/or seek to achieve positive social outcomes.

Relevant projects to mitigate COVID-19-can include expenditures to increase capacity and efficiency in provisioning healthcare services and equipment, medical research, SME loans that support employment generation in affected small businesses, and projects specifically designed to prevent and/or alleviate unemployment stemming from the pandemic according to ICMA.