Most asset managers have outsourced some of their trading, or plan to do so.

In January 2023, just over a year ago, BNY Mellon expanded outsourced trading to buy-side clients which was the culmination of a six-year journey to make the firm’s own trading more efficient and the implementation of its xSTAR framework for execution strategy, trade automation and routing.

The outsourced trading offering was launched last year to buy-side institutions globally, including asset managers and asset owners.

Dragan Skoko, head of buy-side trading solutions at BNY Mellon, told Markets Media: “Last year was our foundational year as we came to market, onboarded new clients and proved ourselves. This year is the pipeline year and next year we will be scaling.”

BNY Mellon consistently invests in technology and the team has grown every year according to Skoko. He added: “We plan to continue growing based on client engagement and our pipeline.”

Skoko argued that BNY Mellon is really skilled in solving its own challenges, then providing those solutions to clients and scaling them as businesses. He gave the example that BNY Mellon was once a brand new custodian and is now the biggest asset servicing platform in the world.

Six years ago BNY Mellon began reviewing how to deliver efficiencies to xBK, the buy-side trading division that executes an average of more than $1 trillion in volumes for the company’s investment management business. The firm combined three trading desks to achieve scale, retired one dozen legacy trading platforms and partnered with a vendor to build an all-asset execution system.

“We increased our scale five times, got better trading outcomes, better rankings and a lower operating cost,” added Skoko. “It is rare to achieve that combination and this success gave us the confidence to say that our clients could benefit from our specialised trading expertise based on our own capabilities.”

xSTAR framework

Skoko said they questioned what the future of trading would look like, and although the firm had a lot of “fantastic seasoned” traders the business wanted to increase exposure to science, engineering, technology and mathematics (STEM), and to quant and data science talent.

He believes the future of trading will be increasingly reliant on machine learning and data management to give traders the ability to make a lot of decisions consistently and at scale, and to have a very disciplined process for evolving and improving those decisions.

“The goal has been to create a flywheel effect, where we constantly improve as it takes many incremental improvements to deliver significant positive outcomes over time,” Skoko added. “We do that by tightly integrating our traders with our technology and data science teams.”

BNY Mellon implemented a framework called xSTAR, for execution strategy, trade automation and routing. The system recommends an execution strategy based on the attributes of a trade or set of trades, an access method and which tactics to use, which the trader can accept or override and real-time data is then captured during trading.

The firm captures more than more than 1 billion, and sometimes 2 billion, rows of trading market data in a single day and every inbound and outbound FIX message and intersects the information with market data.

“We analyse every decision and every outcome to see if they added value, and how they perform relative to thousands of other potential outcomes,” Skoko said. “We think this approach is the most optimal in today’s environment to allow us to continue to tweak the system, dynamically react to changes in market structure and how we engage with global liquidity.”

Demand

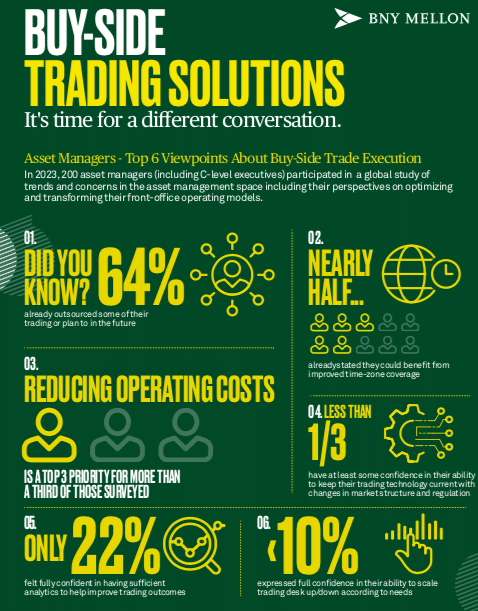

Last year BNY Mellon surveyed 200 asset managers globally, including C-level executives, on their trends and concerns including their perspectives on optimizing and transforming their front-office operating models.

Skoko was surprised that 64% of survey respondents said they had outsourced some of their trading or plan to do so in the future. The survey also found that nearly three quarters, 70%, of respondents felt it is difficult to keep trading technology current in light of the regulatory and market structure changes. In addition, 60% felt it is difficult to scale their trading desk up and down according to their needs.

As a result, demand has led to a significant number of service providers in the outsourcing space.

For example, State Street said on 1 February 2024 that it had completed its acquisition of CF Global Trading, a global firm specializing in outsourced trading on an agency basis across asset classes including equities, listed derivatives and fixed income. State Street had provided outsourced trading to clients in the Americas, Asia Pacific and Middle East, and CF Global Trading will extend the ability for the firm to provide these services to clients in the UK and the EU.

Half of respondents in BNY Mellon’s survey said they could use additional expertise or additional market access in certain asset classes and 40% said they could use better timezone coverage.

BNY Mellon’s differentiator is the ability to handle complexity and at scale for larger clients as the business has the foundation of serving one of the top 15 global asset managers according to Skoko. In addition, he said another differentiator is the firm’s buy-side heritage so it has a true understanding and empathy of what it means to do the job of the buy-side trader and properly service portfolio managers.

“Just one fifth of respondents were fully confident that they have sufficient analytics and capabilities to measure and improve trading outcomes,” he added. “That was really interesting and gave us even more confidence that we could help solve some real problems for clients.”

BNY Mellon has had interesting conversations around fixed income and derivatives, and also new regions and countries according to Skoko. He highlighted that so much has happened over the last four years that it has become increasingly important for the buy side to capture opportunities as they shift from one asset class to another, and from one region to another.

Demand is also being driven by the US reducing its settlement cycle in May 2024, which will affect overseas investors who buy and sell US equities. The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on Tuesday 28 May 2024. Canada and Mexico moving on the previous day, the U.S. Memorial Day holiday

“A chunk of our inbound requests come from the T+1 concerns and right now the concern is focused on how to handle this operationally on a post-trade basis and prevent failed trades,” said Skoko. “Once T+1 is here, I think that conversation will shift towards managing settlement date cash with a cash constrained portfolio, which will be increasingly relevant.”