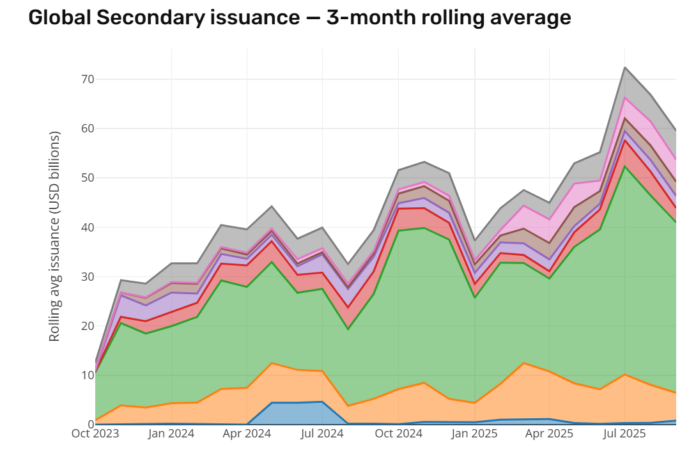

In 2025, investors poured US$27 bn into European equities and sold volatility via US$12 bn flows to income products, while ESG funds witnessed a US$ 17bn rout amid the new political climate, according to Global Trading analysis of Morningstar data.

Our new fund flow visualization, building on data provided by Morningstar; highlights clear allocation tilts in equities in the eight months to August 2025. Readers should be aware that our data focuses on the ten largest flows per category of funds, not every constituent. Broad rolled up category numbers should be read as directional rather than market totals.

European equity focused funds drew in US$27.3bn 2025. The largest recipients were broad European index trackers. Standout funds include Vanguard FTSE Europe ETF (+US$6.0bn, 36.1% of end-2024 AUM), Amundi Core STOXX Europe 600 (+US$4.8bn , +53.4%), iShares Core MSCI Europe (+U$3.6bn, +44.6%), Six Circles Managed Equity Portfolio International Unconstrained (+$2.8bn, +45.3%).

According to BMLL data, trading volumes are reflecting these inflows with year to end of September addressable volumes across European (including UK) equity running at €16.4 trillion versus €12.7 trillion for the same period in 2024 or up 29% year over year.

Derivative-income funds which generate income and protection through selling covered calls continued to draw substantial amounts of investor flows. Demand for income with volatility monetisation was concentrated in a few large vehicles.

JP Morgan income funds invest in higher dividend-paying portfolios for 80% to 90% of their AUM, with the rest in equity linked notes (ELNs), on which they have discretion to sell covered calls, likely adding pressure to out of the money calls on broad based US index.

JP Morgan Nasdaq equity premium income ETF (+$8.8bn, +42.7% of end-2024 AUM) and JP Morgan equity premium income ETF (JEPI) (+$4.6bn, +12.6%) led inflows by a distance.

Rotation into the vehicles has led to increased volume all year with JEPI’s monthly notional average volume have been sustained above US$5bn all year, up 45% year on year.

The other well-known derivatives based JP Morgan funds, the hedged equity funds (JHEQ I, II), that focused attention last year having had US$2bn of inflows on more than US$30bn of AUM and carry outsize collared positions (short a call, long a put spread) is flat on the year but still focus market attention. According to JP Morgan disclosure as of 30 September JHEQ (I and II) is short US$30 bn notional of 5% out of the money (OTM) call on the S&P 500 and long the equivalent of 5% OTM puts as well as smaller exposure for October and November, and a short leg of OTM puts. These are rebalanced monthly and quarterly.

ESG, Healthcare and Energy are out of favours and being actively liquidated.

ESG-labelled equity saw their green bleed away as the new US administration turned against all such endeavours. 21 states in the US have now banned or restricted ESG investing.

Redemptions were concentrated in climate and ecology focused vehicles with US$16.8bn of redemptions seen by Global Trading in Morningstar data. The largest single outflow was at BlackRock ACS climate transition screened & optimised world equity which saw US$14.7bn of outflows (-86.9% of end-2024 AUM).

A Blackrock spokesperson told Global Trading that this extreme outflow is a technical feature rather than an actual massive redemption;

They said: “These assets remain with BlackRock and will be reallocated within the firm. Clients continually update their asset allocation preferences in order to meet their investment objectives.”

Healthcare focused vehicles also saw large outflows. Redemptions in 2025 are broad-based across active and passive vehicles. Totalling the largest flows in Morningstar data, Healthcare related vehicles has US$17.9bn f redemptions;

Of note, Vanguard health care fund lost US$4.8bn (-11.9% on year end 2024 AUM),and T. Rowe Price health sciences bled US$2.0bn (-15.4%), alongside sizeable withdrawals in passive vehicles like the SPDR healthcare sector funds (–US$2.3bn and –US$1.2bn).

Despite these outflows trading is also sustained in underperforming funds because of investors’ rotation. For example XLV, the health care select sector SPDR fund volumes are up 50% year on year to September to US$35bn.

Energy equity funds were the final notable laggards with US$12.5bn of outflows: Flows were negative across both traditional and clean-energy exposures. The largest outflow was suffered but the energy select sector SPDR fund (–$7.0bn, -20.9%). Clean-energy redemptions included BGF’s sustainable energy fund (~–$0.8bn, -19.2%), Pictet’s clean energy transition (~–$0.6bn ≈16.3%), and Robeco sustainable energy fund (–$0.4bn, 12.3%).