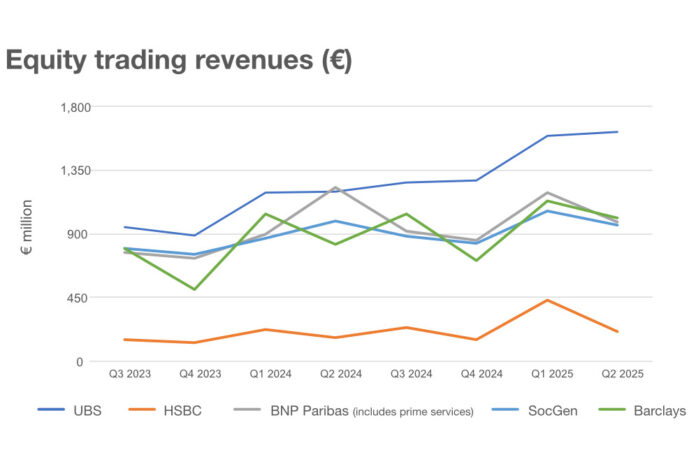

UBS dominated non-US equity trading revenues in the first half of 2025, with record results pushing it further ahead of its competitors.

The bank reported €1.6 billion in equity trading revenue in Q2 2025, an 1% increase QoQ and 35% increase YoY. Growth was driven by strong activity in cash equities, equity derivatives and financing, the bank said.

In the derivatives and solutions division of global markets, revenues were up 24% YoY to approximately €963.9 million (US$1,115m).

More broadly, Sergio Ermotti, Group CEO at UBS, commented, “we further simplified our operations across the organization and made good progress in our active wind down efforts in non core and legacy, particularly around costs.”

The bank’s results call was dominated by concerns about potential changes to capital requirements proposed by the Swiss Federal Council, which would require it to hold approximately US$42 billion in additional CET1 capital.

Ermotti stated, “The proposals fail to recognize that UBS has had a consistently strong capital position, business model and risk management framework, and the fact that UBS has not relied on regulatory concessions or overly aggressive valuations of foreign participations. Further, it disregards the significant diversification value our foreign subsidiaries provide to all of our stakeholders, including our clients in Switzerland. We are strong, thanks to our global footprint, not in spite of it.

“In addition, the proposal at ordinance level only consumes surplus capital and cosmetically reduces the group CET1 ratio. This would underrepresent the true capital strength of the firm on an absolute basis and relative to peers.”

UBS has seen consistent growth since Q4 2023, unlike the more up-and-down paths of its competitors.

Runner-up Barclays overtook BNP Paribas this quarter, continuing its zig-zag earnings pattern. Revenues fell back 11% from Q1’s €1 billion, but still represented a 22% YoY increase for the bank.

C.S. Venkatakrishnan, group chief executive at Barclays, highlighted strong momentum in client onboarding over the quarter.

“Stable income streams now account for 40% of the investment bank’s income in the past year, up from 29% in 2021,” he commented.

“From this structurally stronger base, the investment bank is also better positioned to monetise cyclical market activity by helping clients to manage volatility. This cyclical activity is included in traditional areas of strength for us, such as credit and macro, and also in new areas of strength, such as equity derivatives and prime.”

Equity trading revenues at BNP Paribas, SocGen and Barclays once again converged in the middle of the pack, falling from Q1 spikes.

BNP Paribas reported €980 million, just above SocGen’s €962 million. The firm saw a 17% decline on Q1, and an even larger 20% decline from Q2 2024’s €1.2 billion.

SocGen’s results illustrated a 9% QoQ decline, but just a 3% drop YoY from €989 million.

Lars Machenil, group chief finance officer at BNP Paribas, observed, “Equity and prime services (EPS) was down about 15% due to the high base effect a year ago and compared with our US peers who are more exposed than us to the flow business, which was very strong this quarter on the other side of the Atlantic.

“We were also impacted by lower demand for structured products in the context of the uncertainty post Liberation Day. However, if we look at the first semester results at €2.2 billion, they represent a record for EPS, driven in particular by prime and cash.”

Barclays also drew attention to its performance during April’s volatility.

Venkatakrishnan commented, “We [delivered] this performance whilst managing risk well, maintaining stable value at risk (VaR) and incurring two trading book loss days, one in April and one in May, in line with the average since 2019.”

Trailing after a sharp Q1 increase, HSBC reported €210 million in the second quarter, down 51% QoQ – but making a 25% gain YoY. Figures for the bank have been calculated based on full year 2024 reports, as HSBC no longer breaks down its equity and FICC trading revenues.