Equity segments in Sweden, Denmark and Finland have been granted EU “SME Growth Market” status.

There is increasing interest from overseas issuers in listing on Nasdaq First North and the Nordic platform has been granted ‘SME Growth Market’ status by the European Union, which could further boost its international profile.

Adam Kostyál, senior vice president and head of EMEA listings at Nasdaq, told Markets Media: “There is increasing interest from international issuers as between 10 and 15% of our pipeline is non-Nordic. Brexit is creating uncertainty that London will remain a centre for small and medium sized enterprises but it takes time to change behaviour.”

The exchange announced last week that the equity segments of Nasdaq First North in Sweden, Denmark and Finland have been granted the European Union’s ‘SME Growth Market’ status from the beginning of next month. These three segments will then be referred to as Nasdaq First North Growth Market.

SME Growth Markets are a new subcategory of multilateral trading facilities introduced in the MiFID II regulations at the start of this year, and aim to make it easier for SMEs in the region to access equity capital markets.

“EU SME Growth Market Status allows us maintain high quality standards and keep the support of institutional investors,” said Kostyál. “The combination of Growth Market Status and the new prospectus directive means SMEs can issue a lighter prospectus to move to the main market which is very attractive.”

Nasdaq said the new status is also expected to increase the visibility and international profile of Nasdaq First North and attract more international investors to the market.

Bjørn Sibbern, executive vice president and president of European Markets at Nasdaq, said in a statement that SMEs represent the vast majority of all companies across the European economy and are critical to job creation and growth.

Sibbern added: “Maintaining a strong and dynamic market place for companies and investors while safeguarding market integrity is one of Nasdaq’s top priorities, and we are confident that the SME Growth Market status will make Nasdaq First North an even better platform for European SMEs looking to raise capital.”

Activity

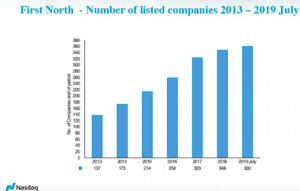

Kostyál continued that Nasdaq First North had 80 listed companies in 2012, which has grown to 360 during the first half of 2019. There were 348 listed companies at the end of last year

“Around 80 companies have transferred to the main market since Nasdaq First North was launched, so it has been a successful stepping stone” added Kostyál.

There were 50 new listings last year, of which 37 were initial public offerings. This year there have been 25 new listings, including 16 IPOs.

Source: Nasdaq

Kostyál said: “We are likely to reach more than 400 listed companies either this or next year, but a number of companies are likely to move to the main market – success is our worst enemy.”

He noted there is strong activity in both listings and secondary capital raising.

Last year €2.6bn was raised in IPOs and €6.5bn in secondary capital raising across both the main market and Nasdaq First North. On only Nasdaq First North, €0.7bn was raised in IPOs and €1.7bn in secondary offerings in 2018. Secondary offerings have raised €1bn on Nasdaq First North in the first half of this year.

Activity may fall if research coverage of SMEs drops off. MiFID II mandated the separation of trading commissions and research payments, leading to anxiety that bank analysts would stop covering less liquid SME stocks.

“We are concerned about the impact of MiFID II unbundling on research for SMEs and this is something we are watching closely,” Kostyál added.

However he said that Nasdaq First North has been the most active market for SMEs, especially in Sweden. He explained this was because Sweden has encouraged the active participation of retail investors in IPOs and there is an ecosystem of micro funds and smaller advisory firms which is not present in the rest of Europe.

“Nasdaq in the US has been looking to First North as an example of how to make capital markets more relevant to SMEs,” added Kostyál. “Apple raised $50m in its IPO but those days are gone and it is roughly the same picture in Europe.”

In 2017 Nasdaq unveiled a Blueprint to Revitalize Capital Markets in the US. The exchange targeted three areas – overly complex regulations that discourage market participation; one-size-fits-all market structure and a culture that creates an imbalance between the value of long-term return and short-term potential.

CCP

In addition to gaining the new status, Nasdaq introduced a central counterparty in June to clear equity trades on Nasdaq First North in the Nordics and Nasdaq Stockholm Small Cap – which decreases counterparty risk while improving market efficiency and potentially increasing liquidity.

“We have launched a CCP for equities for Nasdaq First North and we are revamping our liquidity provider scheme to make sure our market is more attractive to international issuers and investors,” added Kostyál.

Nasdaq First North and Nasdaq Stockholm Small Cap now have the same post-trade process as the other market segments and allow access to institutional investors who need CCPs in order to trade.

Patrik Tigerschiöld, chairman of Bure Equity AB, said in a statement: “We fully support Nasdaq’s efforts to reduce the risk and potentially increase the liquidity pool in small- and medium sized companies. We are also happy to see that trading conditions between Nasdaq’s European markets have been further aligned, increasing overall market efficiency.”

The introduction of a CCP on Nasdaq First North and Stockholm Small Cap was the final step of a transformation to central counterparty clearing for all shares listed on Nasdaq’s equity markets in Sweden, Denmark and Finland.

While much ballyhooing and bellybucking surround cryptocurrency and stablecoins, the future might just belong to digital assets and the trading of them, according to Templum Co-Founder Vince Molinari. His New York-domiciled firm is committed to the digital asset space – operating both a flagship broker-dealer subsidiary, Templum Markets, and a blockchain-enabled, regulated alternative trading system (ATS) for the primary sale and secondary trading of digital assets. Templum has also entered into a strategic partnership with the Miami Exchange Group (MIAX) to launch an SEC-regulated digital securities exchange.Molinari and Templum have jumped all-in into this new realm and spoke with Traders Magazine’s editor John D’Antona Jr. about new broker regulations such as Reg BI, digital asset creation and trading, and future digital asset regulation.

While much ballyhooing and bellybucking surround cryptocurrency and stablecoins, the future might just belong to digital assets and the trading of them, according to Templum Co-Founder Vince Molinari. His New York-domiciled firm is committed to the digital asset space – operating both a flagship broker-dealer subsidiary, Templum Markets, and a blockchain-enabled, regulated alternative trading system (ATS) for the primary sale and secondary trading of digital assets. Templum has also entered into a strategic partnership with the Miami Exchange Group (MIAX) to launch an SEC-regulated digital securities exchange.Molinari and Templum have jumped all-in into this new realm and spoke with Traders Magazine’s editor John D’Antona Jr. about new broker regulations such as Reg BI, digital asset creation and trading, and future digital asset regulation.