the etf firm’s assets under management crossed $100bn in December.

WisdomTree Investments said that its total assets under management had crossed $100bn in December 2023, driven by 12 consecutive quarters of net inflows until the fourth quarter of last year.

The US asset manager launched its initial suite of exchange-traded funds in 2006 which included the first international small-cap ETFs listed in the U.S. and the first family of ETFs that tracked indexes of high-yielding international equity securities.

WisdomTree created new indexes designed to overcome the potential drawbacks of market cap-weighted benchmarks. The first indexes were fundamentally weighted, such as being based on the total cash dividends paid by companies. In its first five months WisdomTree’s assets under management increased from $220m to more than $1bn, and have now surpassed $100bn.

Jarrett Lilien, president and chief operating officer at WisdomTree, told Markets Media that many factors contributed to the firm’s growth, starting with innovation.

Lilien said: “We have been a leader in ETFs for 17 years, but we weren’t the first to the ETF party. This meant that when we came to the market we had to innovate, because all the big beta exposures, like the S&P, were already taken.”

Therefore, WisdomTree’s strategy is to offer a differentiated product that aims to generate alpha. Lilien said another important contributor to growth has been building out a broader product suite which is relevant across all market cycles.

“In the fourth quarter we unfortunately just ended a streak of 12 consecutive quarters of net inflows,“ he said. “That is a stand out three years of quarterly inflows over many different kinds of market cycles.”

In addition to differentiated products, Lilien argued that WisdomTree differentiates itself through its research and services, such as tools on its website to provide analytics.

“That has all helped us build more of a partnership relationship with our clients,” he added. “Not only has it been great to hit that milestone of $100bn, we have also got the best organic growth rate of our publicly listed competitors.”

Lilien continued that he has much confidence in the future because he believes WisdomTree has a really broad product suite and is continuing to innovate. For example, WisdomTree has added around 30 new products annually in the last three years and he expects that 2024 will be similar.

Managed models

In 2020 WisdomTree launched a managed models franchise, an open architecture framework for advisors that includes a mix of investment products from WisdomTree and other managers, which had grown to more than $2.5bn in assets by the third quarter of last year according to the earnings presentation.

Jonathan Steinberg, WisdomTree

Jonathan Steinberg, WisdomTree

Jonathan Steinberg, founder and chief executive of WisdomTree, said in the third quarter results that assets under management in managed models at Merrill was more than $500m across 850 advisors , both of which doubled from prior year period levels. In addition, WisdomTree had more than 60 registered investment advisors and independent broker-dealers representing potential partner opportunities with over $60bn in assets under management.

Lilien continued that one of the biggest macro trends in the US is wealth management firms centralizing asset management functions, or partnering with asset managers. He said WisdomTree describes the managed model business as a shared CIO (chief investment office), as opposed to an outsourced CIO.

“At Merrill we have a great relationship and worked with them on a model that goes on their managed models platform, which they make available to all their financial advisors through an easy button,” Lilien added.

Independent advisors might not have that infrastructure so WisdomTree provides them a different service which includes an easy button to access the models. The managed model franchise is growing faster than WisdomTree’s 15% to 16% organic growth according to Lilien, and he expects growth to increase in 2024.

“We have got a really good recipe, and we are just going to continue with it,” Lilien added. “We have got to not lose sight of what got us here because it will get us to the next $100bn as well. We want to be big but we want to keep our soul and character because I think it is one of our key differentiators.”

Digital funds

Although WisdomTree has a history of ETF innovation, Lilien said the firm does nor define itself as an ETF issuer. Instead, it defines itself as providing the best structured, transparent exposures in the marketplace.

“Today we believe ETFs are the best, transparent exposure,” Lilien said. “Part of our innovation is not only looking for new ETFs, but also the next best transparent wrapper that’s coming down the pike and think that is blockchain-enabled finance.”

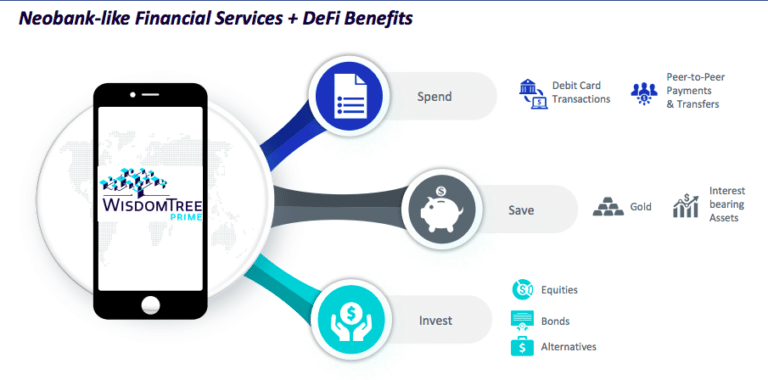

WisdomTree has 10 digital funds which are effective with the US Securities and Exchange Commission available in the WisdomTree Prime mobile app, which is being rolled out across the US. WisdomTree Prime covers a variety of blockchain-native asset classes such as a select suite of crypto assets including bitcoin, ether, tokenized physical assets such as gold as well as mainstream traditional asset classes, The firm’s digital digital funds can only currently exist in he WisdomTree wallet but he expects that to change as the digital ecosystem matures.

Lilien expects digital funds to be a future contributor to growth as they gain momentum over time.

“The mutual fund business still exists but ETFs are growing faster and taking share” he added. “ETFs have picked up momentum over time and I think digital finance will pick up momentum in the same way.”

He argued that WisdomTree does not yet receive any credit for being a first mover in digital funds, which the firm expects to be the next investment wrapper.

He gave the example of Vanguard introducing passive mutual funds which allowed them to become a “gorilla”. In addition, he credited BlackRock’s iShares being the first mover in launching ETFs for many beta exposures, also helping them to become a “gorilla.”

“One of the things that we are doing in the digital space is laying claim to the first to market beta positions,” Lilien added. “ETF growth, coupled with our leadership position and staying power, in what we think is the next wrapper in asset management innovation means we should also be a gorilla in 17 years.”

Overseas growth

WisdomTree completed the acquisition of the European ETP business of UK-based ETF Securities in 2018 after buying a majority stake in Boost ETP, a UK ETP provider in 2014.

Lilien described expansion in Europe as very important and highly successful. He said Europe is having record results in terms of revenues and new product launches, with the UCITs suite of funds breaking through $5bn in assets under management in 2023.

“That is an area where I think we have a lot of growth potential ahead and where you will see us continue to focus with new product launches,” he added.

In addition to diversifying revenues, Lilien said the European business diversifies beta exposures with gold and commodities.

WisdomTree also has distribution partners Latin America, Asia and Middle East. He said listing ETFs in new markets often involves dealing with new regulatory regimes and new operations, but digital products will eventually be able to travel the world seamlessly.

“A lot of our global expansion might even come quicker through some of our digital efforts,” Lilien added.

Steinberg said in a statement: “I’ve always said, if we can get to $5bn, we can get to $50bn, and if we can get to $50bn, we can get to $100bn. This is by no means the finish line but rather the starting line and we’re excited for what’s to come.”