The return of calmer market conditions after April’s tariff turmoil led to slimmer pickings for giant market makers, as the price improvement offered to retail plummeted. This came as retail flows increased, even though overall volumes declined, Global Trading analysis shows.

As equity markets returned to a lower volatility regime in May, the price improvement offered by market makers to retail brokers declined, according to Global Trading analysis of regulatory filings. Execution quality improved at some firms and deteriorated at others but all the biggest markets beat the US national best bid offer (NBBO) based on effective-to-quoted spread ratio (E/Q) analysis.

Read more: Six market makers delivered $666m price improvement for US retail in April – Global Trading

We analysed the SEC Rule 605 disclosures of Citadel Securities, Virtu, Jane Street, G1 (part of Susquehanna), Hudson River Trading (HRT), and Two Sigma Securities.

As in April, Citadel led execution and improvement statistics having executed 27.2 billion shares and provided retail with US$131.8 million of price improvement covered within the current 605 disclosure regime. That compares with $160 million of improvement in April. Virtu followed with 15.4 billion shares executed and US$81.2 million of improvement, versus $109 million in April.

Meanwhile, G1 (Susquehanna), Jane Street, HRT, Two Sigma executed 7.7 billion, 8.8 billion, 6.1 billion and 2.2 billion shares respectively. In the same order, they provided retail traders with US$55.7 million, US$ 46 million, US$ 33.2 million and US$9.8 million of price improvement versus quoted spread. All these improvement amounts were more than 20% lower than the previous month.

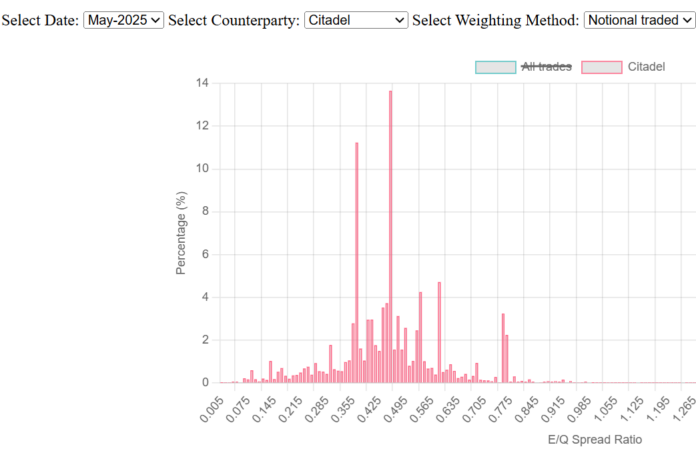

The graph above presents the cumulative distribution for the selected market maker, along with the equivalent distribution for a sample of the whole continuous lit market. For this ‘All trades’ measure, we look only lit trades whose bid-ask spread is greater that US$0.001, bid and offer size if superior to one lot, and quotes are less than 25 milliseconds old. Our sample in May represents 73.4 billion shares traded with US$3.95 trillion of notional versus 89.6 billion shares traded with a notional of US$4.8 trillion in April.

We plot this ‘All trades’ measure against the E/Q of individual market makers both in terms of shares traded or in terms of notional. To recreate approximate notional for market makers, we used the monthly volume weighted average price (VWAP) of each ticker as calculated from our market sample as the relevant price for each ticker in their disclosure.

The cumulative distributions show significant differences in execution quality between different market makers as well as variations over time. For example, in May, Citadel shows the highest execution quality with 50% of trades with E/Q below 0.45, while Two Sigma has the worst, with median E/Q of 0.50. Execution quality for all six market makers changed since April, with Citadel and Two Sigma showing an improvement while Virtu, Susquehanna and Jane Street showing a decline.

For the ‘All trades’ measure, 90% of trades occur with E/Q of one, or on the NBBO in other words. However, a substantial proportion, 10% to 15% depending on weighting methodology, of lit market trading happens at mid.

As volatility decreased in May, bid ask spreads tightened and the opportunity for market makers to improve on it despite larger volume traded also dwindled.

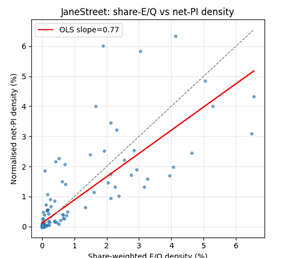

Market maker execution disclosures exhibit further differences. Price improvements at both Citadel Securities and Virtu follow the density distributions of their share weighted E/Q, while for Jane Street, price improvement is skewed suggesting a specialization in where they provide price improvements.

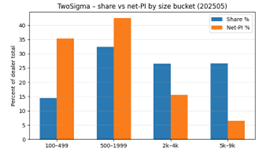

Other notable differences happen at the order size level. The current Rule 605 disclosure requires the market makers to disclose execution quality for order size 100 to 499, 500 to 999, 1000 to 4999 and 5000 to 9999 shares.

For the whole panel the total price improvements provided by the market makers are disproportionately allocated to the lower order size compared to the bigger one.

In the below example one can see for example that while the 100 to 499 shares size bucket represented only 12.9% of the shares executed by Virtu in May, these orders got provided and with 34.8% of the total improvements Virtu offered retail traders, and an E/Q of 0.33, while the 5000 to 9999 represented 31.2% of the shares traded at Virtu but only 9.1% of the total price improvement at an E/Q of 0.7. Similar patterns are visible at all the market makers on the panel we studied. We provide data for Two Sigma as another such example.

Virtu told Global Trading that these outcomes are “an artifact of the current rule 605 methodology”.

Academic research suggests that retail broker focus on different order types (such as small or large orders) is mirrored by market makers that compete and adapt to capture their flow. The SEC’s upcoming improved Rule 605 disclosure is likely to allow a far more detailed analysis of brokers and market makers practices.